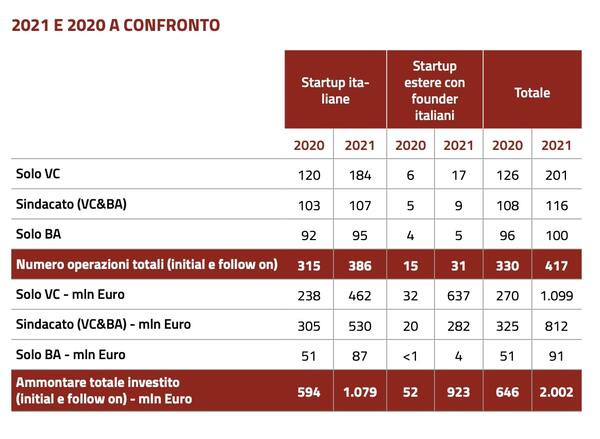

The Venture Capital Monitor (VeMTM) of the Venture Capital Observatory of LIUC Business School implemented the same analysis approach as BeBeez for monitoring the Italian investments in startups (see here a previous post by BeBeez). VeMTM actually analysed startups based in Italy or foreign startups and scaleups with Italian founders and counted a total of 417 companies that raised 2 billion euros. BeBeez actually counted 533 venture capital rounds of 503 startups who raised in the region of 2.9 billion. See here the BeBeez Venture Capital Report for 2021 available for the subscribers to BeBeez News Premium and BeBeez Private Data, the Database that BeBeez developed with FSI. Book a demo videocall here.

The Venture Capital Monitor (VeMTM) of the Venture Capital Observatory of LIUC Business School implemented the same analysis approach as BeBeez for monitoring the Italian investments in startups (see here a previous post by BeBeez). VeMTM actually analysed startups based in Italy or foreign startups and scaleups with Italian founders and counted a total of 417 companies that raised 2 billion euros. BeBeez actually counted 533 venture capital rounds of 503 startups who raised in the region of 2.9 billion. See here the BeBeez Venture Capital Report for 2021 available for the subscribers to BeBeez News Premium and BeBeez Private Data, the Database that BeBeez developed with FSI. Book a demo videocall here.

Scalapay, a Milan-based fintech scaleup, raised a 497 million US Dollars new round and hit a unicorn enterprise value of one billion (see here a previous post by BeBeez). Tencent and Willoughby Capital led the investment. Scalapay also attracted the resources of Tiger Global, Fasanara Capital, Gangwal, Moore Capital, and Deimos. Simone Mancini, Johnny Mitrevski, Raffaele Terrone, Mirco Mattevi, and Daniele Tessari, founded the company in 2019.

Milan-listed CNH Industrial, a producer of machinery for the sectors of agricolture and constructions of which Milan-listed Exor owns a stake, launched its corporate venture capital veichle CNH Industrial Ventures (see here a previous post by BeBeez). CNH already allocated in the corporate venture capital portfolio its minority investments in Augmenta, Bennamann, Gearflow, Geoprospectors, Monarch Tractor, The Westly Group, and Zasso. CNHIV will invest in the sectors of alternative propulsion, digital, automation, robotics and other critical, cutting-edge technologies.

Mediobanca Private Banking launched Mediobanca Venture Capital Fund, a division of Russell Investments Alternative Investment ICAV who targets tech startup mainly based in USA (see here a previous post by BeBeez). Mediobanca Private Banking will distribute the fund untli 25 March, Friday, to its clients who on average have assets worth in the region of 10 million euros. MVC has a fractional capital calls structure at different investment windows. Theo Delia-Russell is the Deputy Head of Mediobanca Private Banking and Head of Products & Service while Angelo Viganò heads Mediobanca Private Banking

Lokky, a digital insurance broker with a focus on micro-businesses, professionals and contractors, launched a 5 million euros investment round, sources said to BeBeez (see here a previous post by BeBeez). Lokky previously said to BeBeez that it was going to launch an investment round in 2021. However, the company decided to postpone the fundraising. The insurtech may undertake a multi-tranche capital increase and will invest the proceeds in its organic development, proprietary product development, and further partnerships. Paolo Tanfoglio (ceo) and Sauro Mostarda (executive director) founded Lokky in 2019.

Wallife, an Italian insurtech startup, raised 4.8 million US Dollars seed round from Nerio Alessandri, Antonio Assereto, Andrea Dini, and other investors (see here a previous post by BeBeez). Fabio Sbianchi founded Wallife in 2021, Maria Enrica Angelone is the company’s ceo. Wallife has its focus on the protection of individuals from the risks arising from technological innovation and scientific progress in the three areas of genetics, biometrics and biohacking. The startup will invest the raised proceeds in its organic development and the launch of other products. Wallife will launch another investment round in 2022.

B2B Gellify acquired Antreem, a developer of digital solutions for financial services firms and middle market companies (see here a previous post by BeBeez). Antreem has sales of 1 million euros. Fabio Poli is the company’s ceo.

Unicredit committed to support the startups and SMEs that belongs to the community of G-Factor, an incubator and accelerator that Fondazione Golinelli created in 2018, for supporting innovative SMEs and startups (see here a previous post by BeBeez). Niccolò Ubertalli, Italy’s head of UniCredit, Antonio Danieli, the ceo of G-Factor, and Andrea Zanotti, the chairman of Fondazione Golinelli, signed such an agreement. Unicredit will allow the companies that G-Factor supports to get access to Start Lab, the bank’s platform for business and innovation.

Ecomill, an Italian crowdinvesting portal for the energetic transition sector and ESG projects, raised 0.2 million euros from Fondazione Social Venture Giordano Dell’Amore (FSVGDA), the impact investing vehicle of Fondazione Cariplo (See here a previous post by BeBeez). Ecomill is born in 2014

Enry’s Island, an Italian incubator and accelerator that leads the table of Crunchbase, attracted 500k euros from Key Capital, an investment company that Giorgio Di Stefano founded (See here a previous post by BeBeez). Luigi Valerio Rinaldi is the founder of Enry’s Island who allows to invest tickets of 0-1 – 0.15 million in each project. Enry’s Island portfolio includes Expace (a startup that creates experiences for tailoring smartworking spaces), Wastebox (a B2B player for the waste management company), BOS5 (an international marketplace), Wasteup (a digital platform for the waste management), FoxRent (a blockchain-based platform for renting commercial vehicles). Further portfolio companies are Etsa, Luxalia, Gaimyfriend, Coypay, and HUI. Enry’s Island also launched a crowdfunding campaign for supporting its international expansion and development as metaverse ahead of a listing on two different European exchanges.