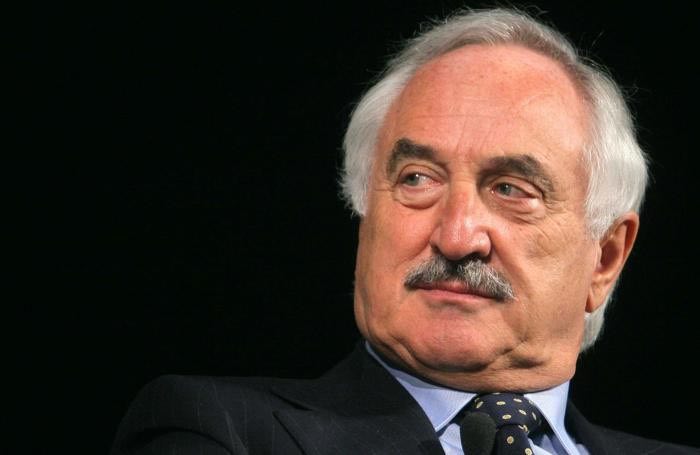

Well-known Italian entrepreneurs Alberto Bombassei, Angelo Radici and Pierino Persico launched the venture capital fund Cysero for investing in humanoid robotics and cybersecurity (see here a previous post by BeBeez). Bombassei, Radici and Persico poured 15 million in the fund ahead of a target of 100 million. Avm Gestioni, the fund that Giovanna Dossena heads, will manage the vehicle that will be based at Parco Scientifico Tecnologico Kilometro Rosso in Bergamo.

Wonderflow closed a 2 million euros round that P101 and Italia 500 subscribed (see here a previous post by BeBeez). The company also attracted the resources of EIT Digital and of Jan Bennink. Wonderflow is a Dutch company that Roberto Osti (ceo), Giovanni Gaglione (cto) and Michele Ruini (coo) founded in 2018.

Earlier in November, Starting Finance, an edutech platform focused on finance and trading, raised 625k euros from London-based Atypical Partner (see here a previous post by BeBeez). Mauro Moretti heads Atypical Partner. Since its foundation in 2018, Starting Finance raised more than 0.95 million from investors for a post-money value of 3 million. Marco Scioli (chairman) and Edoardo Di Lella (ceo) founded Starting Finance.

Japal attracted a 250k euros in the form of a convertible loan subscribed by Intesa Sanpaolo (see here a previous post by BeBeez). Paolo Broglia, Jacopo Moschini and Jacopo Paoletti founded Japal as a spin-off of MyChicJungle. The company raised last Aprile 160k euros from a group of italian entrepreneurs and private investors whole in March 2019 completed an equity crowdfunding campaign raising 55k euros.

Swedish Tink, of which Poste Italiane owns a stake, aims to raise a further 85 million euros after having attracted a 90 million investment earlier in January (See here a previous post by BeBeez). Eurazeo Growth and Dawn Capital led this round. Tink will invest such proceeds in its organic development.

The Italian Ministry for Economic Development (MISE) finally published a document making clear that foreign citizens may carry on investments in Italy withouth applying for an Italian fiscal code. A law had been in force since the beginning of 2018 but it needed specific ruling to be implemented. This is a major result for all the fintech sector (see here a previous post by BeBeez).

From 2021, Andrea Rota will be the managing director of Club degli Investitori, a Turin-based network of business angels that since 2010 invested more than 20 million euros in 39 startups and scaleups (see here a previous post by BeBeez). Giancarlo Rocchietti, the chairman and founder of CdI, said that in the next three years the nework aims to double its investments and expand its operations abroad.

ProfumeriaWeb (PW) launched an equity crowdfunding campaign on Mamacrowd and raised 88,000 euros ahead of a target of 200-600k euros on the ground of a pre-money value of 12.5 million (se here a previous post by BeBeez). Vincenzo Cioffi founded the business in 2010. The company has sales of 40 million and it will generate its first positive ebitda in 2022 ahead of a listing scheduled for 2023. PW will invest the raised proceeds in its organic develpment.

The Italian subsidiary of Estonia’s accelerator Startup Wise Guys raised more than 1.2 million euros (well above the 0.3 million target) through an equity crowdfunding campaign on CrowdFundMe that managing partner and ceo Andrea Orlando led (see here a previous post by BeBeez). Startup Wise Guys may raise up to 2.4 million as its fund Challenger will match the raised proceeds.

BFC Media launched the startup abilitator BFC Ventures Studio based in Milan’s Le Village by Credit Agricole (See here a previous post by BeBeez). BFC Ventures Studio is already supporting Gooruf, Infinity Space Satellite and Forbes Academy and invested in the equity of Notarify and ClubDealOnline. The professionals in charge of BFC Ventures Studio are Federico Morgantini, Andrea Tessera, Marco Romei, and Eugenio Caserini. Denis Masetti is the chairman of BFC Media.

Italian innovation platform B2B Gellify signed a strategic partnership with Vittoria hub, the insurtech incubator of Vittoria Assicurazioni (See here a previous post by BeBeez). Vittoria hub’s focus sectors are insurance products for persons, home, mobility, and smart business. In October 2019, Gellify attracted a 15 million euros investment round for which Azimut has been the lead investor.

In its way towards fintech specialization and increasing in electronic payments services, Enel X acquired CityPoste Payment (CPP) from Mail Express Group (MEG) (see here a previous post by BeBeez). Bachisio Ledda is MEG’s ceo and majority shareholder.

GBM Banca completed its transformation in a fintech bank and renamed as Aigis Banca, an AI-based bank (see here a previous post by BeBeez). In 2017, Metric Capital Partners acquired 75.36% of GBM Banca together with Nicola Bonito Oliva and Filippo Cortesi who purchased 21.43% of the asset. The deal value amounted to 7 million euros while investors made a recapitalization of 20 million and rebranded the bank as Aigis Banca.

ClubDealOnline and Almaviva launched the digital trust ClubDeal Fiduciaria Digitale (CDFD) (See here a previous post by BeBeez). CDFD will support ClubDealOnline for the capital increases of startups, scaleups and SMEs.