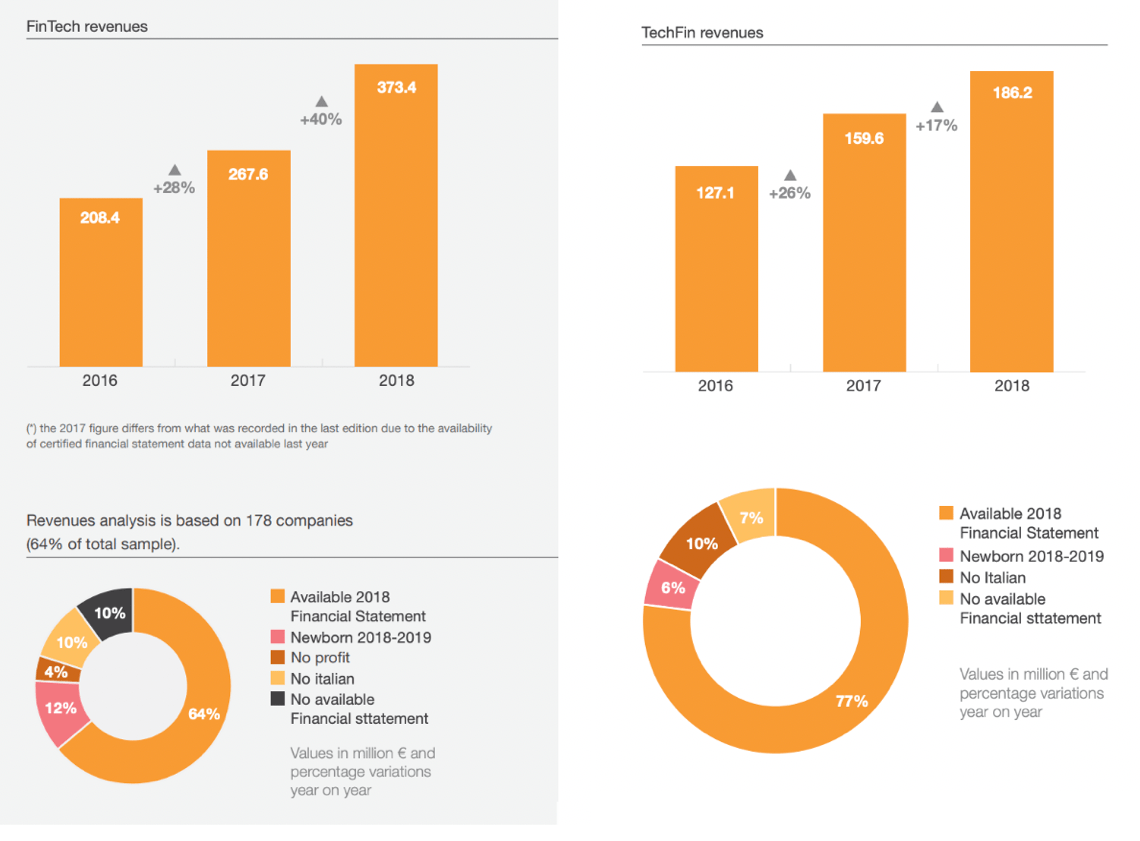

The aggregate turnover of Italian fintech startups and scaleups amounted to 373 million euros in 2018 (+40% yoy), said Fintech Calls for Fuel – Italian Fintech Observatory 2020, a report of PwC and NetConsulting3 that included BeBeez in its sources of information for the sector (See here a previous post by BeBeez). The sectors that posted the highest growth rate are lending, wealth and asset management and payments. The report said that in 2019, the fintech firms raised 153.6 million through 34 deals (297.2 million for 35 transactions in 2018 – Prima Assicurazioni raised 1000 million). BeBeez data for 1Q20 say that Italian startups and scaleups raised 110 million euros, while the investments in the sector amounted to 261 million for 2019 (200 million in 2018 – See here the BeBeez Fintech Report 2020, and find out here how to subscribe to BeBeez News Premium for just 20 euros per month and read the BeBeez Reports and Insight Views.).

The aggregate turnover of Italian fintech startups and scaleups amounted to 373 million euros in 2018 (+40% yoy), said Fintech Calls for Fuel – Italian Fintech Observatory 2020, a report of PwC and NetConsulting3 that included BeBeez in its sources of information for the sector (See here a previous post by BeBeez). The sectors that posted the highest growth rate are lending, wealth and asset management and payments. The report said that in 2019, the fintech firms raised 153.6 million through 34 deals (297.2 million for 35 transactions in 2018 – Prima Assicurazioni raised 1000 million). BeBeez data for 1Q20 say that Italian startups and scaleups raised 110 million euros, while the investments in the sector amounted to 261 million for 2019 (200 million in 2018 – See here the BeBeez Fintech Report 2020, and find out here how to subscribe to BeBeez News Premium for just 20 euros per month and read the BeBeez Reports and Insight Views.).

Mangrovia Blockchain Solutions, a company whose controlling shareholders are Angelomario Moratti and Seven Investments, acquired the majority of Italian fintech Mind Over Money (see here a previous post by BeBeez). The target’s founders Graziano Bugatti and Matteo Temporin sold part of their stakes. Mind Over Money developed a proprietary Robo-advisory platform for finance, insurance and credit and aims to implement blockchain solutions on its technology.

