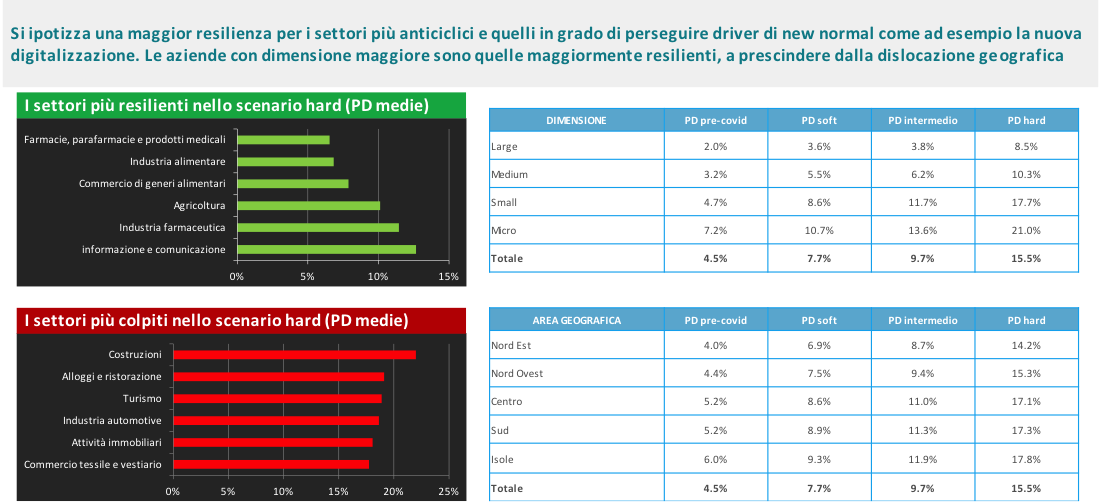

If a new coronavirus related emergency arises, 15.5% of Italian companies would risk to bankrupt, said the report “Evolution and impacts of the COVID-19 pandemic emergency on Italian non-financial corporates” that Cerved Rating Agency published (see here a previous post by BeBeez). A previous report of the agency was more optimistic as it said that up to 6.8% of the companies may bankrupt. Cerved Rating Agency outlined 3 scenarios:

If a new coronavirus related emergency arises, 15.5% of Italian companies would risk to bankrupt, said the report “Evolution and impacts of the COVID-19 pandemic emergency on Italian non-financial corporates” that Cerved Rating Agency published (see here a previous post by BeBeez). A previous report of the agency was more optimistic as it said that up to 6.8% of the companies may bankrupt. Cerved Rating Agency outlined 3 scenarios:

- worst case (low likelihood): 15.5% of the companies may risk to default

- intermediate (median likelihood): 9.7% of the companies may risk to default

- optimistic (high likelihood) 7.7% of the companies may risk to default

Italian real estate company Statuto, the owner of high-end hotels Four Seasons and Mandarin in Milan, Danieli in Venice and San Domenico Palace in Taormina (Sicily), said that on 4 May, Monday, it paid to Apollo Global Management the 94 million euros debt that the fund previously acquired from Montepaschi (see here a previous post by BeBeez). Statuto acquired Danieli from Starwood in 2005 for 242 million with a 170 million financing facility that Mps provided with two other banks. The Children’s Investment Fund (TCI) is the only creditor for such loan whose tenure ends in 2022. Every hotel that belongs to Statuto is part of a vehicle that has a debt with funds or banks. The company has debts in the region of 500 million with Banco Bpm and of 126 million with Amco, which acquired the NPLs with Veneto Banca. In January 2016, Statuto issued a bond of 34 million and a Vienna-listed bond of 25 million that Cale Street Partners subscribed in a private placement. The bond is due to mature in January 2021 and pays a 6% coupon.

Alma, a staffing agency, and its subsidiaries Articolo1 and Idea Lavoro filed an application for receivership with Naples Court for restructuring its above 600 million euros debt (see here a previous post by BeBeez). In November 2019, an auction for Articolo1 and IdeaLavoro of Naples Court did not attract bidders. The company’s troubles started at the end of 2018, when its executives Francesco Barbarino and Luigi Scavone have been arrested for tax fraud of 70 million.

A pool of 11 entrepreneurs and professionals that Maurizio Pellegrino and Fabio Pagliara head, created SIGI, a newco for acquiring troubled Italian football team Catania Calcio (see here a previous post by BeBeez). Pellegrino said that SIGI would drop the plan for acquiring the team if it bankrupted. Catania Calcio belongs to Antonino Pulvirenti.

