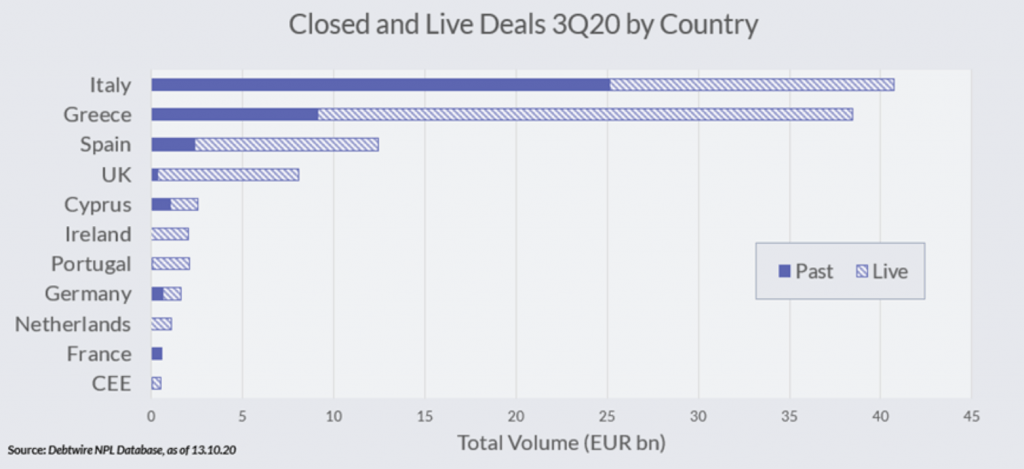

At the end of 2Q20, the amount of distressed credits for European Banks amounted to 526.3 billion euros (522.8 billion at the end of 1Q20), said EBA’s Risk Dashboard for 2H20 (see here a previous post by BeBeez). Italy, which weighs almost a fifth of that figure, with its 108.4 billions, is actually going against the trend, down from 111.6 billions at the end of March. A situation, this one that had been already anticipated by BeBeez in its Insight View of last September 29 (available to subscribers to BeBeez News Premium, see here how to subscribe), which highlighted that on the financial statements of the first seven Italian banking groups at the end of June 2020 there were 87.5 billion euros of gross non performing exposures. Meanwhile, disposals of non-performing loans on the European market have slowed further. Debtwire in its latest European NPLs Report calculated that from the beginning of the year to the end of September transactions concluded were worth only 39.2 billion euros GBV.

At the end of 2Q20, the amount of distressed credits for European Banks amounted to 526.3 billion euros (522.8 billion at the end of 1Q20), said EBA’s Risk Dashboard for 2H20 (see here a previous post by BeBeez). Italy, which weighs almost a fifth of that figure, with its 108.4 billions, is actually going against the trend, down from 111.6 billions at the end of March. A situation, this one that had been already anticipated by BeBeez in its Insight View of last September 29 (available to subscribers to BeBeez News Premium, see here how to subscribe), which highlighted that on the financial statements of the first seven Italian banking groups at the end of June 2020 there were 87.5 billion euros of gross non performing exposures. Meanwhile, disposals of non-performing loans on the European market have slowed further. Debtwire in its latest European NPLs Report calculated that from the beginning of the year to the end of September transactions concluded were worth only 39.2 billion euros GBV.

Rainer Masera, the current dean of the Economics faculty at Unimarconi and a former Italian Ministry of budget and economic planning and ceo of Sanpaolo Imi, said to Stefania Peveraro, the Editor in Chief of BeBeez, that he is not convinced that the calendar provisioning could work for the distressed credits sector, while the creation of an European bad bank would not rule out actions at a domestic level (see here a previous post by BeBeez). Masera was speaking on the sidelines of the event Alma Iura for which he acts as the chairman of the scientific board.

In 1H20, the Italian servicer Fire posted a 2.7 million euros ebitda (+16%) with assets under management for 203 billion (+15%) (see here a previous post by BeBeez). The turnover and the operative costs have gon down 8% and 11% in light of the Covid-19. Alberto Vigorelli is the ceo of Fire.

