The fintech revolution will involve also the NPL sector, says Fitch. Meanwhile, the Italian banking system keeps offloading NPLs and SMEs raise funds through private debt channels.

The fintech revolution will involve also the NPL sector, says Fitch. Meanwhile, the Italian banking system keeps offloading NPLs and SMEs raise funds through private debt channels.

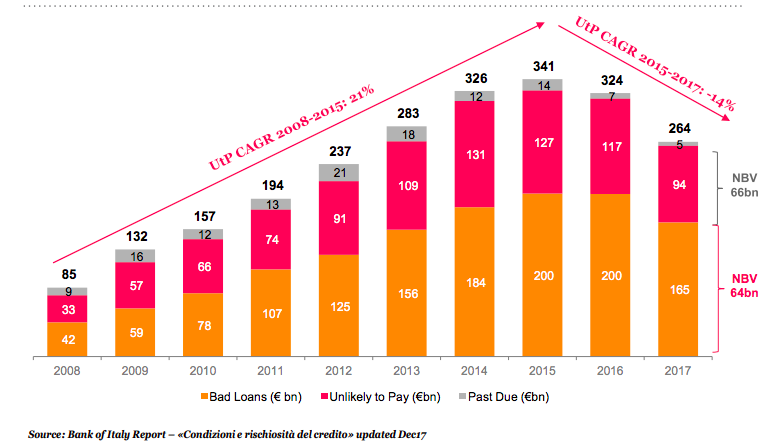

Fitch, the rating agency, said that banks will increasingly need the support of special servicer that own proprietary artificial intelligence and machine learning technology for analysing unlikley to pay (UTP) positions (see here a previous post by BeBeez). Last year, Italian banks held UTPs worth 94 billion of euros, part of a total amount of problematic credits of 264 billion (324 billions in 2016).

Banco Bpm, the listed Italian bank, started a securitisation of Project Exodus, a portfolio of NPLs worth 5.1 billion of euros backed by the Italian Government through a Gacs (see here a previous post by BeBeez). Mediobanca, Banca Akros, and Deutsche Bank are Bancop Bpm’s financial advisors, while Prelios is acting as servicer. Bpm is also studying the way to sell further NPLs amounting to 3.5 billion together with the platform that handles the bank’s problematic credits.

Car Clinic, a company that repairs cars and commercial vehicles, listed on ExtraMot Pro a 2 million senior unsecured minibond with a five years tenure, a 3.25% coupon, and an amortising reimbursement starting from the second year (see here a previous post by BeBeez). Car Clinic will have the possibility to increase by one million the nominal value of such bond by 30 September 2019, if it sticks by the covenants. Car Clinic belongs to the Panicco Family and last year posted sales of 31.4 million with a 3.2 million ebitda and a net financial debt of 0.38 million. The company will invest such proceeds for developing further the core business and refinancing the current liabilities.