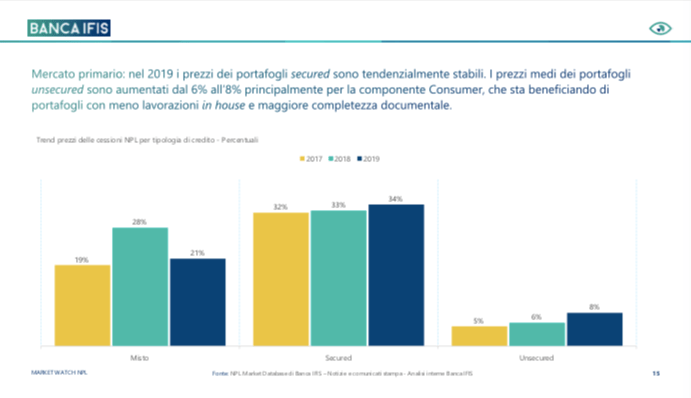

Prices for Italian unsecured NPLs portfolios rose from 6% at the end of 2018 to 8% at the end of 2019. This is thanks to the consumer component, which is benefiting from portfolios with less internal processing and greater document completeness. On the other hand, the prices of secured NPLs portfolios remained stable (from 33% to 34%), while the prices of mixed portfolios fell to 21% from 28%, the 10th edition of Banca Ifis’ Market Watch NPL, entitled “NPL Transaction Market and Servicing Industry” said (see the full study here and the press release here).

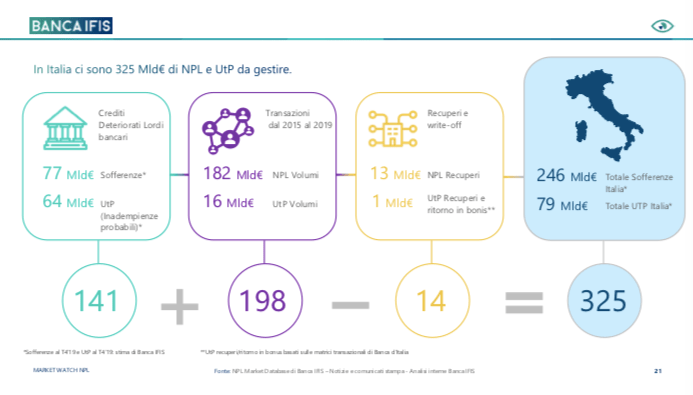

The Banca Ifis report also calculates that in Italy there are still 325 billion euros of NPLs and UTPss to manage: 246 billions of NPLs and 79 billion of UTPs. In detail, 141 billions were on the balance sheets of Italian banks at the end of 2019 (of which 77 billions of NPLs and 64 billion of UTPs, to which 4 billion euros of past due loans must be added, which however are not part of Banca Ifis’s calculation of impaired loans still to be managed), while 198 billions have been sold to various investors since 2015, which have so far only recovered 14 billions.

Compared to the first half of 2019, the loans to be managed fell from 330 to 325 billions (see here a previous article by BeBeez). Construction remains the sector most affected by debt deterioration, still well above pre-crisis levels. In Italy, the 10 main servicers concentrate 78% of the masses managed by the market; on the doValue podium (82 billion assets under management); Credito Fondiario (52 billion) and Cerved Credit Management (46 billion).

Compared to the first half of 2019, the loans to be managed fell from 330 to 325 billions (see here a previous article by BeBeez). Construction remains the sector most affected by debt deterioration, still well above pre-crisis levels. In Italy, the 10 main servicers concentrate 78% of the masses managed by the market; on the doValue podium (82 billion assets under management); Credito Fondiario (52 billion) and Cerved Credit Management (46 billion).

npl and utp to manage

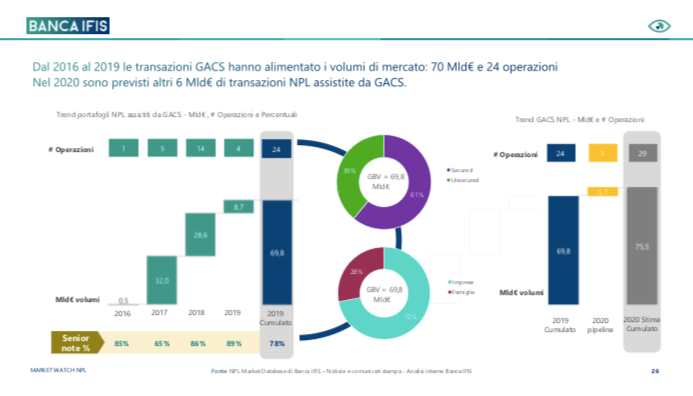

Banca Ifis expects that by the end of 2020 there will be other 37 billion euros GBV of NPEs transactions compared to the 32 billion euros transacted in 2019. The BeBeez Npl 2019 Report (reserved to subscribers of the BeBeez News Premium or BeBeez Private Data Combo, find out how to subscribe here) instead plans for this year deals for at least 41 billions in the NPEs sector, while for last year it has calculated a value of NPLs and UTPs transactions for almost 50 billions; the figure follows that of an impressive 101 billions gross value of transactions announced in 2018 (see here the BeBeez Npl 2018 Report). Among the 2019 trends reported by the 2019 BeBeez Report, that of the creation of UTP management platforms in joint ventures, while the launches of funds specialized in UTP corporate single name are multiplying.

Lastly, Banca Ifis’s analysis estimated the impact of the GACs on the sector at 70 billion euros, spread over 24 transactions carried out between 2016 and 2019. Their average prices have a growing trend, linked to the percentage of Npl secured present in the portfolios. In 2020 further transactions are expected for 6 billion euros on NPLs assisted by Gacs.

EdiBeez srl