BeBeez will be the media partner for Global NPL, an online event of SmithNovak for 27 and 28 October, Tuesday and Wednesday (see here a previous post by BeBeez). The conference will allow for an effective networking through a conference app. More than 300 market participants will join the event that will host roundtables with more than 80 speakers. Click here for further information

Berkshire Hathaway, the firm of Warren Buffett, signed a partnership with Milan-based merchant bank Davis & Morgan for investing in Italian real estate UTPs (see here a previous post by BeBeez). The firms will invest in portfolios worth up to 15 million euros that have underlaying real estate assets based in Milan and other big Italian cities.

Borgosesia RE, a subsidiary of Milan-listed Borgosesia will develop a real estate project in Milan area on behalf of an investor in NPLs (see here a previous post by BeBeez). Borgosesia is reportedly interested in developing special situations real eatate projects. Davide Schiffer is the company’s ceo. In 2019, Borgosesia’s equity amounted to 26.9 million euros, net profits of 2.7 million (+69% yoy), a turnover of 14.5 million, an adjusted ebitda of 5 million (+17.6%), a net financial debt of 3.9 million (8 million).

Troubled Milan-listed textile company Vincenzo Zucchi concluded earlier than scheduled its debt restructuring strategy thanks to its own resources and a refinancing facility that CCR II fund, managed by Dea Capital Alternative Funds sgr, and Illimity provided (see here a previous post by BeBeez). However, sources said to BeBeez that lenders written off part of the debt. The company and the funds invested more than a total of 15 million euros in even parts. Zucchi is now ready to grow again. On 30 August 2020, the gross financial debt of Zucchi amounted to 48.8 million, this figure does not include the 49.6 million of banking loans, while the net financial debt was of 37.7 million (43.1 million at the on 31 December 2019).

CCR Dea Capital Alternative Funds acquired a portfolio of UTPs with a gross value of 50 milllion euros and reached a GBV of 925 millions for its CCR II fund (see here a previous post by BeBeez). As BeBeez reported earlier in September, such credits include the 27 million resources of the closing that took the fund’s NAV to above 600 million. CCR acquired the credits of Microgame, ICQ Holding and Istituto Neurotraumatologico Italiano. Marco Castaldo is the ceo of Microgame which has sales of 28 million and since 2016 it belongs to Monitor Clipper (46.76%), Tpg Growth (44.93%) and to Massimiliano Casella (8.31% – Unicredit and IKB have this stake as collateral) the founder Fabrizio D’Aloia and his wife Daniela Di Rubbo sold all their interest in the company. ICQ Holding sold in 2008 a stake to Ambienta (exit in 2017) that in three years poured 37.5 million for a 23.8% of the business. Enerva (a company of ICQ’s chairman Antonio Caporale), Rienervia, Tuaenergie, Eurenergia, Maria Teresa Buonocore, and other minority investors currently own the company. Istituto Neurotraumatologico Italiano has sales of 83.1 million with an ebitda of minus 0.61 million and a net financial debt of about 26 million. CCR recently recorded a further closing as it acquired a credit of a gross value of 25 million that Banca Popolare di Sondrio had with Gruppo Calvi Holding, of which the found acquired a 26% in 2019 when it converted in equity a debt of 63 million. The Chini Family kept the majority. CCR acquired from Unicredit, Intesa Sanpaolo, Banco Bpm, Bnl, Ubi Banca, Mps, Banca Ifis, and Credito Valtellinese the credits of nine industrial groups amounting to 230 million and raised 70 million from Dea Capital and institutional investors. Further to converting the debt in equity, in March 2019, CCR poured 13.5 million of fresh resources in Calvi together with Illimity. The bank partially refinanced the debt of Calvi for 34 million. Calvi has a turnover in the region of 322.8 million, an ebitda in the region of 21 million and a net financial debt of 23.9 million.

In 3Q20, Generalfinance, a provider of factoring facilities to companies in distress, posted a 25% growth of its core business to 506 million euros (See here a previous post by BeBeez). The company’s net profit is of 4.1 million (+30%), a 12 million brokerage margin (+24%), issued credits for 327 million (+23%), an annualized Roe of 32%, and equity of 21.4 million. Massimo Gianolli is the ceo of Generalfinance.

