“Intesa Sanpaolo communicates that the bank is examining strategic options with respect to Unlikely-To-Pay loans. In this context, the bank has signed a non-binding agreement with Prelios, which has been allowed a period of exclusive negotiations with a view to possibly forming a strategic partnership to optimise the management of UTP exposures. Any finalisation relating to said options, specifically the aforementioned partnership with Prelios (…) will not affect the strategic partnership already formed with Intrum in respect of bad loans.”.

“Intesa Sanpaolo communicates that the bank is examining strategic options with respect to Unlikely-To-Pay loans. In this context, the bank has signed a non-binding agreement with Prelios, which has been allowed a period of exclusive negotiations with a view to possibly forming a strategic partnership to optimise the management of UTP exposures. Any finalisation relating to said options, specifically the aforementioned partnership with Prelios (…) will not affect the strategic partnership already formed with Intrum in respect of bad loans.”.

This was announced yesterday by Intesa Sanpaolo with a note following rumors published by MF Milano Finanza, reporting that the Milan servicer Prelios had started due diligence on a 10 billion euros gross value UTPs portfolio.

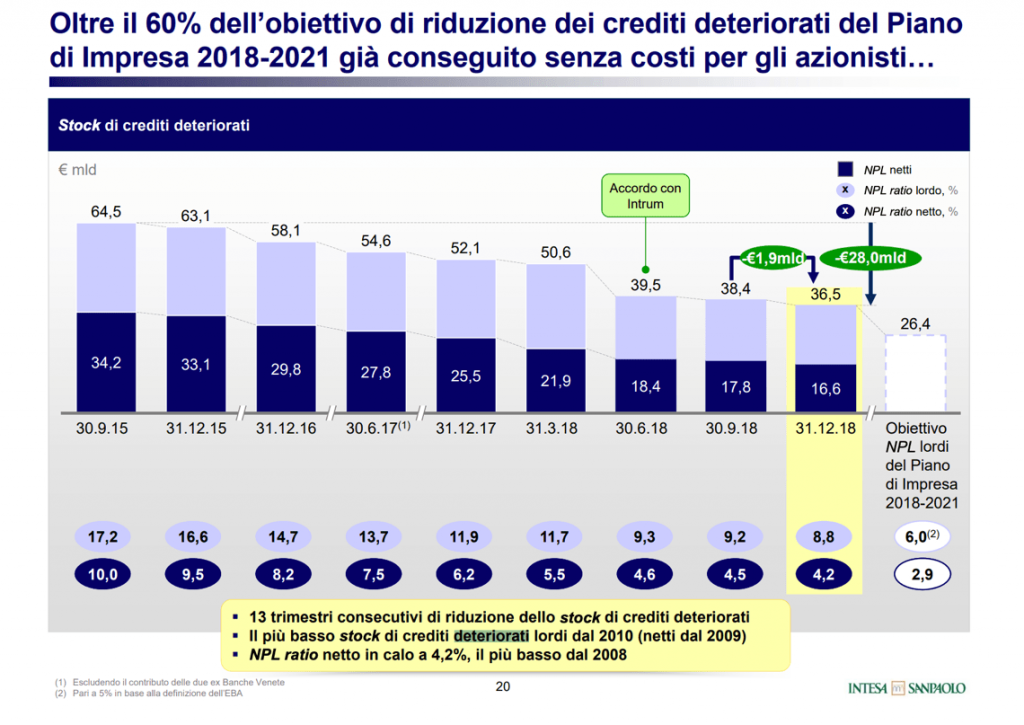

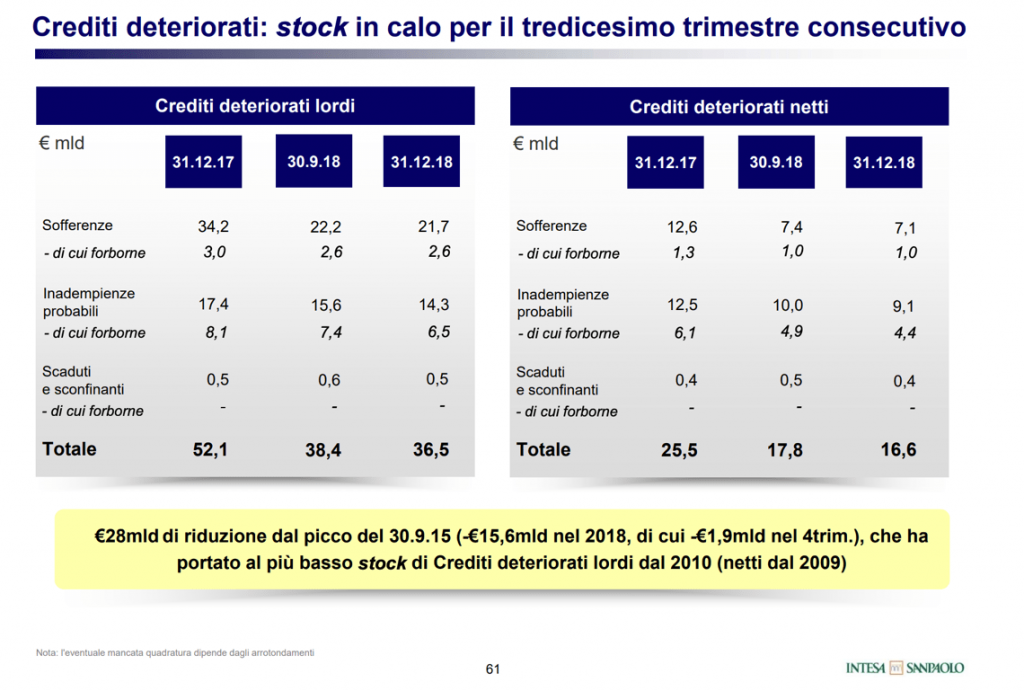

Business plan by the banking group led by ceo Carlo Messina provides for the reduction of the gross NPE ratio to 6% by the end of 2021, both through sales and through optimization by internal management. As highlighted in the presentation to analysts of the 2018 results, last year the group reduced gross impaired loans by 15.6 billion euro, increasing coverage to 54.5%. To date the group holds 36.5 billion in gross problem loans, of which 14.3 billion are UTPs, with a coverage ratio of 36%. Therefore, if the Intesa-Prelios agreement were successful, it would cover over two thirds of the Utp credits.

The analysis of the positions (which should involve a large number of legal and financial advisors including KPMG, Deloitte and EY) should come alive in April and end in June. According to MF-Milano Finanza, it is possible that one-two billion euros of Utp can be sold, while the remaining 8-9 billion will be maintained on the books of the group and managed by the Prelios structures.

If the agreement with Prelios were structured in such a way as to entail a deconsolidation of all 10 billion euros of Utp, then the gross NPE ratio would fall from 18.8% at the end of December 2018 to 6.6%, approaching the neighboring bank on the target threshold of 5% of NPE, Fidentis’ analysts calculated yesterday.

On the subject of the management of UTPs by Italian banks a focus is made by the March newsletter of TMA Italia, the Italian association of turnaround manger, edited by BeBeez (see here a previous post by BeBeez).