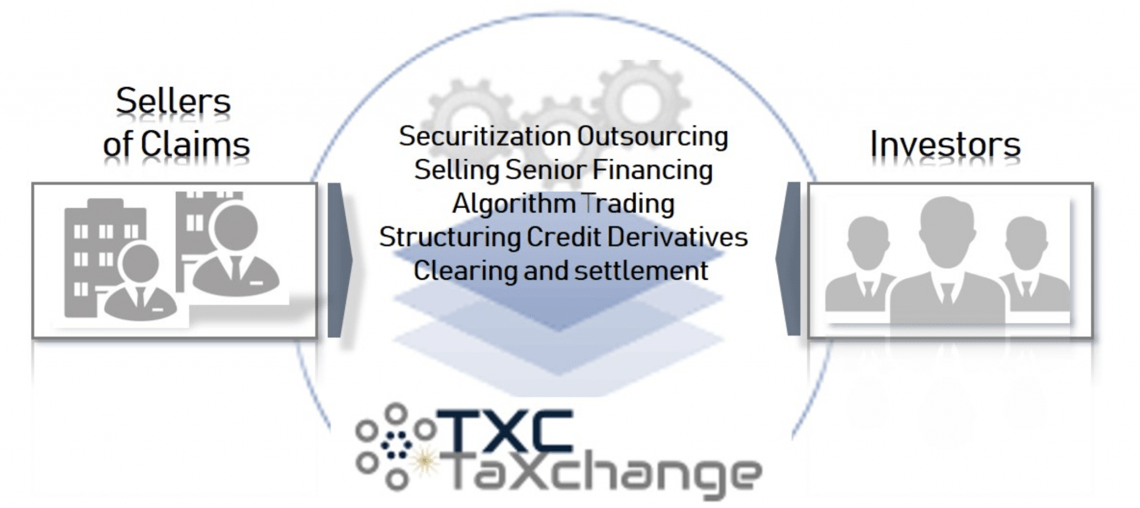

TXC TaXchange the platform for the trade of tax credits that TXC Markets created, will start its activity on January 2020 (see here a previous post by BeBeez). Bruno Lorenzelli, a seasoned investment banker with specific skills in trading illiquid credits, founded TXC Markets. In December 2018, TXC Markets raised 500k euros million euros in equity from OIB invested for a 42% stake and 700k euros from IntesaSanpaolo who provided a financing that Mediocredito Centrale secured. On top of these amounts, Italian law firm RCCD and US tech partner OIX received 165k euros in work for equity. Some of TXC Markets business partners are: List Group, a software publisher for the trading sector; Milan-listed corporate intelligence provider Cerved, and Deloitte STS, who provides the credit due diligence. In 2016, Lorenzelli founded London-based Nova Star Financial Solutions and developed the business plan of TXC TaXchange that aims to become a marketplace for illiquid and distressed credits.

TXC TaXchange the platform for the trade of tax credits that TXC Markets created, will start its activity on January 2020 (see here a previous post by BeBeez). Bruno Lorenzelli, a seasoned investment banker with specific skills in trading illiquid credits, founded TXC Markets. In December 2018, TXC Markets raised 500k euros million euros in equity from OIB invested for a 42% stake and 700k euros from IntesaSanpaolo who provided a financing that Mediocredito Centrale secured. On top of these amounts, Italian law firm RCCD and US tech partner OIX received 165k euros in work for equity. Some of TXC Markets business partners are: List Group, a software publisher for the trading sector; Milan-listed corporate intelligence provider Cerved, and Deloitte STS, who provides the credit due diligence. In 2016, Lorenzelli founded London-based Nova Star Financial Solutions and developed the business plan of TXC TaXchange that aims to become a marketplace for illiquid and distressed credits.