On 21 May, Thursday, Officine Maccaferri, an asset that belongs to Seci, filed an application for receivership with Bologna Court after having subscribed the restructuring proposals of Ad Hoc Group (AHG), which reunites Carlyle and 54% of the investors in the 190 million euros bond (see here a previous post by BeBeez). Sources said to BeBeez that the directors are keen on relaunching the business through the implementation of the receivership plan once the Court gives its approval.

The board of directors of troubled Milan-listed contractor Astaldi allocated resources of up to 75 million euros and issued hybrid instruments for paying its unsecured creditors (See here a previous post by BeBeez). Creditors will get the hybrid instruments as soon as the company’s receivership plan will be omologated. Unsecured creditors will get 12,493 newly issued shares of Astaldi every 100 euros of credits, a hybrid instrument for each euro of credit. The net profits out of the sale of the non-core assets of Astaldi and of Astaldi Concessioni will pay as well the unsecured creditors.

Perini Navi, a yachts producer that Fabio Perini founded in 1983, filed an application for receivership with Lucca’s Court (See here a previous post by BeBeez). Perini Navi belongs to Lamberto Tacoli and the Tabacchi Family through Felix and to Fabio Perini. The company has sales of 65.5 million euros, an ebitda of minus 4.25 million, losses of 8.3 million and net financial debt of 26.42 million. Between 2016 and 2018 the company cumulated losses for 55 million and for 140 million in the last 9 years. Milan-listed yachts producer Sanlorenzo said on 21 May, Thursday, that it is holding exclusive talks for acquiring the Majority of Perini. Sanlorenzo has sales of 456 million, an adjusted ebitda of 66 million and net profits of 27 million. Earlier in May, the company received a 10 million financing facility from CDP and will invest such proceeds in its organic development.

Illimity Bank acquired and restructured hybrid instruments and mortgage credits amounting to 130 million euros that 13 banks had with Tre Holding, whose chairman is Maurizio Ria, a managing partner of Duke&Kay(See here a previous post by BeBeez). Tre Holding is the owner of the logistic and productive assets that Targetti Sankey spun-off and belongs to the Targetti family.

Crèdit Agricole Italia is working on the sale of a portfolio of Utps worth a few hundred million euros (See here a previous post by BeBeez). The bank is also looking to sign a partnership with Illimity, doValue or Intrum for managing a further billion of Npes. Crèdit Agricole Italia has NPLs with a face value of 1.9 billion euros, UTPs worth 1.6 billion and 30.5 million of expired credits for a total of 3.5 billion of distressed credits (3.7 billion in 2018), for a 7.1% gross NPE (7.6% ins 2018).

Credito Fondiario, an Italian investor in NPLs, has 51.1 billion euros of assets under management in 1Q20 (See here a previous post by BeBeez). The company posted a turnover of 31 million (15.8 million in 1Q19), an ebitda of 22.5 million (8.3 million), an interest margin of 20 million (8.8 million), and net profits of 8.5 million (1.5 million). Credito Fondiario has net cash of 230 million that in the last weeks of April amounted to 300 million. The company is reportedly interested in launching an ipo.

Intrum Italy promoted Roberto Borrelli as head of program and project management; Stefano Giudici as real estate director, and Antonio Rabossi as operation director, while Emanuela Crippa, previously working for Pirelli as head of finance and special projects, will be the new company’s head of legal (See here a previous post by BeBeez). They will all report to Intrum Italy’s ceo Marc Knothe. Intrum Italy is a joint venture between Intesa Sanpaolo (49%) and Sweden’s Intrum (51%) signed in Aprli 2018. Intrum Italy’s chairman is Giovanni Gilli. Earlier in February, the company reportedly called off the exclusivity talks for acquiring Cerved Credit Management because of the coronavirus emergency for 450 million. Intrum Italy also launched Intrum Italy Re Sales (IIRES), a network of real estate brokers (see here a previous post by BeBeez). IIRES aims to sign mandates worth 200 million and quickly sell them for recollecting credits.

Lorenzo Maternini, the vicepresident of Talent Garden, joined the board of directors of Guber Banca for strengthening the firm’s digital competences (see here a previous post by BeBeez). Maternini founded Talent Garden, a co-working and digital training platform, in 2011. Guber Banca, an investor in distressed credits, has asset under management amounting to 9 billion euros.

