Moody’s and Dbrs assigned yesterday a rating to the first transaction backed by non-performing loans originated by Unicredit part of the so-called FINO Project consisting in a total gross book value of 17.7 billion euros (see here the press release and a previous post by BeBeez).

This first deal is made thorough spv FINO 1 Securitisation srl and relates to a 5.374 million euros gross value Npl portfolio (as for last July 3rd, after having deducted collections received from that date up to 4 November 2017 not available for the future). The spv has issued 770 million euros of asset backed securities all with legal maturity in 2045. The issue consist in 4 different tranches, one of which (Class D, 50.311 million euros) is not rated (see here the report by Moody’s). The average Npl price for that portfolio is then 14.3% of the gross book value.

Class A securities have been issued for 650 million euros and obtained rating A2 and BBB (high) by Moody’s and Dbrs respectively. For those securities Unicredit will ask for the Italian Government’s public guarantee (Gacs). Moreover Class A securities benefits from an amortising cash reserve equal to 5% of the Class A notes balance (equivalent to 32.5 million euros), which will be funded by a limited recourse loan extended by Natixis in case of any shortfall on the first payment date in January 2018. As for Class B securities (29.4 million euros), they have been assigned a Ba3 and a BB (high) rating by Moody’s and Dbrs respetively, while Clss C securities (40 million euros) have rating B1 and BB by the two agencies. Master and special servicer for the portfolio will remain doBank.

The portfolio composition sees a 48% of the GBV being unsecured loans and 52% of the GBV representing secured loans (where residential properties represent around 49% of the total real estate valuation amount, the remaining being commercial properties by different types; properties located in the North of Italy account for approximately 45% of the total valuation amount). The majority of the portfolio (93% of the GBV) is made by loans owned by companies, while the remaining 7% of the GBV are loans where the borrower was a business owner. Finally, 80% of the GBV are loans mostly owned by borrowers defaulted from 2010 onwards, while the remaining 20% of the GBV are loans where the borrower usually defaulted before 2010 (so called “legacy portfolio”).

As for the FINO Project, Unicredit’s consolidated first half 2017 financial report explained that “Stage 1 consists in initiating several securitisation transactions whose closing took place at the end of July 2017 entailing the issuing of asset-backed securities (Senior, Mezzanine and Junior) by Special Purpose Vehicles (SPVs or Vehicles) that are transferees of the loans included in the FINO Portfolio, and with their relevant subscription by UniCredit spa (49.9% of all classes of the securities issued) and by third-party Investors (50.1% of all classes of the securities issued). Stage 2 entails the possible allocation of a public rating (Gacs guarantee) to Senior and Mezzanine securities, as well as the gradual sale to third-party investors by UniCredit spa of securities that it had subscribed”.

More in detail, “on July 17, 2017 UniCredit spa announced that it had entered into final agreements for the disposal of the FINO Portfolio with Pimco and Fortress. Pursuant to these agreements, the Securitisation Vehicles have purchased the loans included in the portfolio for the various funds (sub-portfolios) pertaining to the relevant equity interests of Pimco and Fortress, as set out in the contractual documentation (Transfer Agreement) signed on July 14, 2017 by the bank and ONIF Finance srl (the loan transferee SPV that refers to Pimco), and by the bank and Arena NPL One srl and Fino 1 Securitisation srl and Fino 2 Securitisation srl (the latter are the loan transferee SPVs that refer to Fortress).

Fino Project securitization documents have been singed last July (see here the press release), and Unicredit said “durante la Fase 2 del Progetto Fino nella seconda metà dell’anno, Unicredit considererà l’eventuale assegnazione di rating pubblico ai titoli senior e mezzanini emessi nell’ambito della cartolarizzazione e la vendita della rimanente quota di Unicredit, per detenere meno del 20%“.

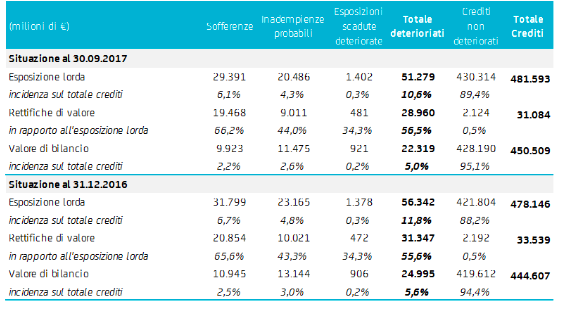

At the end of last June Unicredit still had 46.15 billion euros of gross book value bad loans on its books (or 11.8 billions of net book value bad loans) including bad loans that were to be moved in the FINO Project portfolio. Excluding the 17.7 billion euros of GBV FINO Project bad loans, Unicredit GBV were down to 29.4 billion euros (or 10 billions net of write offs).

Actually at the end of last September Third Quarter 2017 Group results showed sofferenze gross bad loans down to 29.4 billion euros with a coverage ratio of 66.2%, while unlikely to pay loans were down to 20.5% with a 44% coverage ratio and other non perfroming exposures were 1.4 billion euros with a 34.3% coverage ratio.