Mossi Ghisolfi, an Italian chemical group and a leading global supplier of polyethylene terephthalate (PET), is selling its biofuel business in Italy as part of a debt restructuring agreement it is arranging with its lenders in the US with the restructuring process being coordinated by Rothschild, Reuters, yesterday wrote. Mediobanca is the mandated advisor for the biofuel business sale, the newswire added.

Mossi Ghisolfi, an Italian chemical group and a leading global supplier of polyethylene terephthalate (PET), is selling its biofuel business in Italy as part of a debt restructuring agreement it is arranging with its lenders in the US with the restructuring process being coordinated by Rothschild, Reuters, yesterday wrote. Mediobanca is the mandated advisor for the biofuel business sale, the newswire added.

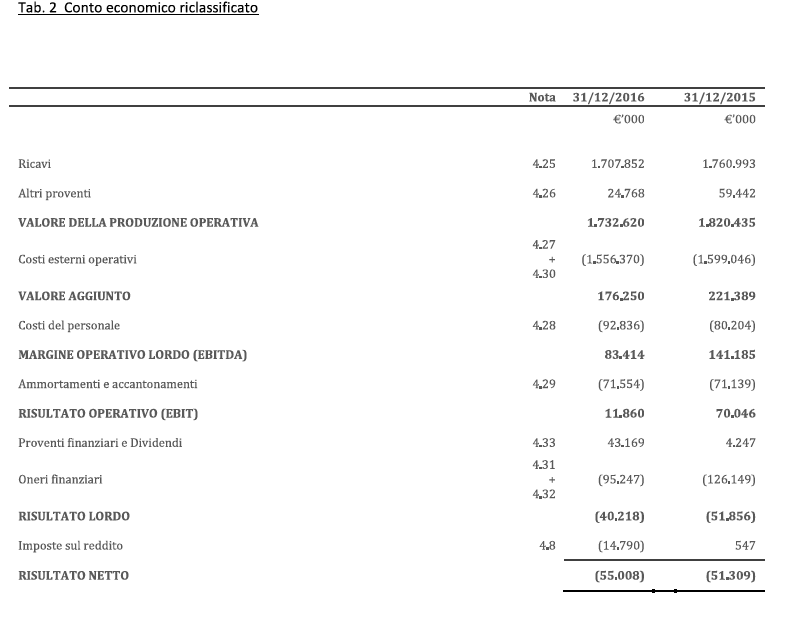

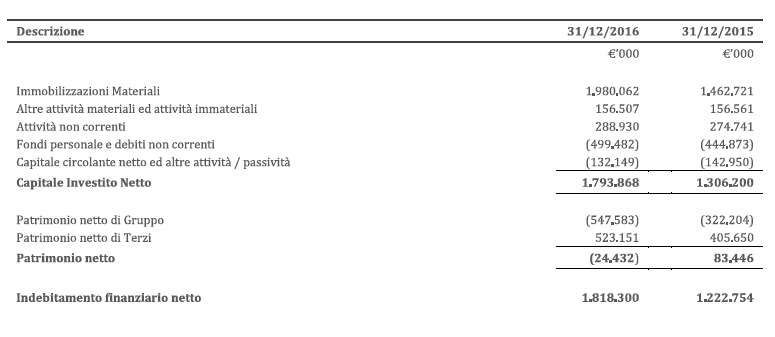

Founded in 1953 and controlled by the Ghisolfi family, Mossi Ghisolfi closed FY 2016 with 1.7 billion euros in revenues (down from 1.8 billions in 2015) and a 83.4 million euros ebitda (down from 141.1 millions), due to pre-operative costs related to the construction of the greatest integrated PTA/PTE production plant in Corpus Christi in Texas (16 million euros) and positive margins cashed in in 2015 from the sale of a portion of land (9 millions) in Corpus Christi.All that brought the group to a net loss of 55 million euros in 2015 (from a 51.3 million euros net loss in 2015) and to a net financial debt of 1.8 billions (from 1.2 billions), with the debt increase due to new financing for the Corpus Christi’s plant.

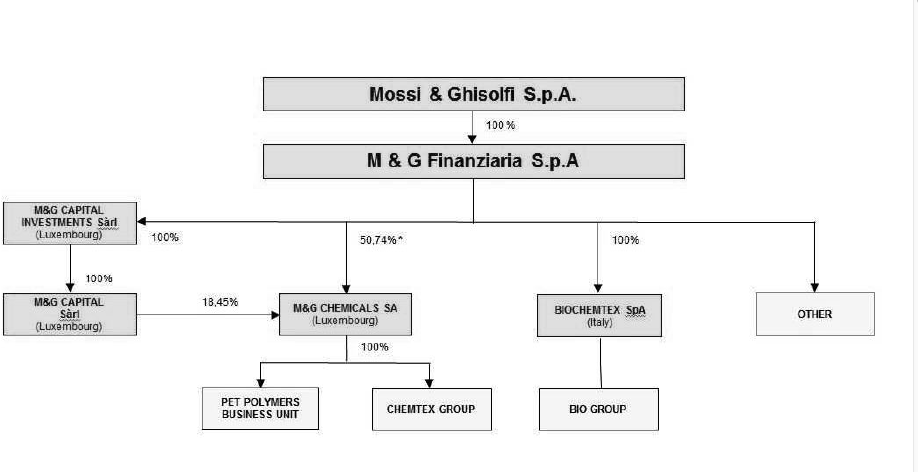

The group tried to list its chemical division M&G Chemicals in Hong Kong in December 2014 but the ipo was pulled due to adverse market conditions. The ipo would have raised about 4 billion Hong Kong dollars (or 500 million US dollars or about 375 million euros at the exchange rates of that time) for a 30% stake of the company.

After the ipo was pulled the group decided to open M&G Chemical’s capital to US private equity group TPG who subscribed a 300 million dollars capital increase for just less 30% of M&G Chemicals. The investment was made through TPG Opportunities Partners fund (see here a previous post by BeBeez).

TPG and M&G had already been in business together back in October 2011 when TPG Capital and TPG Biotech, itogether with M&G Chemtex, invested 250 million dollars to build the joint venture Beta Renewables (M&G Chemtex had a 75%).