Poke House, a restaurant chain, raised more than 5 million euros through a round that Milano Investment Partners (MIP) led as it acquired 25% of the company (see here a previous post by BeBeez). Matteo Pichi and Vittoria Zanetti founded the company in 2018. Poke Hous has sales of 0.695 million euros and an ebitda of minus 0.25 million. The company will invest these proceeds in expanding its foreign operations and its organic growth.

IntendiMe, a startup that was born during the second edition of Cagliari University’s event ContaminationLab, raised a series A round of 2.3 million euros from Vertis (see here a previous post by BeBeez). In February 2019, IntendiMe, a provider of devices and apps for supporting deaf and hard of hearing persons, raised a 75,000 euros Proof-of-Concept (PoC) facility and 0.5 million round from Vertis. Italian incubator The Net Value later invested in the company. Alessandra Farris, Giorgia Ambu, Antonio Pinese, and Leonardo Buffetti founded IntendiMe in 2014, which received a 25,000 euros grant from Telecom Italia in 2015. The company will invest these proceeds in R&D and expanding its workforce.

London fintech Meniga raised 8.5 million euros through a round that French Groupe BPCE led and Unicredit (a strategic partner of Meniga since 2018 when it joined a 3.1 million investment round in June 2018) joined together with Portuguese Grupo Crèdito Agrìcola, Velocity Capital, and Industrifonden & Frumtak Ventures (see here a previous post by BeBeez). Meniga is a B2B fintech data company. In January 2019, Meniga acquired Swedish reward platform Wrapp. Asgeir Orn Asgeirsson, Georg Ludviksson, and Viggo Asgeirsson founded Meniga in 2009.

Orapesce, an e-commerce for the sale and delivery of fresh seafood, raised 0.4 million euros through an equity crowdfunding campaign on Mamacrowd for which it set a target of 80,000 euros -0.25 million (see here a previous post by BeBeez). Orapesce sold a stake of 8.16% on the ground of a 0.9 million pre-money value. The investors will get a 20% – 30% discount on future buys. In March 2018, Giacomo Bedetti and Alberto Mazza founded Orapesce together with an executive MBA class of MIP, the Business School of Milan Polytechnic University. The company previously raised 0.117 million from investors in two rounds: one in December 2018 for 35,000 euros and another for 82,000 in September 2019. Orapesce has net sales of 75,000 euros and will invest the raised proceeds in its organic development.

Bocconi for Innovation (B4i), the pre-acceleration and acceleration platform of Milan’s Bocconi University, signed a partnership with Plug and Play (P&P) the open innovation platform that groups startups, global corporates and international venture capital funds (see here a previous post by BeBeez). In April 2019, Plug and Play created a Milan-based fintech pole together with Nexi and Unicredit. B4i aim to liaise the startups of its programme with corporates and venture capital with the support of P&P.

Fabrick, a fintech platform for open banking, received from Banca d’Italia the authorization to act as a payment institute (see here a previous post by BeBeez). Banca Sella owns 80% of Fabrick, while the remaining stake belongs to shareholders-entrepreneurs. Paolo Zaccardi is the ceo of Fabrick.

On 26 May, Tuesday, Fabio Allegreni, the secretary of Italy’s Assofintech an ceo of EdiBeez (the publisher of BeBeez and of CrowdfundingBuzz), made the opening speech of Workshop Fintech&Blockchain of Italia4Blockchain, Assofintech and Innexta – Camera di Commercio di Milano, Monza Brianza e Lodi (see here a previous post by BeBeez). Allegreni said that the BlockChain can support the traditional financial transactions and other sectors. Jacopo Sesana, the founder of Italian WondersItalian Wonders, outlined the support that the tokenomics and cryptocurrencies can provide the tourism sector. Marcello Negri, the chairman of EasyFintech, a publisher of banking software for audit and credit alert, explained how the blockchain could support the back office activities of financial firms. Diego D’Aquilio, the cmo of Young Platform, the owner of the cryptocurrencies trading market Exchange Young Platform, said that the company aims to raise 10 million euros through a capital increase. Eterna Capital, an investor in blockchain-based in London that Andrea Bonaceto founded together with Nassim Olive, Asim Ahmad and Mattia Mrvosevic, is currently launching a second fund, said the founder.

A report of Centro di Ricerca su Tecnologie, Innovazione e Servizi Finanziari (CeTIF) of Milan Catholic University and of Banca Generali said that banks and wealth managers must implement open innovation patterns with the support of fintech companies (see here a previous post by BeBeez). The CeTIFF report siad that fintech companies may also help to innovate the services for instant payments, instant lending, and instant wire.

Iungo, a provider of optimization systems and software solutions for B2B supply chain in which Gellify invested, signed a partnership with Phoenix Capital Iniziative di Sviluppo (see here a previous post by BeBeez). Iungo will provide the supply chain collaboration solution to Phoenix clients. Phoenix is a spin-off of Modena and Reggio Emilia University.

Innogest Capital’s founder Claudio Giuliano said that the company will launch a new fund with a focus on cardiovascular disease (see here a previous post by BeBeez). Giuseppe Donagemma is the chairman of 2006-born Innogest, that has 200 million euros under management. In December 2019, Inogest board hired Hiroaki Tanaka and Hadi Abderrahim as partners. Innogest Capital is one of the investors that BeBeez Private Data monitors. Find out here how to subscribe to the Combo Version that includes the reports and the insight views of BeBeez News Premium 12 months for 110 euros per month.