GlassToPower, a spin-off of Milan University for the production of photovoltaic panels, aims to raise 8 million euros by June 2020 on the ground of a pre-money valuation of 9 million (See here a previous post by BeBeez). The current shareholders already invested one million. Emilio Sassone Corsi, the ceo of Glass to Power, said that the company is already holding talks with venture capital funds and family offices. In July 2018, GlassToPower raised 2.25 million through an equity crowdfunding campaign on the platform CrowdFundMe for a 20% stake. Federico De Nora (FDN), the holding of Gruppo Industrie De Nora, invested 0.627 million in Glass to Power. FDN, a co-founder of the startup, poured resources in order to keep unhanged its 25% stake. In 2017, the startup launched another campaign on CrowdFundMe and raised almost 0,184 million on the ground of an enterprise value of 1.5 million.

DEXTF (Decentralized Traded Funds), a Singapore-based fintech that Italian entrepreneurs Mario Aquino, Nicola Dalmazzo, Filippo Fanin, and Federico Cristina founded in 2017, raised 0.46 million US Dollars (See here a previous post by BeBeez). LuneX Ventures (the investment unit for a blockchain technologies of Golden Gate Ventures), SGInnovate, CDAM, and further private investors supported DEXTF. The company is a wealth management firm that carry on its activity on the ground of the blockchain technology. Singapore’s boutique wealth management firm Mindful Wealth, where Cristina works as senior consultant, is DEXTF’s strategic partner.

New York-based digital & verification company Integral Ad Science (IAS), a portfolio company of private equity Vista Equity Partners, acquired ADmantX, an online advertising company that Milan-listed Expert System previously spun off (See here a previous post by BeBeez). The target’s managers, private investors, Expert System (60.8%), and Atlante Ventures Mezzogiorno (AVM 18.43%) (whose even owners are Intesa Sanpaolo and the Italian Ministry for the Publica Administratione and Innovation) wholly sold their stake in the business. ADmantX value is in the region of 16 million euros. The company has sales of 2 million, an ebitda and net financial debt that are both worth 0.36 million. Expert System sold its stake for 7.098 million. Atlante Ventures Mezzogiorno invested 2 million in ADmantX in 2011. In September 2015, the company launched a 2.16 million capital increase on the ground of a pre-money value of 15 million. Expert System diminished its stake from 69.4% to 60.7%, Atlante Ventures Mezzogiorno went down to 18.1% from 20.7%, while private investors had 21.2%. The client list of ADmantX includes the FT Group, Sky, NBC Universal, Ozone, News UK, Ikea, Thompson Reuters, Experian, Manzoni, Dentsu Aegis, TIM, Amnet, Simple Agency, Accuen, RCS Group, Mondadori as well as bespoke DSPs and SSPs. Indaco Venture Partners, the owner of AVM, was born in May 2018 and belongs to Davide Turco and the former management team for venture capital activities of Intesa Sanpaolo, and to Futura Invest (whose owners are Fondazione Cariplo and Fondazione Enasarco) and Intesa Sanpaolo who share even parts of the fund’s remaining 49%. Indaco has resources of above 250 million for its 5 funds: Indaco Venture, Atlante Seed, Atlante Ventures, TTVenture, and Atlante Ventures Mezzogiorno. ADmantX is the third exit of AVM after the sale of Expert System, and Mosaicoon, which took place in 2016. Mosaicoon, a platform for the creation of video adverts, bankrupted in July 2018

Oval Money, the London-based fintech that created an online piggybank, launched a one million British Pounds equity crowdfunding campaign on British platform Seedrs (see here a previous post by BeBeez). Oval is offering a 2.05% stake on the ground of a pre-money value of 47.8 million and will invest the proceeds of this campaign in its organic development. The company already raised 890k pounds from more than 1100 investors and previously launched an investment round of 4 million for a 12.5% stake. Eurizon, the asset management unit of Intesa Sanpaolo poured 2.5 million pounds and will invest a further 1.5 million pounds by June 2020 if the company achieves undisclosed targets. Benedetta Arese Lucini, the former general manager of Uber in Italy, Claudio Bedino and Edoardo Benedetto (who previously co-founded the crowdfunding platform Starteed.com), and Simone Marzola created Oval in April 2017. At the end of 2016, Oval raised an investment of 1.2 million euros from Intesa Sanpaolo, b-ventures (the accelerator that Mauro del Rio founded), and Bertoldi Holding. In April 2018 the company raised a round of 1.5 million British Pounds from several investors and 0.788 million British Pounds through an equity crowdfunding campaign on CrowCube. In June 2018, Oval received 4 million euros from Intesa Sanpaolo’s corporate venture Neva Finventures.

