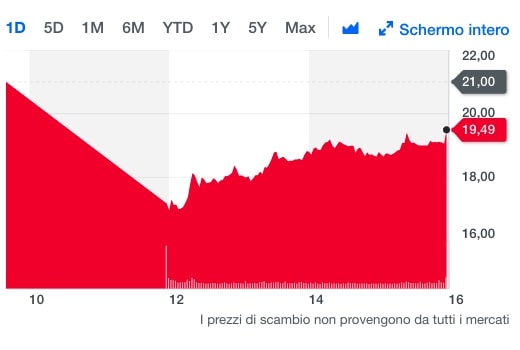

On 16 July, Friday, Stevanato, an Italian packaging company, financed by Pricoa Capital, launched its ipo on New York Stock Exchange (see here a previous post by BeBeez). However, the share price lost 6.3% from its 21 US Dollars of the opening and closed ad 19.67 US Dollars. The company only listed 32 million shares of new issuance through a capital increase. Stevanato raised 672 million US Dollars, well below an expected amount of 960 million for a market capitalization of 6.3 billion at the opening of trading and 5.9 billion at the closure.

SIT, an Italian producer of solutions for measuiring energy consumption that listed on Milan market in 2017 after the business combination with Industrial Stars of Italy 2, acquired the unit for the production of valves for the gas storage water heaters of NYSE-listed Emerson Electric (See here a previous post by BeBeez). Earlier in May, SIT issued an ESG-linked bond of 40 million euros that Pricoa Private Capital subscribed in the frame of a 100 million US Dollars private shelf-facility programme. The proceeds of the bond refinanced the previous credit lines and acquisitions. Sit has sales of 320.7 million, an adjusted ebitda of 44.6 million, net profits of 13.4 million and a net financial debt of 115.8 million.

Fabbrica Italiana Sintetici (FIS), an Italian producer of active ingredients for the pharmaceutical industry, signed with Milan-listed illimity Bank a 21 million euros reverse factoring agreement for supporting the company’s suppliers (See here a previous post by BeBeez). FIS also received from illimity a 23 million factoring facility. FIS belongs to the Ferrari Family and has sales of 498.6 million, an ebitda of 22.3 million and a net financial debt of 264.2 million. In January 2018, FIS issued a senior unsecured bond of 50 million due to mature in January 2028 that Pricoa Private Capital subscribed. In 2017 FIS issued a 50 million Vienna-listed bond that Cassa Depositi e Prestiti subscribed. The issuance is due to mature in October 2024 and pays a 2.747% coupon. Sign up here for BeBeez Newsletter about Private Debt and receive all the last 24 hours updates for the sector.

Citel Group, an Italian provider of Artificial Intelligence for corporate digitalization, acquired Italian competitor Competence & Digital from the founders Alessandro Ilarda and Laura Caretta (see here a previous post by BeBeez). Earlier in November, Valerio D’Angelo, the ceo of Citel, said to BeBeez that the company was actively looking for acquisitions that would have financed with its 2.6 million euros cash, banking loans and the resources it had raised through the issuance of a 2 million minibond that was part of Garanzia Campania Bond (GCB), a basket bond programme for which Cassa Depositi e Prestiti and Mediocredito Centrale acted as anchor investors. GCB raised more than 97 million euros through the issuance of asset backed securities notes.

Fantic Motor, an iconic Italian producer of motorbikes and e-bikes, issued a 6-years minibond of 7 million euros that Unicredit subscribed and for which Sace provided a 50% warranty (See here a previous post by BeBeez). Since 2014, Fantic Motor belongs to VeNetWork, an investor in re-startups. Fantic has sales of 150 million but aims to generate a turnover of 300 million by 2024. The company will invest the raised proceeds in integrating further Motori Minarelli, an asset that acquired from Yamaha Motor Europe in 2020, developing its e-mobility activities and expanding the business in Germany, Spain and the USA.

Primotecs (fka Tekfor), an Italian producer of automotive components that belongs to Frankfurt-listed Mutares, received a financing facility of 8 million euros with the warranty of Sace (see here a previous post by BeBeez). The loan has a tenure of 6 years with three years of pre-amortisation and three years of repayment. Primotecs has sales of 90.5 million euros and will invest the raised proceeds in the improvement of its industrial machinery. Mutares owns 26 companies that have a cumulated turnover of 1.6 billion.

CRS Impianti, an Italian producer of industrial systems, raised a 5 million euros financing facility through Azimut Direct (fka Epic sim), part of Milan-listed Azimut (see here a previous post by BeBeez). An institutional investor subscribed this facility with a tenure of 4 years and that received a warranty from Sace. CRS Impianti has sales of 30.9 million with an ebitda of 1.15 million. The company will invest the raised proceeds for supporting the construction of systems in Mexico and Ghana. Sign up here for BeBeez Newsletter about Private Debt and receive all the last 24 hours updates for the sector.

Cerutti, a troubled Italian producer of machines for the printing and packaging industry, now belongs to Switzerland’s Bobst, the owner of Rotomec, an Italian competitor (see here a previous post by BeBeez). Cerutti attracted a 6.2 million euros offer from Bobst and a competing bid from Rinascita Seconda, a club deal that Marco Drago, Diana Bracco, Ernesto Pellegrini, Franco Goglio, and Paolo Montironi launched.

Due to the regulations related to the coronavirus that blocked the new foreclosures and suspended the auctions in Courts concerning residential properties, in the first half of 2021 out of 74,960 auctions published, 32% concerned only the insolvency proceedings that are all sales that refer to bankruptcies, arrangements with creditors, debt restructuring, compulsory administrative liquidations. The figure compares with 28% in 2020. This is what emerges from an analysis made by the Astasy study center of NPLs RE_Solutions and by Frontis Npl (see here a previous article by BeBeez).