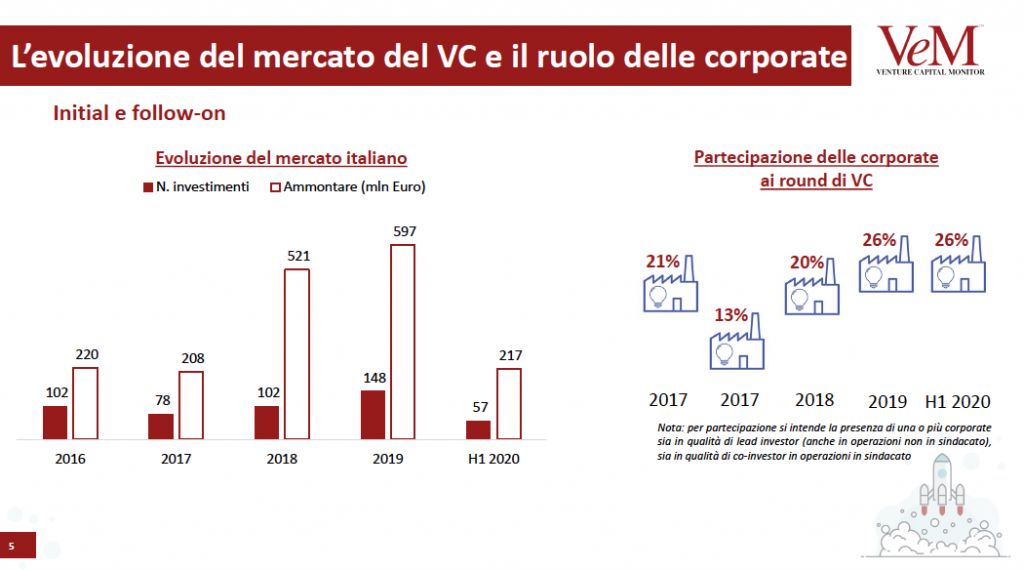

In 1H20, Italian investments in venture capital went down 30% to 217 million euros for 57 deals from 217 million in 1H19 for 69 deals said the Report of the Venture Capital Monitor (VeM) of LIUC Business School (see here a previous post by BeBeez). AIFI, Intesa Sanpaolo Innovation Center and E. Morace & Co. Law firm collaborated for the production of the report. If we consider, however, also the activities of corporate venture capital and business angels, then the numbers grow. Overall, venture capital and corporate venture capital invested 119 million euros over 36 rounds in the six months, and syndication activities between venture capital, corporate venture capital and business angels recorded investments of 98 million euros on 21 transactions and businesses alone angel have invested 31 million in 31 rounds. The total of these activities leads the early stage supply chain to have invested 248 million euros over 88 rounds.The data of venture investments in a broader sense provided by VeM is in line with the 253 million euros that emerge from the BeBeez database (the BeBeez Report on 6 months of venture capital 2020 will be available shortly for subscribers to BeBeez News Premium ). In total there are 74 rounds of investment by funds, investment holding companies, corporate venture capital and business angels, in addition to 67 equity crowdufnding campaigns (net of real estate ones) successfully concluded, which have collected in total 28 million euros (source: CrowdfundingBuzz). The figure of the 253 million compares with that of the whole of 2019, when BeBeez had mapped 244 rounds for a total of about 605.6 million euros, in sharp increase from the 510 million euros, split over 179 companies, registered in 2018 ( see here the BeBeez Report on Venture Capital 2019, available shortly for subscribers to BeBeez News Premium) .

In 1H20, Italian investments in venture capital went down 30% to 217 million euros for 57 deals from 217 million in 1H19 for 69 deals said the Report of the Venture Capital Monitor (VeM) of LIUC Business School (see here a previous post by BeBeez). AIFI, Intesa Sanpaolo Innovation Center and E. Morace & Co. Law firm collaborated for the production of the report. If we consider, however, also the activities of corporate venture capital and business angels, then the numbers grow. Overall, venture capital and corporate venture capital invested 119 million euros over 36 rounds in the six months, and syndication activities between venture capital, corporate venture capital and business angels recorded investments of 98 million euros on 21 transactions and businesses alone angel have invested 31 million in 31 rounds. The total of these activities leads the early stage supply chain to have invested 248 million euros over 88 rounds.The data of venture investments in a broader sense provided by VeM is in line with the 253 million euros that emerge from the BeBeez database (the BeBeez Report on 6 months of venture capital 2020 will be available shortly for subscribers to BeBeez News Premium ). In total there are 74 rounds of investment by funds, investment holding companies, corporate venture capital and business angels, in addition to 67 equity crowdufnding campaigns (net of real estate ones) successfully concluded, which have collected in total 28 million euros (source: CrowdfundingBuzz). The figure of the 253 million compares with that of the whole of 2019, when BeBeez had mapped 244 rounds for a total of about 605.6 million euros, in sharp increase from the 510 million euros, split over 179 companies, registered in 2018 ( see here the BeBeez Report on Venture Capital 2019, available shortly for subscribers to BeBeez News Premium) .

Italian Insuretech Yolo attracted an investment round of 3 million euros that Neva Finventures led, while Intesa Sanpaolo Vita acquired a 2.5% of the business (see here a previous post by BeBeez). Primomiglio, Banca di Piacenza, Be Shaping the Future, and CRIF joined the round. Simone Ranucci Brandimarte, the founder of Buongiorno and Glamoo, founded Yolo in 2017 together with ceo Gianluca de Cobelli and Italian broker Mansutti. The company raised 10 million since its birth.

