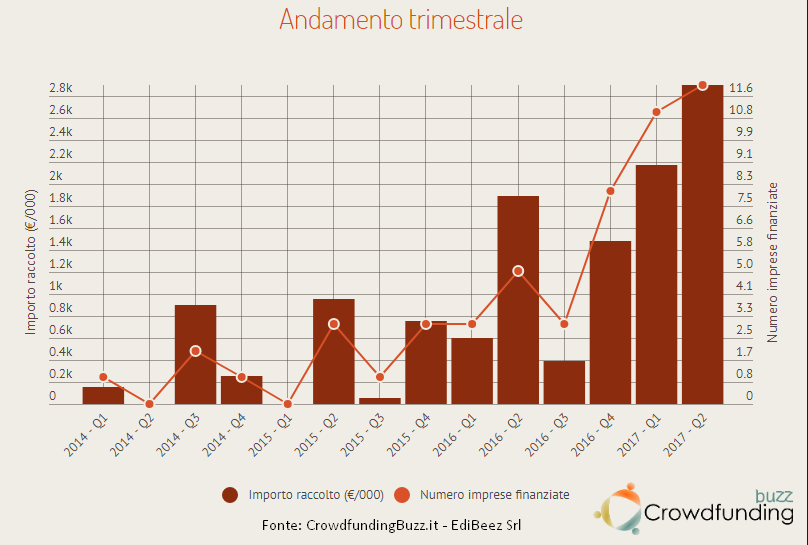

Italian equity crowdfunding platforms raised 5 million euros for 23 companies or much more than in 2016 as a whole (4.3 million euros for 19 companies) equity crowdfunding . This result move the total fundriasing by equity crowdfunding platforms in Italy sine 2014 (year the first platform started working) to 12,5 million euros for 53 companies. Thease are figures calculated CrowdfundingBuzz, an Italian crowdfunding focused internet site published by EdiBeez srl, the same publisher of BeBeez.

Italian equity crowdfunding platforms raised 5 million euros for 23 companies or much more than in 2016 as a whole (4.3 million euros for 19 companies) equity crowdfunding . This result move the total fundriasing by equity crowdfunding platforms in Italy sine 2014 (year the first platform started working) to 12,5 million euros for 53 companies. Thease are figures calculated CrowdfundingBuzz, an Italian crowdfunding focused internet site published by EdiBeez srl, the same publisher of BeBeez.

Out of the 23 financed companies, 19 are so called innovative startups, 2 are SMEs and one is an investment veichle. Almost all (87%) the campaigns were overfunded which means that they raised nore money than their minimum raising target. More in detail, as the average fundraising target was sligtly more than 100k euros, the effective raised capital were more than 200k euros.

And the siz of the single investment is lowering as the number of investors is going up: in these 6 months 63 investors per campaign have been seen on the Italian equity crowdfunding platforms for a 3,500 euros average investment, but in 2016 only 39 investors per campaign have been seen for a single average investment of about 5,800 euros.

However some platforms are specializing in attracting ore retail investors such as Crowdfundme and Mamacrowd, which were the most active successful platforms in H1 2017, with 7 successful campaigns for a total of 3.3 million euros raised or 66% of the total capital raised. ciascuna con 7 società finanziate, per complessivi 3,3 milioni (66% del totale). Mamacrowd saw an average of 64 investors per campaign, while Crowdfundme saw an average of 119. On the other side there are platforms working more specifically with professional investors. Actually the other 9 successful campaigns saw an average of 20 investors per campaign with an average investment of about 10k euros.