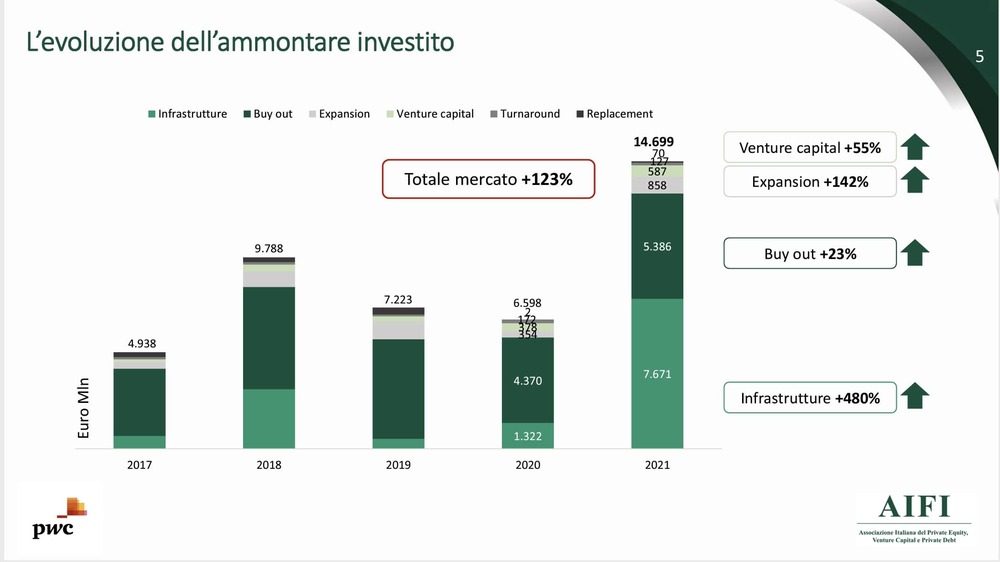

In 2021, venture capital funds invested 587 million euros in early stage deals in Italy (+55% from 2020) spread on 371 transactions (+21%), data from AIFI (Italian Association of Private Equity, Venture Capital and Private Debt)-PwC Italia say (see here a previous post by BeBeez). We recall that as reported by the BeBeez Report on Venture Capital 2021, published last January (available to subscribers of BeBeez News Premium and BeBeez Private Data) . the reality of venture capital in a broad sense is much bigger, with 533 rounds registered for a total of 2.9 billion euros.

In 2021, venture capital funds invested 587 million euros in early stage deals in Italy (+55% from 2020) spread on 371 transactions (+21%), data from AIFI (Italian Association of Private Equity, Venture Capital and Private Debt)-PwC Italia say (see here a previous post by BeBeez). We recall that as reported by the BeBeez Report on Venture Capital 2021, published last January (available to subscribers of BeBeez News Premium and BeBeez Private Data) . the reality of venture capital in a broad sense is much bigger, with 533 rounds registered for a total of 2.9 billion euros.

Newcleo, a British-Italian startup that aims to develope fourth-generation nuclear reactors, announced the opening of a new 300 million euros investment round just a few months after having raised a previous 118 million euros round (see here a previous post by BeBeez). The company previously acquired US-based Hydromine Nuclear Energy from Hydromine. Newcleo will invest the raised proceeds in the production of the first prototype fourth-generation lead-cooled reactor in a country that already uses nuclear energy. Newcleo opened a bureau in France, started to hiring resources in the UK and signed an agreement with ENEA, the Italian energy agency. Stefano Buono is the founder and ceo of newcleo, Luciano Cinotti is the chief scientific officer, Elisabeth Rizzotti is the coo and ceo for the Italian R&D activities. The company appointed Adrienne Kelbie, Julia Pyke, Kathryn Kerle, Raffaele Petrone, and Ruben Levi as directors.

Primo Digital, a native ESG venture capital fund that Primo Ventures sgr (fka Primomiglio sgr) launched, reached its first fundraising closing at 65 million euros (see here a previous post by BeBeez). The vehicle attracted the resources of cornerstone investor CDP’s fund of funds FoF VenturItaly, Italia Venture, Fondo Imprese Sud, European Investment Fund (EIF), Milan-listed Tinexta, Banca Sella Holding, and other angel investors. The hard cap of Primo Digital is of 80 million. Antonio Concolino is the fund’s ceo, Gianluca Dettori is the chairman, Franco Gonella is a director and Niccolò Sanarico is the investment manager. In the next 10 years, Primo Digital aims to develop a portfolio of 25 startups preferably based in the South of Italy and operating in the sectors of software, retail & marketplaces, cybersecurity, blockchain, fintech, insurtech, regtech, and proptech.

CRIF, an Italian provider of business and credit information services, invests 11 million euros for the launch of BOOM, an Italian innovation pole (see here a previous post by BeBeez). BOOM is based in Bologna area and aims to boost the cross fertilization of different cultures and technologies. Crif has sales of 567 million and an ebitda of 26 million.

Heqet Therapeutics, a biotech spin-out of London’s King’s College that Mauro Giacca founded, raised 6.6 million pounds (8 million euros) from Claris Ventures sgr, 2Invest and other investors (see here a previous post by BeBeez). The company will invest the raised proceeds in the development of its current projects. Marta Antonucci is the ceo of Heqet Therapeutics, while Pietro Puglisi, Heikki Lanckriet, Giacca (the Dean of School of Cardiovascular Medicine & Sciences at King’s College), and Ajay Shah are part of the company’s board

Boom Imagestudio, an Italian photetch scaleup, raised 6.6 million euros from Vintage Capital of Stefano Siglienti (2 million for a stake of 8.45%) and other investors (See here a previous post by BeBeez). Federico Mattia Dolci, Giacomo Grattirola and Jacopo Benedetti founded Boom in 2018 raised 6 million from United Ventures, Wellness Holding, Viris, and Anya Capital. The company also attracted the resources of Andrea Guerra, Dominique Marzotto’s Ignotus, Pietro Loro Piana’s LP Capital, Luigi Berlusconi, and Luca Riboldi. Boom Imagestudio has sales of 1.7 million, an ebitda of minus 1.8 million and net cash of 4.7 million.

lH1, the financial holding of Italian startup studio Mamazen, raised 1.65 million euros on top of other 750k euros previously raised reaching a total of 2.4 million euros of fire power (see here a previous post by BeBeez). The holding will invest these proceeds in launching new startups. IH1 attracted the resources of Colombia’s Asiri. IH1 and Mamazen aim to launch 15 startups in 5 years. The holding will invest 3 million in Mamazen and 7 million in ten startups that the mother company will select. Alessandro Farhad Mohammadi, Alessandro Mina and Alexandre Campra lead Mamazen while Anna Siccardi, Mauro Maltagliati and Alberto D’Agnano are part of the board of directors.