The gross value of distressed credit sales in Italy in 2018 was about 100 billion of euros, according to BeBeez database (see here the NPLs BeeBez report for 2018). In 2017, such kind of transactions were worth 46 billion. In 2019, portfolios worth more than 25 billion will be up for sale. On the private debt front, Italian companies kept a hectic activity.

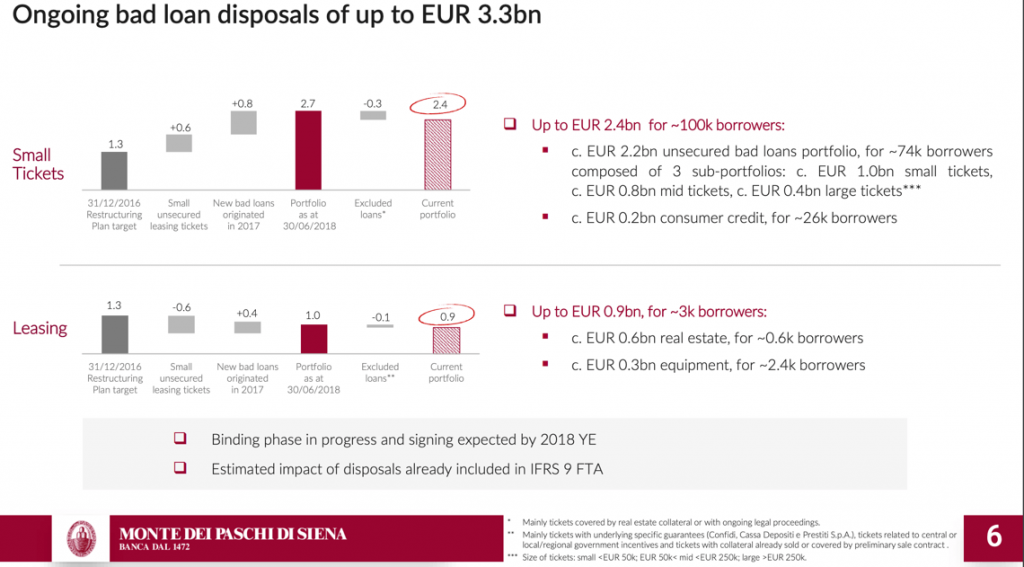

Banca Montepaschi sold 3,5 billion euros of gross non-performing exposures at the end of last December so the bank was able to post a pro-forma gross NPE ratio for 3Q18 in the region of 16% (versus 19.4% without the sale) (see here a previous post by BeBeez). Mps sold to Ifis Npl 1.16 billion euros of unsecured bad loans, representing the small and consumer cluster of the so-called Project Merlino (see here a previous post by BeBeez), while it sold to Credito Fondiario and Fire the mid-size loans cluster (704 million euros) and to Balbec Capital the large loans cluster (336 million euros). Mps also sold 900 million euros of bad leasing loans (Project Morgana) to Bain Capital Credit and 400 million euros of UTPs (Project Alfa 2) (see here a previous post by BeBeez).

Troubled Banca Carige will sell a portfolio of NPLs worth 1 billion of euros and 1.8 billion of unlikely-to-pay loans after the European Central Bank put the bank under external administration (see here a previous post by BeBeez). SGA may acquire both portfolios.

Italian shipping company Ignazio Messina & C. is finalising with the support of Long Term Partners the restructuring of its debt worth 450 million of euros and secured by the company’s vessels (see here a previous post by BeBeez). Banca Carige is Messina’s main lender with an exposition of 420 million. Messina’s shareholders will gradually repay the debt’s principal, will launch a capital increase and will sell a stake to Gruppo MSC, which belongs to the Aponte Family. In the frame of this agreement, Messina will transfer 4 of its 8 vessels to a newco in which Msc will have a 52% stake. Messina will own the other four vessels, its port terminals, and shipping activities, and MSC will have a 49% stake. The capital increase will be of up to 30 million of euros, of which the Messina Family and MSC will subscribe 5 million and up to 25 million. Messina will repay Banca Carige between 2019 and 2032.

