The Italian Government is working on extending the GACS, the State warranty for NPLs, to UTPs (see here a previous post by BeBeez). The Italian Government will discuss this plan with the European Commission in the last quarter of 2018. On another front, Banco di Desio announced it obtained GACS on senior tranches of its 1 billion euros NPLs securitization (2Worlds), while Banco di Sardegna (part of Bper) gained the GACS for its NPLs portfolio 4 Mori that sold in June.

The Italian Government is working on extending the GACS, the State warranty for NPLs, to UTPs (see here a previous post by BeBeez). The Italian Government will discuss this plan with the European Commission in the last quarter of 2018. On another front, Banco di Desio announced it obtained GACS on senior tranches of its 1 billion euros NPLs securitization (2Worlds), while Banco di Sardegna (part of Bper) gained the GACS for its NPLs portfolio 4 Mori that sold in June.

The turnaround fund that FVS sgr and Pillarstone Italy launched to recover the businesses that the bankruptcy of Veneto Banca and Popolare di Vicenza damaged, has started to work with SGA (Società Gestione Attività – of whichMarina Natale is the ceo), said Fabrizio Spagna, chairman of Veneto Sviluppo, the owner of FVS (see here a previous post by BeBeez). Spagna was speaking on the side lines of an event that Italian financial advisor Frigiolini & Partners Merchant arranged. FEP is the owner of equity crowdfunding platform Schermata.

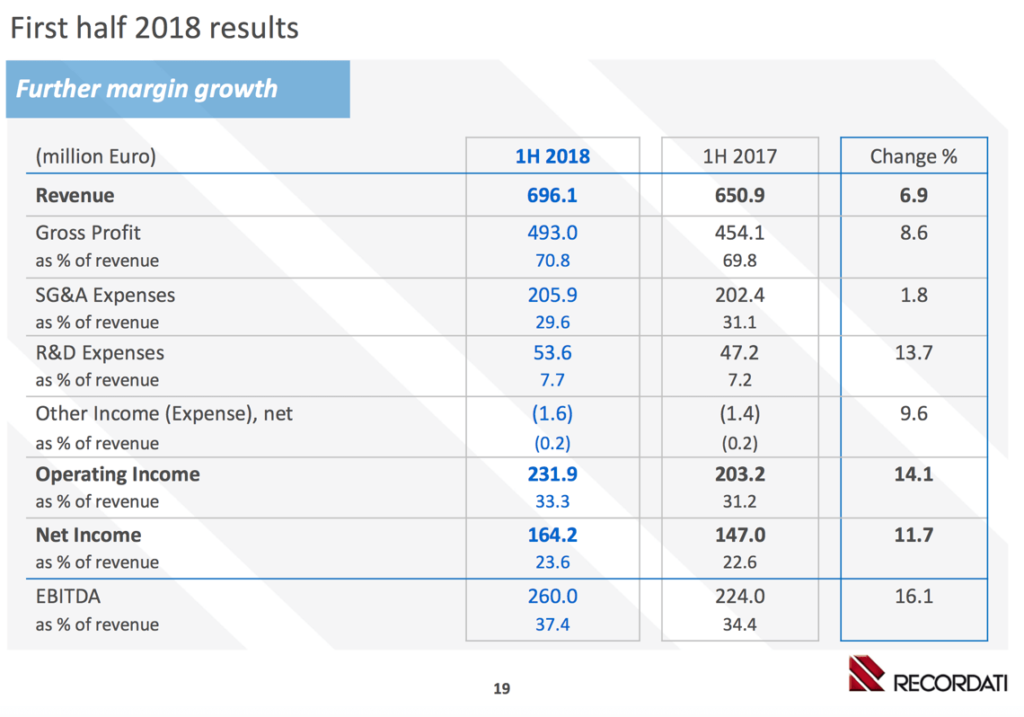

CVC Capital Partners is about to finalise the issuance of bonds for financing the acquisition of Italian listed pharma company Recordati (see here a previous post by BeBeez). The private equity giant will place one senior secured tranche of 1.28 billion of euros with a 7 years tenure callable from the third year paying an undisclosed fixed rate. The second tranche will instead pay an undisclosed floating interest, have a seven years tenure and will be callable after the first year. Standard&Poor’s gave the preliminary B rate with stable outlook to CVC’s SPV Rossini Acquisition and its senior secured liabilities due to mature in 2025. Recordati’s management will invest 78 million in the company. Once the regulatory authorities will clear the transaction, CVC will acquire the company without delisting it. Deutsche Bank, Credit Suisse, Jefferies, and Unicredit will provide the financing to CVC. S&P’s expects Recordati to generate an ebitda of 475-480 million in 2018 and of 505 million in 2019.

Hoist Italia acquired Italian credit recovery business Maran Group, a company that Nazzareno d’Atanasio founded in 1993 and that was in receivership since early 2018 (see here a previous post by BeBeez). Hoist Finance purchased the target from the d’Anastasio Family. Maran has revenues of 22 million of euros. R&S, a further company of DTN Group the holding of the d’Anastasio family, is also in receivership. Clemente Reale is the country manager of Hoist Italia.

BV Tech, the operative holding operativa of the eponymous Italian Ict company , will supply a convertible loan of 0.95 million of euros to its London AIM-listed UK subsidiary Defenx (see here a previous post by BeBeez). BV Tech will be able to convert up to 27.3% of Defenx and increase its stake in the business to 67.1% for this 6% rate loan due to mature in January 2020 and convertible with shares worth 0.08 British Pounds each. Chairman and ceo Raffaele Boccardo founded BV Tech in 2004. The company has sales of 42.9 million, an ebitda of 2.2 million and generates cash for 2.4 million. Defenx is a cybersecurity provider that in 2016 acquired 95.2% of Italy’s Memopal. Pi-Campus, a Rome-based incubator and investor for startups that Marco Trombetti and Gianluca Granero. Last year in August, Defenx issued a secured convertible bond of 1.25 million of GBP. Defenx will have to decide whether to approve the loan conversion on their meeting scheduled for 31 October. BV Tech and Andrea Stecconi, the ceo of Defenx, own 61.2% of the AIM-listed company. Defenx, will invest these resources for supporting its working capital. At the end of June 2018, the company posted revenues of 0.701 million of euros (3.1 million yoy), a gross loss of 1.6 million (1.5 million).

Marina di Punta Nera, a Rome-based provider of services for public utility networks and for real estate, issued a 25 million of euros worth senior secured bond due to mature on 30 June 2023 and paying a 7% coupon (see here a previous post by BeBeez). The company increased its share capital from 0.039 to 0.050 million. Giovanni Carlodalatri is the ceo of Marina di Punta Nera which will invest the proceeds of this issuance for its organic growth.

Alcea spa (Azienda Lombarda Colori e Affini), an Italian painting producer, received a five-years senior unsecured loan of 2 million of euros from the private debt arm of Hedge Invest that receive advisory services from CrescItalia Holding (see here a previous post by BeBeez). The parties agreed on the issuance of an eventual further tranche of 1 million. The Parodi Family founded Alcea in 1932. During a receivership period that ended last year, Alcea sold MPM in 2014 to Luxembourg private equity Open Mind Investment Sicar and to Italian entrepreneur Francesco Stella. Alcea has sales of 34.5 million, an ebitda of 3 million, net profits of 2.2 million, equity of 16.4 million, and generates cash for 0.945 million. The Parodi family is the controlling shareholder of Pulveri, another Italian painting producer with revenues of 80 million.