Hal Service, an Italian ICT company, listed on the Milan ExtraMot Pro3 market its one million euros minibond previously placed on CrowdFundMe, a crowdfunding platform, between July and September 2020 (see here a previous post by BeBeez). The minibond is due to mature in October 2024 and pays a 4.25% coupon. Hal Service will invest these proceeds in its organic development. HAL has sales of 4.7 million, an ebitda of 0.65 million and a net financial debt of 0.6 million.

Italian fintech Borsa del Credito (BdC), a company in which P101, Azimut and GC Holding invested, launched Eco-Green Starter a financing facility for the companies in the fields of energy and seismic upgrading of the buildings (see here a previous post by BeBeez).

Ver Capital and Sinloc (industrial advisor) launched Ver Capital Sinloc Energy Transition Fund (VCSETF), an impact investing vehicle for the energy transition (see here a previous post by BeBeez). VCSETF aims to raise 200 million euros with an annyal yield of 8-10%. Andrea Pescatori and Antonio Rigon act as ceo for Ver Capital and Sinloc.

Alba Leasing carried on a securitization of a 490 million portfolio of SMEs performing leasing credits (see here a previous post by BeBeez). The European Investment Bank (440 million) and the European Investment Fund (50 million) subscribed the senior and mezzanine notes. Investment Plan for Europe will provide a warranty for 50 million of this securitization. Alba Leasing will now allocate resources for financing SMEs worth a total of 980 million (10% for environmental projects; two thirds for companies with up to 250 workers and one third for companies with up to 3000 employees). Alba Leasing was born in 2010 and belongs to Banco Bpm (39.19%), Bper Banca (33.5%), Banca Popolare di Sondrio (19.26%), and Credito Valtellinese (8.05%). Luigi Roth and Massimo Mazzega are the bank’s chairman and ceo.

Zegna Baruffa Lane Borgosesia (ZBLB), an Italian textile company, received from Intesa Sanpaolo a 6-years financing facility of 10 million euros with the warranty of Sace’s Garanzia Italia (see here a previous post by BeBeez). The company will invest such proceeds in its working capital and the human resources costs. ZBLB has sales of 100.3 million, an ebitda of 5.1 million a net financial debt of 37.7 million with equity of 78 million. Alfredo Botto Poala is the chairman of ZBLB.

On 20 October, Tuesday, Aifi (the Italian association of private capital investors) hosted an event for discussing about the rolse of Eltifs for unlisted companies and the real economy (see here a previous post by BeBeez). Daniele Colantonio, partner product development of Anthilia Capital Partners, said that his firm launched a 7-years Eltif with 2 classes: one for the wealth management and another for institutional investors. Claudia Vacanti, Head of Product Development of Banca Generali launched Real Italy Eltif as part of the programme BG4Real. Such Eltif allocates its assets in debt (80%) and equity (20% – 10% in listed SMEs and 10% in direct investments and coinvestments in corporates). Rossano Rufini, Managing partner of Equita Capital, said that his company launched an Eltif that invests 60-70% of its resources in lower mid market private equity funds (targets with sales of 25-30 million) and 20-30% in small-caps (market capitalization of less than 500 million). Alessandra Manuli, the ceo of Hedge Invest, said that Hedge Invest Algebris Italia Eltif targets listed and soon-to-list firms with a market capitalization below 500 millioni. Filomena Cocco, a managing director of Muzinich & Co., said that her firm launched a 450 million Eltif for European investments that allocated 280 million for the Italian market. Muzinich also launched an Eltif Pir with Azimut for the retail clients. Marco Belletti is the ceo of Azimut Libera Impresa. Stefania Peveraro, the chief editor of BeBeez, detailed about the private market products for private banking clients in her book “Private Capital. Esperienze e soluzioni. Ecco perché la finanza alternativa funziona” (click here for free download) of which EdiBeez srl is the publisher.