Guber Banca and Barclays Bank acquired from Banca Valsabbina a portfolio of NPLs worth in the region of 150 million of euros (see here a previous post by BeBeez). The securitization of this portfolio will issue untranched shares that Guber Banca and Barclays Bank will subscribe. These credits are secured (30%) and unsecured (70%). Guber Banca will also handle the servicing activities. According to PwC tables, Guber Banca is handling 9 billion worth proprietary or under management Npls. Il ticket medio dei crediti in portafoglio a quella data era di 60mila euro, con una maggioranza (80%) di crediti unsecured.

Banca Interprovinciale, soon to rebrand as Illimity, acquired several portfolios of NPLs worth 150 million of euros (85% of these are unsecured and corporate) and 25 million worth single name NPLs, represented by five different exposures towards corporates secured by industrial and commercial assets (see here a previous post by BeBeez). Banca Interprovinciale NPEs portfolio currently amounts to 1.15 billion.

Intrum Italy, the joint venture between Intesa SanPaolo (49%) and Swedish Intrum (51%), appointed Giovanni Gilli as chairman and Marc Knothe as ceo (see here a previous post by BeBeez). Further to the chairman and the ceo, the board of directors includes Camilla Tinari for ISP, Danko Maras, and Anders Engdahl (for Intrum). Gilli created and led ISP’s Capital Light Bank and reported to Carlo Messina, ISP ceo, as well as having been in charge of ISP’s M&A and corporate development. Tinari, an executive director and former Group Treasurer of ISP, currently heads Capital Light Bank. Knothe is Intrum’s regional manager Western Southern Europe in charge of the firm’s activity in Italy, Belgium, France, Ireland, The Netherlands, and England. Knothe previously worked as country manager of Lindorff in The Netherlands. Engdahl joined Lindorff in 2014 as Vice President Debt Purchasing after having worked for Morgan Stanley, Goldman Sachs, Credit Suisse, and McKinsey. Maras is Intrum cfo since July 2018 and previously worked for Unilever, Leaf, and Cloetta.

Rummo, the Italian food company that the eponymous family founded in 1846, reached an agreement with 18 lenders for its debt (see here a previous post by BeBeez). According to the business plan, the company may generate sales of 100 million of euros and a cash flow able to repay the full banking debt. In 2018, Rummo posted sales of 90 million with a 12% ebitda del 12%. In 2017, the company’s net financial debt was of 52 million of euros (97 million in 2015).

Clevertech, a producer of industrial machinery for the consumer goods industry, issued a 5 million of euros minibond that Anthilia Capital Partners subscribed (see here a previous post by BeBeez). The bond is due to mature on 31 December 2023, has an amortizing structure, pays a 5.6% fixed coupon and is secured by the InnovFin SME GuaranteeFacility of the European Investment Fund. Clevertech sells its products to P&G, Henkel, Unilever, Nestlé, Kellog’s, and Pepsi and generates abroad 91% of its sales of 35 million. The company will invest the proceeds of such an issuance in developing its organic business.

TSW Industries, a producer of industrial machinery for the packaging industry, issued a 0.6 million of euros and listed it on the ExtraMot Pro market. The minibond is due to mature on 28 December 2023 with a 6% coupon (see here a previous post by BeBeez). TSW will invest the proceeds of such an issuance in the development of its organic business. The company generates abroad 90% of its sales of 8.2 million with an adjusted ebitda of 1.6 million and a net financial debt of 3.3 million.

Italian doBank will buy 85% of Altamira Asset Management, an independent NPL and real estate servicer operating in Southern Europe with AUM for 55 billion of euros, revenues of 255 million, and an ebitda of 95 million. (see here a previous post by BeBeez). Apollo Global Management, Canada Pension Plan Investment Board, and Abu Dhabi Investment Authority are selling their stake in the asset. Banco Santander has a 15% interest and may also decide to sell it. Altamira’s enterprise value is of 412 million of euros. However, doBank may pay an earnout of up to 48 million linked to the international development of the company. In 2014, the vending private equity funds paid 664 million to Banco Santander for acquiring their 85% stake. Altamira attracted offers also from Fortress and Cerberus. Buyer doBank will finance such a transaction with a five years credit line worth 450 million and with a 250 bps spread over the 6monts Euribor rate that will also refinance Altamira’s existing debt.