Le Cesarine, the Italian startup for home catering, aims to raise 4 million euros, ceo Davide Maggi said (see here a previous post by BeBeez). The company will launch a capital increase for its current shareholders and then will pitch venture capital funds and family offices. The startup previously raised 2 million from Daniele Ferrero, the ceo of Venchi; Niccolò Branca, ceo and chairman of the eponymous group; Emmanuel Osti, formerly a managing director of de L’Occitaine, Marco Airoldi, formerly ceo of Benetton group; Roberto Nicastro, vicepresident of Ubi Banca,;Massimiliano Benedetti, former executive of Yoox Net-a-Porter Group. Maggi founded the company in 2016 and acquired the brand together with Massimiliano Benedetti. The ceo said that the company aims to raise a turnover of 34 million in 2024 with an ebitda of 3.9 million. Le Cesarine may generate a 0.2 million ebitda in 2022, while for 2020 it foresees to generate sales of 3 million.

BeBeez is the media partner for the event Blockchain behind and beyond the hype event that Distributed Minds, a Think Thank with a focus on blockchain that Sara Noggler, a Public Affairs Consultant San Marino Innovation and ceo di Polyhedra Blockchain PR Company, founded (See here a previous post by BeBeez). The event will take place on the 28 November, Thursday, in Milan at LeVillage in Corso di Porta Romana, 61. Blockchain4Innovation, San Marino Innovation, and the European Commission patronise the event.

At the end its first day of public trading on 20 November, Wednesday, Milan-listed fintech startup UCapital24, who launched its ipo at 4 euros per share, closed with a price of 4.03 after having hit a 4.3 euros peak and 3.91 floor (see here a previous post by BeBeez). The company raised 2.5 million euros after having converted 1.5 million euros of shareholders’ loans into equity and listed a 19.67% stake. Gianmaria Feleppa is the founder, chairman and ceo of UCapital24. The company plans to generate sales of 2.3 million for 2020. UCapital24 hit a 4.7 euros per share peak (+16.63%) on 21 November, Thursday while the warrant’s price has been of 0.5699 euros (+171.38% from the 0.21 euros opening price) (see here a previous post by BeBeez). Each new investor had received one warrant for each share owned. You have right to buy one share every two warrants owned and to exercise the warrant t specific dates and prices. The first date for exercising the warrant is October 2020 at a price of 4.40 euros. Before the listing, UCapital24’s 85% owner was UCapital Ltd, a holding that belongs to Feleppa, Vetrya (12.5%) and 4Media (2.5%). Vetrya and 4Media invested in UCapital 24 in February 2018 and acquired 25% for 0.25 million and 5% for 50,000 euros through a capital increase. UCapital23 board members are Feleppa, Giuseppe Vegas (the former head of Italian stock market regulator Consob), Davide Leonardi, Stefano Mazzocchi, Werther Montanari, Edoardo Narduzzi, and Giovanni Natali.

Ninesquared, a producer of sportwear with a focus on volleyball, launched an equity crowdfunding campaign on 200Crowd on the ground of a pre-money valuation of 1.95 million euros (see here a previous post by BeBeez). Since the initial date of 30 October 2019, the company raised more than 0.2 million ahead of an upper target of 0.48 million. Investors may get products of Ninesquared, depending on the resources they pour. Trentino Sviluppo, the financial arm of Trentino Region that supports local SMEs, is the anchor investor with a 10,000 euros ticket. The firm will invest a further amount worth 5% of the total amount raised with the campaign. Ninesquared will invest the proceeds in its organic development. Lorenzo Gallosti is the cofounder and ceo of Ninesquared. Matteo Masserdotti is the ceo of Two Hundred. Former professional Italian volleyballers Filippo Lanza, Lorenzo Gallosti, