UniCredit announced yesterday in London that it has sold down its holding of FINO Project bad loans portfolio to below 20% after agreeing a sale with Italian insurer Generali and signing a binding agreement for selling another stake of the portfolio to King Street Capital Management and Fortress (see here the press release)

UniCredit announced yesterday in London that it has sold down its holding of FINO Project bad loans portfolio to below 20% after agreeing a sale with Italian insurer Generali and signing a binding agreement for selling another stake of the portfolio to King Street Capital Management and Fortress (see here the press release)

The sale of bad loans were a key part of a restructuring announced in December 2016 by ceo Jean Pierre Mustier. The loan portfolio originally included 17.7 billion euros of bad loans and last July Fortress and Pimco agreed to buy half of the portfolio through a securitization deal while the Italian bank retained a 49.9% of the asset backed securities.

There are three securitizations tied to the loans: Fino 1 Securitization srl and Fino 2 Securitization srl are vehicles tied to the loans sold to Fortress (14.4 billion euros), while Onif srl is the vehicle for the Pimco loans (3.3 billion euros). Generali is buying 30% of the Onif notes or a further 990 million euro GBV of the loans at a “slightly higher” price than the original sale, when the loans were sold at around an 87% discount to par. King Street and Fortress are instead buying a stake of the FIno 1 e Fino 2 notes.

About 15 days ago Fino 1 Securitisation’s first issued notes were assigned a rating by Moody’s and DBRS as for a securitized portfolio with 5.374 billion euros GBV. Notes were issued for a 770 million euros value of which 650 millions were rated investment grade and the Italian Government’s guarantee (Gacs) has been asked for (see here a previous post by BeBeez).

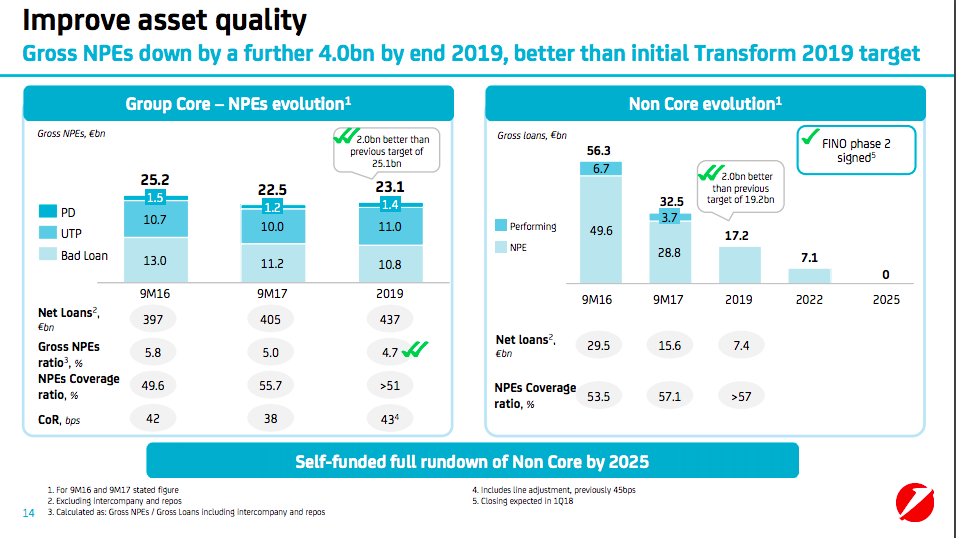

Mustier said UniCredit now wants to reduce its NPLs to €40.3bn by the end of 2019, from 51.3 billion now. The new target is 4 billion less than the previous goal due to a combination of disposals, repayments, recoveries and write-offs (see quhere T.J. Lim’s presentation).