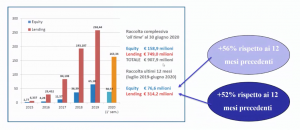

A report of the Crowdinvesting Observatory of the School of Management of Milan Polytechnic University said that from the start of the market in 2015 till the end of H1 2020 the crowdinvesting sector in Italy allowed to raise 158.9 million euros for the equity crowdfunding and 749 million for lending crowdfunding, excluding invoice financing (see here a previous post by BeBeez).

A report of the Crowdinvesting Observatory of the School of Management of Milan Polytechnic University said that from the start of the market in 2015 till the end of H1 2020 the crowdinvesting sector in Italy allowed to raise 158.9 million euros for the equity crowdfunding and 749 million for lending crowdfunding, excluding invoice financing (see here a previous post by BeBeez).

Italian real estate equity crowdfunding portal Concrete Investing raised 3.3 million euros in 72 hours for Milan-based project Washington Building (see here a previous post by BeBeez). Investors expect to gain an annual IRR of 13.6%, and a ROI of 40.4% for a holding period of 32 months. The campaign already attracted 1.5 million.

Primo Space, the Italian venture capital for aerospace investments of Primomiglio, made its first 58 million euros closing ahead of a target of 80 million (see here a previous post by BeBeez). The European Investment Fund and CDP poured 30 million in the vehicle. Primo Space attracted the resources of Compagnia di San Paolo, Luigi Rossi Luciani sapa, Banca Sella and the fund’s managers. Fondazione E. Amaldi, a research institute of the Agenzia Spaziale Italiana supports Primo Space for scouting and advisory. Matteo Cascinari and Giorgio Minola are the key men of Primo Space.

InSilicoTrials, an Italian SME that launched a web platform for clinical trials, raised a 3 million euros round that United Ventures and Pi Campus subscribed (see here a previous post by BeBeez). InSilicoTrials, raised 02 million in October 2017, 0.1 million in March 2018, 0.33 million in April through an equity crowdfunding campaign on CrowFundMe. Luca Emili is the company’s founder and ceo while Roberta Bursi, PhD, heads the R&D unit. Massimiliano Magrini is the managing partner of United Ventures.

Rancilio Cube, the family office of the Rancilio family, invested in the third fund of Zetta Venture Partners who has a focus on artificial intelligence (see here a previous post by BeBeez). After having completed its fundraising of 180 million US Dollars earlier in April, Zetta has resources for 365 million.

Italian events company Fandango Club invested in the first round of Italian accelerator Retail Hub, which attracted resources from Francesco Pinto, Lucia Fracassi and further entrepreneurs and managers of the fashion and retail sector (see here a previous post by BeBeez). Fandango launched the round in April 2019 and set a fundraising target of 0.2 million euros on the ground of a pre-money value of 1.3 million. Sources said to BeBeez that Retail Hub aimed to create a commitment of sector players rather than raising resources. Antonio Ragusa and Massimo Volpe are the founders of Retail Hub, while Michele Budelli is a partner and ceo of Fandango Club.

Be Charge, a subsidiary of Be Power, received a grant of 8.22 million euros from the European Union’s programme Blending Facility Call (see here a previous post by BeBeez). In December 2019, the company received 25 millions from the European Investment Bank. The company will invest the proceeds of the grant in developing in Italy 14,000 recharging stations for electric vehicles by 2023 ahead of 30,000 by 2025 for a total investment of 150 million. Zouk Capital has 51% of Be Power since May 2019, while the remaining 49% belongs to Building Energy.

Lumen Ventures aims to raise 25 million euros to pour in early stage opportunities over 4 years as it received the licence of Simple Investment Company (SIS) from Banca d’Italia come SIS (see here a previous post by BeBeez). Davide Fioranelli (the founder of London’s Freetrade) founded Lumen, whose chairwoman is Rita Laura D’Ecclesia, a full professor of finance at Rome’s Sapienza University, president of the Euro Working Group for Financial Modelling, an independent boardmember of Banco Bpm, and since vice-president of Banca Monte dei Paschi di Siena.

Italian fintech Sardex, a network for swapping credits with goods and services, raised 5.8 million euros from Cdp Venture Capital (lead investor), Fondazione Sardegna, Primomiglio, Innogest, and Nice Group (see here a previous post by BeBeez). Sardex will invest such proceeds in its organic growth. Earlier in January, the company appointed Marco De Guzzis as the new ceo. Carlo Mancosu, Gabriele and Giuseppe Littera, and Franco Contu founded Sardex in 2009, while Piero Sanna joined the company in in 2011.

Deliveristo, an Italian digital B2B marketplace for the catering sector, raised 1.5 million euros from IAG (Italian Angels for Growth), Gellify Digital Investments, Seven Investments (a company of Angelo Mario Moratti), the Doorway community and other private investors (see here a previous post by BeBeez). Deliveristo raised a total of 2.5 million since its foundation and in 2019 received from Food Community Awards the prize for the best Italian foodtech. Ivan Aimo is the company’s founder and ceo.

Red Fish Long Term Capital (RFLTC) launched on Italian portal Opstart an equity crowdfunding campaign with a target of 0.5 – 8 million euros (see here a previous post by BeBeez). The company already raised 2.35 million. RFLTC provides with private capitals SMEs that have a below 10 million ebitda and already invested 50 million through club deals.

Habyt (fka Projects Co-Living), a Berlin-based proptech startup that Italian Luca Bovone and Giorgio Ciancaleoni founded, acquired Germany’s GoLiving (see here a previous post by BeBeez). Habyt also closed a round worth in the region of 3.5 million euros, that P101 and ITALIA500 led. Picus Capital, an investor in GoLiving, also poured resources in Habyt, who previously raised 2. 5 million from Florian Swoboda, Jakob Maehren and P101. Habyt raised 6 million since its foundation and will invest the proceeds of this last round in M&A transactions.