Cerved Group, Italy’s leader in the business information sector, controlling a strong Npl servicing division and a rating agency, won auction for Juliet, Banca Monte Paschi‘s platform that manages the Italian bank’s non-performing loans.

Cerved Group, Italy’s leader in the business information sector, controlling a strong Npl servicing division and a rating agency, won auction for Juliet, Banca Monte Paschi‘s platform that manages the Italian bank’s non-performing loans.

The news was by the bank itself last night (download here the press release), adding that Cerved will pay 105 million euros for Juliet to which an earn-out of up to 66 million euros could be added, based on the achievement of economic results until 2024. The closing of the transaction, expected in the first quarter of 2017, is subject not only to approval by the supervisory authority, but also to the successful completion of the Bank’s transaction of capital increase and simultaneous deconsolidation of non-performing loans. Mediobanca is acting as Financial Advisor to the Bank, whereas the law firm BonelliErede is acting as Legal Advisor.

More in detail, the bank’s press release says that ” transaction involves the sale to Cerved Group of the vehicle that will manage existing non-securitized bad loans, in addition to a significant percentage of the bad loans that will be generated over the next ten years. The vehicle will take on all the employees that, on a voluntary basis, will decide to join the new entity. The same vehicle shall also have the right to manage 1/3 of the loans which will have been securitized within the wider transaction of capital increase and simultaneous deconsolidation of non-performing loans which was communicated to the market on October 25″.

Cerved remained as the sole runner for Juliet ad the other bidder, doBank (former Uccmb, now controlled by Fortress group), withdrew its interest last weekend, MF Milano Finanza writes today. Among other bidders who had posted non-binding offers last September were said to be a consortium between Christofferson Robb & Co and Prelios; a consortium between Lone Star and Caf, an Italian servicer 100% owned by Lone Star; Kkr and Vaerde Partners (see a here a previous post by BeBeez).

Offer from Cerved was approved yesterday by Montepaschi’s Board in the same meeting that decided about an offer to convert subordinated bonds into equity of the bank as a piece of a wider 5 billion euros recapitalization project for the bank (see here the press release), which is looking for anchor investors (Qatar Investment Authority and Temasek might be among them) and of a securitization project of about 27 billion euros of gross bad loans.

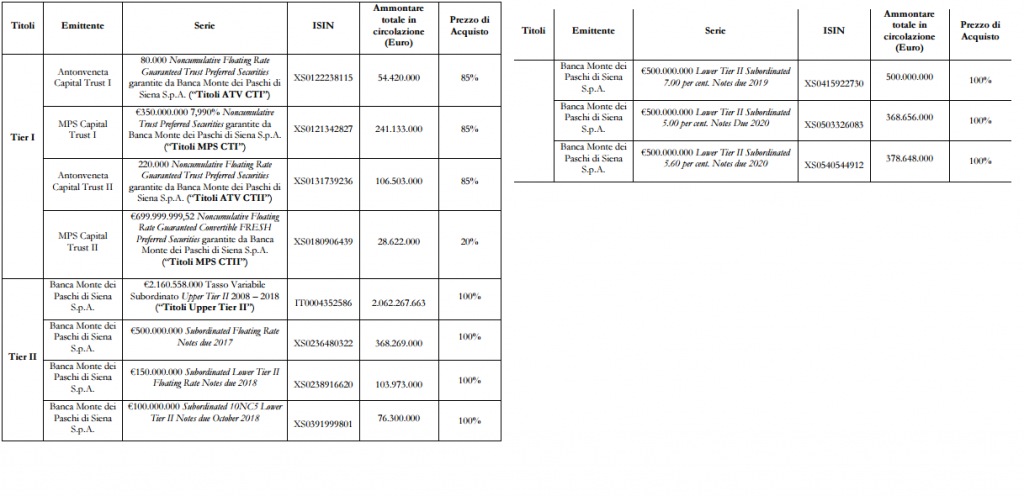

More in detail, Mps announced yesterday night “its intention to launch a voluntary public cash tender offer with the cash amount due to participating holders to be mandatorily applied to subscribe for new ordinary shares in Bmps ” on four Tier 1 subordinated bonds (three of them a price of 85% and one of them at a 20% price) and on seven Tier 2 subordinated bonds (at par). The offer will be made on the outstanding nominal amount of the securities, equal to an aggregate amount of about 4.3 billion euros.

It is still not possible to reason about an exchange rate between bonds and shares as it is still to defined the subscription price of the new shares that are to be issued as for this “liabilitity management exercise ” but it is clear that price will be the same subscription price that will be stated to new shares relating the capital increase.

Here below the offer by Mps for each subordinated bond: