The EU Commission yesterday approved the extension of the GACS scheme, the public guarantee system associated with the senior tranches of non-performing loan securitisations by Italian banks. The scheme, that was approved in February 2016 and last extended in May 2019, will now be valid until June 14, 2022 (see the press release here). Indeed, the Commission has confirmed that the measures are to be considered exempt from State aid under EU rules.

The EU Commission yesterday approved the extension of the GACS scheme, the public guarantee system associated with the senior tranches of non-performing loan securitisations by Italian banks. The scheme, that was approved in February 2016 and last extended in May 2019, will now be valid until June 14, 2022 (see the press release here). Indeed, the Commission has confirmed that the measures are to be considered exempt from State aid under EU rules.

The Italian Government has been negotiating with the EU the extension of the GACS since the beginning of the year (see here a previous article by BeBeez). However, the negotiation did not also concern the extension of the GACS to the UTPs, as requested several times by operators in the non-performing loan market (see here a previous article by BeBeez).

Under the scheme, therefore, Italian banks that meet certain conditions will continue to be able to request a State guarantee on low-risk senior securities issued by securitization vehicles that finance the sale of their NPL portfolios. The riskiest financing tranches of the securitization vehicles will, on the other hand, continue to be sold to private investors and will not be guaranteed by the state.

The GACS, according to the latest Banca Ifis Market Watch, contributed to the rise to 36% from 27% in 2019 in the average price of secured NPLs transactions (see here a previous article by BeBeez). Again according to the bank, from 2016 to today there have been 35 GACS, for a total of 85 billion euros of NPLs securitized portfolios. However, the performance of securitisations was almost all significantly impacted by the Covid-19 pandemic.

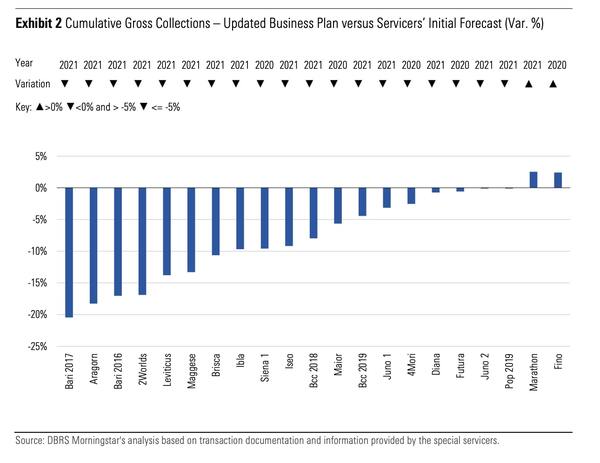

Out of a total of 22 NPL securitization transactions valued between 2016 and the first half of 2020, DBRS Morningstar has calculated that to date the servicers of 21 of those transactions have modified their recovery business plans by forecasting a decreasing amount of gross recoveries. compared to the original business plans in a range between 0.1% and 20.4%. And also ScopeRatings in its latest report reports a big difference between the pace of recoveries of the six months in March 2021 and the previous six months (see here BeBeez‘s Insight View of June 8, 2021 available to BeBeez News Premium subscribers) . And even Moody’s last April pointed out that as many as 15 of the 24 Italian, Portuguese and Spanish securitisations monitored by Moody’s recorded cumulative gross recoveries lower than the forecasts of the servicers included in the original business plans (see here BeBeez‘s Insight View of 8 April 2021 available to BeBeez News Premium subscribers).