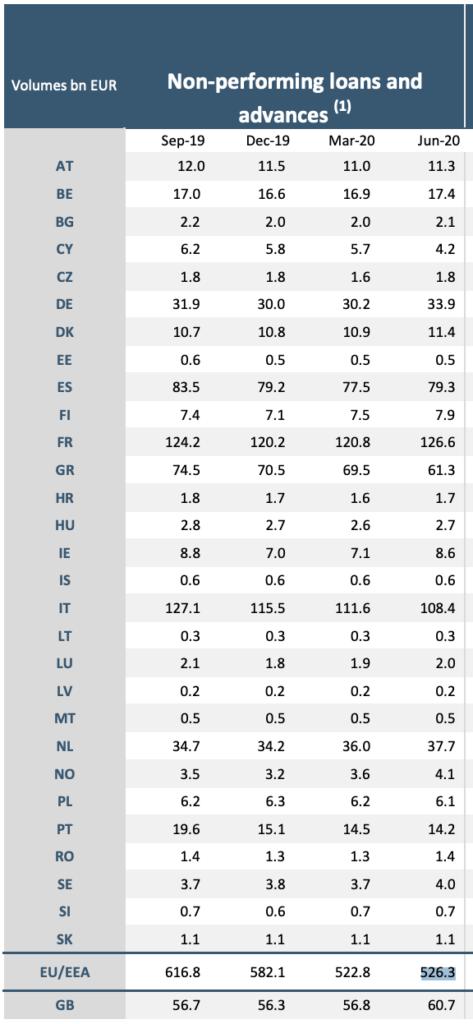

The feared reversal of the trend towards the reduction of the stock of non-performing loans on the books of European banks due to the Covid-19 emergency is already visible in the numbers at the end of June. This was calculated by the European Banking Association (EBA) in its latest Risk Dashboard for the second half of 2020. The stock has in fact risen to 526.3 billion euros, up from the low recorded at 522.8 billion at the end of March.

Italy, which weighs almost a fifth of that figure, with its 108.4 billions, is actually going against the trend, down from 111.6 billions at the end of March. A situation, this one that had been already anticipated by BeBeez in its Insight View of last September 29 (available to subscribers to BeBeez News Premium, see here how to subscribe), which highlighted that on the financial statements of the first seven Italian banking groups at the end of June 2020 there were 87.5 billion euros of gross non performing exposures (or bad loans, unlikely-to-pay loans and past due), down from 90.3 billions at the end of March. A result that, despite expectations, does not yet show the feared increase in the stock of impaired loans due to the consequences of the lockdown. But unfortunately the feeling is that this will no longer be the figure for the next few months.

On the other hand, Andrea Enria, head of ECB Supervision, in an interview Sunday with the German newspaper Handelsblatt, already put his hands forward, warning: “In a serious scenario with a second wave of contagion and containment measures, we have calculated that there could be up to 1.4 trillion euros in non perfoming loans, more than since the last financial crisis. And it is still too early to rule out this serious scenario. This would have consequences on the capital positions of banks ”(see here a previous article by BeBeez). A potential figure that is therefore well above the peak of 1.2 trillions reached in 2014 at a European level.

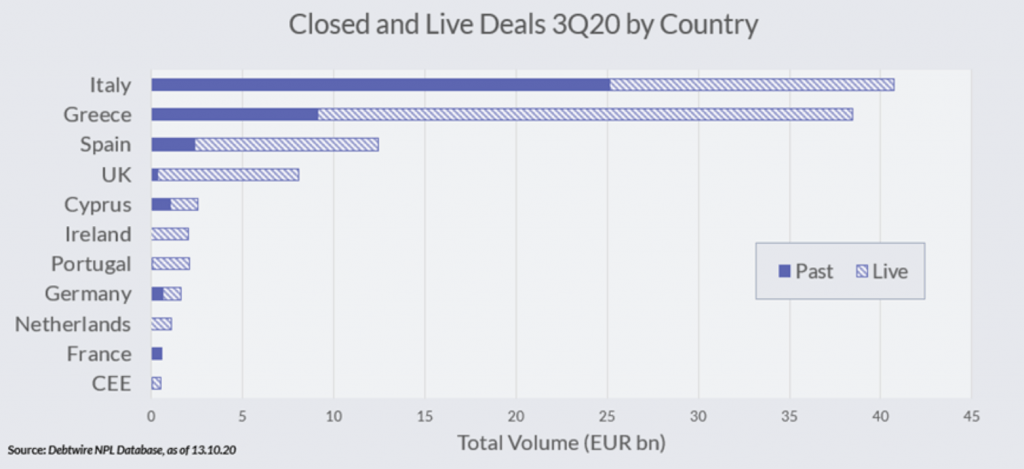

Meanwhile, disposals of non-performing loans on the European market have slowed further. Debtwire in its latest European NPLs Report calculated that from the beginning of the year to the end of September transactions concluded were worth only 39.2 billion euros GBV (in the first half the figure was 30.4 billions, see here a previous article by BeBeez), a a figure that is at the lowest of the last 5 years.

Moreover, even here Italy is in contrast versus the European trend, with transactions concluded for a good 25.1 billion euros at the end of September, followed by Greece with 9 billion euros of deals. The operations carried out between Italy and Greece together represented 87.2% of the gross value transacted on non-performing loans in Europe since the beginning of the year. On the market, however, there are still 70.9 billion euros of deals. And in this case too Italy still weighs for a large share.

BeBeez had calculated that in Italy, from the beginning of the year to the end of July, 42 transactions on non-performing loans for 20.4 billion euros gross had been announced, after a 2019 in which 82 deals were announced for 52 billion euros (see here BeBeez NPLs Report for the first 7 months 202o, available to BeBeez News Premium subscribers, see here how to subscribe). Only two other transactions were then closed between August and September: CreVal sold 372 million euros to MBCredit Solutions and AMCO (see here a previous article by BeBeez) and Illimity sold 266 millions to Banca Ifis (see here a previous article by BeBeez).

However, a mega-deal that will see the passage of 8.1 billion euros of gross impaired loans from MPS to AMCO is in the pipeline (see here a previous article by BeBeez), as well as a series of other significant transactions such as the expected new securitization with GACS of 2 billion euros by the Iccrea group (see here a previous article by BeBeez), the expected sale of a portfolio of corporate SMEs by UBI Banca up to one billion euros (see here a previous article by BeBeez), the expected securitization with Gacs of 2 billion euros of leasing NPLs by Unicredit (see here a previous article by BeBeez) and the upcoming sale of one billion euros of UTPs by Banco Bpm (see here a previous article by BeBeez).