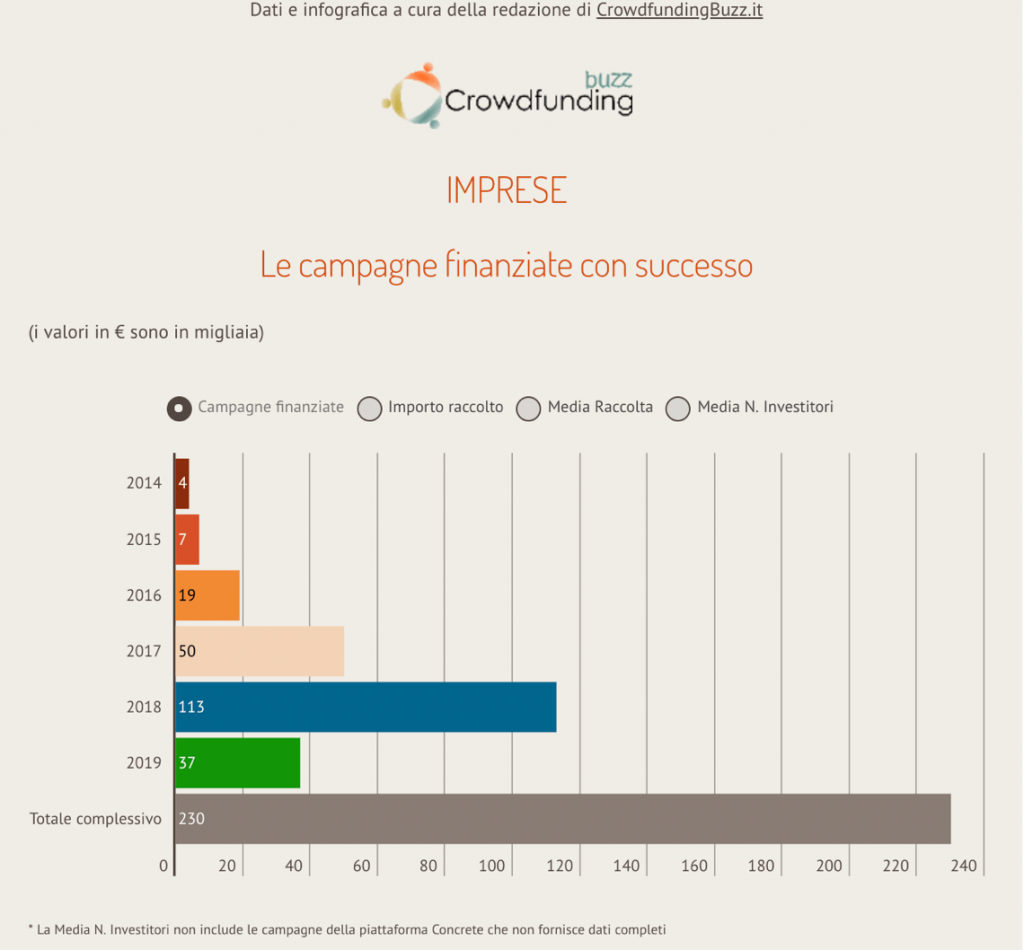

Equity crowdfunding platforms in Italy have raised just under 15 million euros in four months and have reached 70 millions since the start of the market in 2014, with an exponential growth in activity. In fact, only 2018 contributed over 36 millions to the total fundraising (see here a previous post by BeBeez), while the first three months of this year totaled 13 millions, the quarterly record. Figures are calculated by Crowdfundingbuzz (published by EdiBeez srl as well as BeBeez), stating that a total of 230 campaigns were successfully financed, of which 37 this year and 113 in 2018.

