After the launch of the mega securitization of 24.1 billion euros NPLs (see here a previous post by BeBeez), Montepaschi is preparing the sale of both a 2.6 billion euros NPLs portfolio which had been left out of the securitization perimeter and of a 1.5 billion euros UTPs (unlikely to pay) portfolio. It is written in Mps Q1 2018 results’ presentation and the closing of both deals is expected by Q3/Q4 2018.

After the launch of the mega securitization of 24.1 billion euros NPLs (see here a previous post by BeBeez), Montepaschi is preparing the sale of both a 2.6 billion euros NPLs portfolio which had been left out of the securitization perimeter and of a 1.5 billion euros UTPs (unlikely to pay) portfolio. It is written in Mps Q1 2018 results’ presentation and the closing of both deals is expected by Q3/Q4 2018.

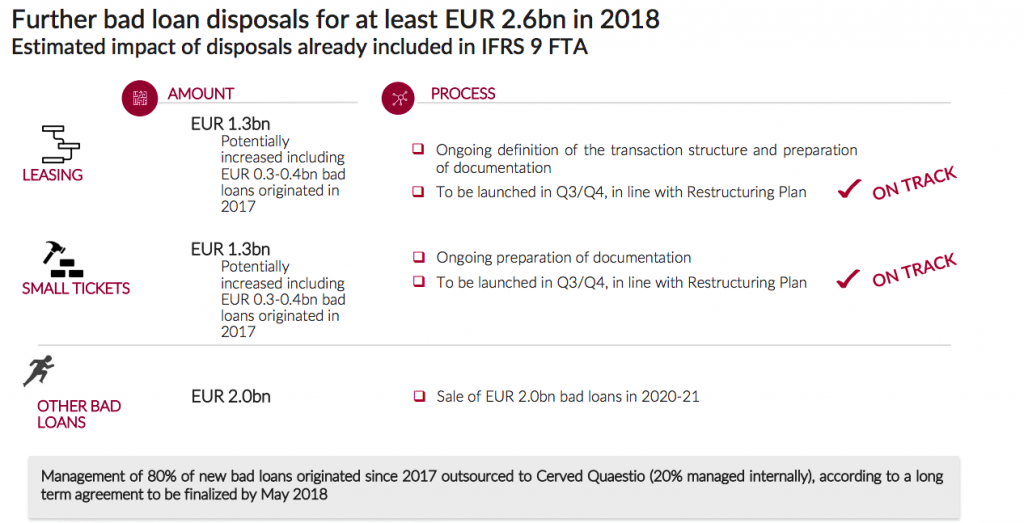

More in detail, the NPLs portfolio is made by 1.3 billion euros of unsecured small ticket loans (lower than 150k euos each) and by 1.3 billion euros of leasing loans. It is then expected the sale of other 2 billion euros of NPLs in 2020 and 2021.

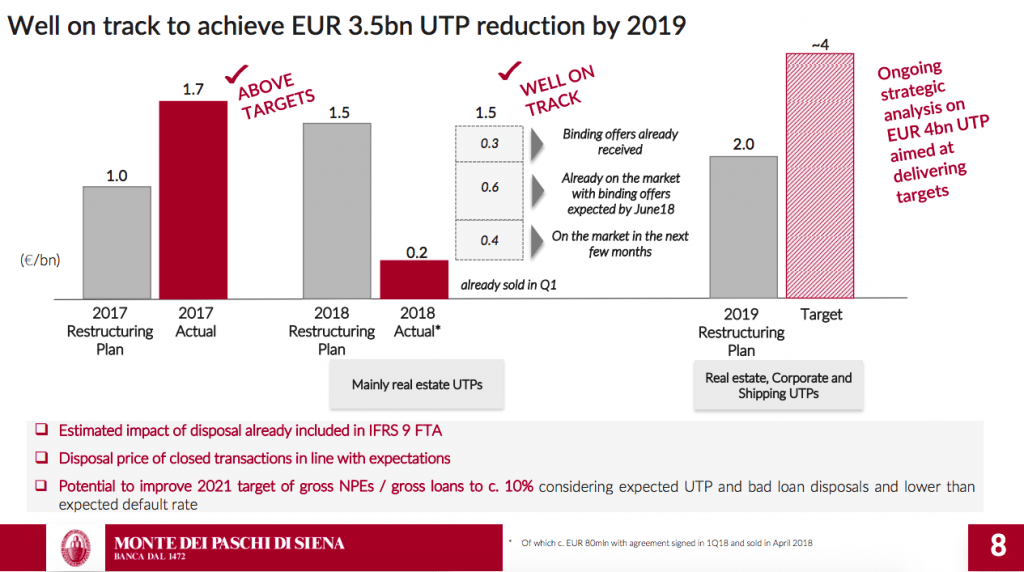

As for the UTPs sale, the bank says that agreements for the sale of 200 million euros of loans (real estate loans for a major part) out of the total of 1,5 billions have been already signed, with 80 millions that have been already sold. For other 300 million euros a binding offer has been already received by the bank and for other 600 millions a binding offer is expected by the end of June, while the remaining 400 million euros of UTPs will come on the market in the next few months. Moreover in 2019 the banks says that its restructuring plan states UTPs sales for other 2 billion euros but Mps is actually studying the sale of UTPs for up to 4 billion euros.

As for the UTPs sale, the bank says that agreements for the sale of 200 million euros of loans (real estate loans for a major part) out of the total of 1,5 billions have been already signed, with 80 millions that have been already sold. For other 300 million euros a binding offer has been already received by the bank and for other 600 millions a binding offer is expected by the end of June, while the remaining 400 million euros of UTPs will come on the market in the next few months. Moreover in 2019 the banks says that its restructuring plan states UTPs sales for other 2 billion euros but Mps is actually studying the sale of UTPs for up to 4 billion euros.