Asja Ambiente Italia, an Italian renewable energy company, issued a minibond of one million euros that Anthilia subscribed (see here a previous post by BeBeez). The bond is due to mature on 29 June 2027 and pays a 5.75% coupon with an amortizing structure from July 2022. This is the second tranche of the 40 million green bond programme of Asja that will invest the proceeds in its organic development. Agostino Re Rebaudengo is the company’s chairman. Asja has sales of 62 million, an ebitda of 21.2 million, and a net financial debt of 143.4 million. Sign up here for BeBeez Newsletter about Private Debt and receive all the last 24 hours updates for the sector.

In 2019, Italian steel company Cogne Acciai Speciali (CAS) posted sales of 574 million euros (-3%) with an adjusted ebitda of of 46.1 million (-14 million) (see here a previous post by BeBeez). In June 2019, the company issued a Milan-listed 15 million bond that Cdp and Iccrea BancaImpresa invested with other minority firms. In October 2018, Cogne issued a 20 million bond that Anthilia subscribed. In December the company received a 10 million financing from Intesa San Paolo with a five years tenure.

Eurostampa North America, the US subsidiary of Eurostampa, received a 6 million euros financing from Intesa Sanpaolo (See here a previous post by BeBeez). Luciano Cillario founded Eurostampa, a producer of labels for producers of wine, spirits, food and cosmetics. Eurostampa has sales of 150.5 million, an ebitda of 10.8 million, and a net financial debt of 52.6 million. Catch the post-lockdown offer for BeBeez News Premium and BeBeez Private Data till year end!

On 21 May, Thursday, Italian equity crowdfunding platform Opstart received from Consob, the stock market regulator, the authorization to advertise the issuance of bonds and other debt instruments of SMEs (See here a previous post by BeBeez). In the next weeks, Opstart will launch Crowdbond, a platform for minibonds that is part of Crowdbase (the Opstart’s hub for institutional investors interested in alternative investments). Giovanpaolo Arioldi, the general manager of Opstart, founded the company in 2015 together with Alessandro Arioldi (cto) and in November 2019 received a financing facility from Aleph Finance Group, the investment holding that owns Pairstech Capital Management. Sign up here for BeBeez Newsletter about Private Debt and receive all the last 24 hours updates for the sector.

CIB Unigas issued a 6.5 million euros minibond that Banca Finint subscribed with Fondo Veneto Minibond (a veichle that Federazione Veneta delle BCC launched with Veneto Sviluppo), Banca IFIS, Banca di Cividale, Mediocredito Trentino Alto Adige, Neafidi, Banca Valsabbina, and Banco delle Tre Venezie (See here a previous post by BeBeez). The bond pays a 3.50% coupon will mature in May 2027 with an amortising reimbursement that will start in May 2022. Claudio Pancolini founded CIB Unigas, a producer of low emissions gas burners, in 1972 and in October 2018 he sold a 30% to Veneto Sviluppo, which supported Riccardo Pancolini, the founder’s son, in the generational change. CIB has sales of 35 million with a 14% ebitda margin.

Weiss-Stern, a producer of taps and fittings, is about to launch a Milan-listed minibond for one million euros (see here a previous post by BeBeez). Weiss-Stern has sales of 6.34 million and an ebitda of 0.489 million.

Italian credit broker Credipass raised 2 million euros through fintech platform October (see here a previous post by BeBeez). The facility has a 48 months tenure, a borrower rate of 5.2%, institutional and private investors subscribed 95% and 5% of it. The company will invest these proceeds in developing its organic business. Fabio Graziotto is Credipass chairman Mauro Baldassin and Letterio Morabito are the ceos. Credipass belongs to Hgroup, whose chairman is Diego Locatelli and Enrico Quadri the ceo. Credipass has a turnover of 30.9 million and an ebitda of 4.6 million with net cash of 0.366 million.

Zamperla, an Italian producer of carousels for amusement parks, received from Cdp and Unicredit a 12 million euros financing with a 7 years tenure (See here a previous post by BeBeez). The company will invest these proceeds in the implementation of its 2019-2022 business plan that includes the further development of Luna Farm, a theme park inside the FICO park in Bologna. Zamperla has sales of 100 million and previously issued four minibonds (three of them are listed).

BeBeez welcomes you after the lockdown period with an unmissable offer:

subscription to BeBeez News Premium and BeBeez Private Data

for only 550 euros plus VAT from 1 June to 31 December 2020

Click here for more info