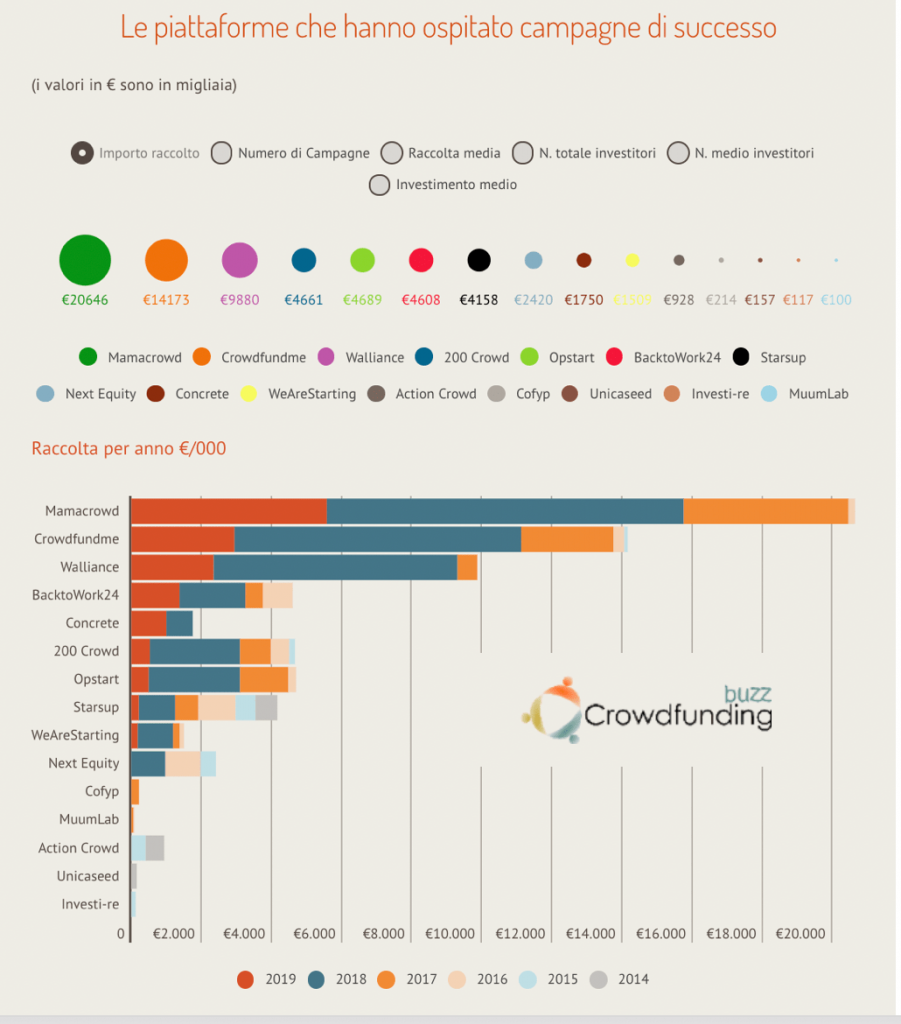

To play the lion’s share among the platforms is always Mamacrowd which has now reached a total of almost 20.7 million euros raised for 53 successful campaigns since the beginning of its activity in 2017, with almost 5.6 millions raised this year. In second place is CrowdFundMe with 14.2 million raised from the beginning of its activity in 2017 too and 49 campaigns, with 2.9  millions this year.

millions this year.

Data were pushed by three campaigns in these first four months of the year, which alone raised over 6 million euros, ie Green Energy Storage and StartupItalia on Mamacrowd and Winelivery on CrowdFundMe.

Green Energy Storage is a Trentino-based startup founded in 2015 that developed an innovative and organic energy storage system. It closed its second equity crowdfunding campaign, raising 2.15 million euros, on an initial target of 505k euro (see here a previous post by BeBeez). StartupItalia is instead an innovative SME that has created the largest Italian community dedicated to startup founders and investors and that in its first equity crowdfunding campaign has raised over 2.8 million euros (see here a previous post by BeBeez). Finally, Winelivery is an ecommerce platform dedicated to wine that allows you to order via app or website and receive products in less than 30 minutes at home. Last January it closed its third equity crowdfunding campaign, raising over 1.2 million euros (see here a previous post by BeBeez).

A separate chapter, finally, do always the equity crowdfunding real estate platforms that started to work only in 2017 and that with few campaigns have already reached remarkable fundraisings. In particular, Walliance has raised 9.9 millions for 9 campaigns, of which 2.4 millions this year, while Concrete starting from 2018 has collected in total 1.75 millions on two campaigns, of which one million since the beginning of the year.