ABHH, the owner of Alfa Bank, acquired UK invoice financing platform Lendflo, in which Italy’s H-Farm invested in 2018 (see here a previous post by BeBeez). H-Farm had a 3% of the business that acquired through a seed round of 0.6 million British Pounds that Apex Ventures and Thompson Crosby led in 2019. H-Farm made a 13X gain out of its investment. Chris Smith, John Smith and Rémi Tuyaerts founded London-based Lendflo in 2017.

Acoesis, a startup born out of a research of Istituto Italiano di Tecnologia (IIT), raised 0.9 million euros from LigurCapital (the 5 million venture capital of the Liguria Region) which poured 0.29 million, Marco Rosetti and Family Office Agave (See here a previous post by BeBeez). Luca Brayda is the company’s ceo, Luca Giuliani the cto, Cristina Loche and Angelo Raspagliesi act as directors.

Leaf Space signed a partnership with UK’s Smallspark Space Systems (see here a previous post by BeBeez). The partnership involves joint bids for projects for the UK Government and other UK commercial operators, with the aim of becoming the main contractor for services to OneWeb, a constellation of 650 satellites that will provide worldwide services for satellite internet and broadband. Leaf Space has sales of 0.224 million euros with an ebitda of minus 0.604 million.

Italian barbers shops chain Barberino’s increased to 1.25 million euros the target of its equity crowdfunding campaign on Mamacrowd (see here a previous post by BeBeez). The company’s pre-money value amounts to 5.2 million. Barberino already hit its hardcap target of 1.7 million and attracted the resources of bespoke Italian entrepreneurs and members of the business community such as Fabio Mondini de Focatiis, Federico Monguzzi, Net4Capital, OneDay Group, and Numenor. The company will invest such proceeds in its organic development. Michele Callegari and Niccolò Bencini founded Barberino’s in 2015. The company has sales of 1.34 million and an ebitda of 62,000 euros.

Investinit, an investor in startups, launched an equity crowdfunding campaign on WeAreStarting (see here a previous post by BeBeez). The company set a target of 0.5 million – 2 million euros and will invest 15% of the raised proceeds in startups and 85% in vehicles that support them. Mattia Silvestrin, Daniele Dal Bo’, Diego Lazzari, Ilaria Fracasso, Eleonora Diana, and Francesca Notaro founded Investinit. The company signed a partnership with FocusFuturo, a financial consulting firm that Paolo Vacchino founded with Antonio Assereto.

LIFEdata, Sooneat and Hexagro are the winners of the call for startup Ceetrus 4 Innovation (C4I) (See here a previous post by BeBeez). Ceetrus Italy launched the challenge earlier in March together with Milan accelerator PoliHub. Each of the winner will receive a 25,000 euros grant for financing their activities for technology development & validation in view of creating a Proof of Concept (PoC) for a market validation. Manufacty received a special mention.

#RestartLombardia, the call that VGen LAB launched earlier in May together with Open Innovation Lombardia, is now over (See here a previous post by BeBeez). The winners of this startup challenge are Ioota, Latitudo, OaCP, Plusimple, Quickly Pro, Senpai, Soonapse, SynDiag, Tactile Robots, and Wenda. The winners of the general challenge are Furnitile, Behind the Glass, My Lombardia, Urban Lab, in-SOAP, Recharge-Mi, Boot, Progetto MMXII, and FashionTech. Open Innovation Lombardia is a platform of Regione Lombardia for the innovation. VGen, a community of Rome’s Tor Vergata University, founded VGen LAB in 2018. In January 2019, VGen opened a bureau in Milan with a team of Bocconi University Students.

Alba Robot, an Italian startup that received the support of I3P, the incubator of Turin Polytechnic University, joined Alexa Next Stage (ANS), the acceleration programme of Techstars and of Alexa Fund, the 200 million US Dollars fund of Amazon (see here a previous post by BeBeez). The other companies that will join the ANS programme are Symbl, Blerp, Sybel, Blue Fever, Lingvist, and Kardome. Alba Robot is a spin-off of Moschini and Teoresi Group born in 2019. The company manufactures smart wheelchairs.

Assofintech, the Italian association of fintech firms, appointed Maurizio Bernardo as its new president and Fabrizio Barini as new general secretary (See here a previous post by BeBeez). They will replace Fabio Brambilla and Fabio Allegreni in their respective roles.

Sia and Crif signed a strategic partnership for the open banking (see here a previous post by BeBeez). The companies aim to accelerate the innovation of banks, corporations and fintech.

Tink, a Swedish open banking platform in which Poste Italiane invested, acquired Instantor, a provider of open banking-based solutions for the assessment of credit risk (See here a previous post by BeBeez). John Grundström and Niklas Bergman founded Instantor in 2010. The company has sales of 4 million euros. Daniel Kjellén and Fredrik Hedberg founded Tink in 2012 which raised 182.6 million in 6 rounds since its birth. The company attracted investments from Dawn Capital, HMI Capital, Insight Partners, Heartcore Capital, ABN AMRO Ventures, Opera Tech Ventures (part of Bnp Paribas), and Poste Italiane.

EdiBeez srl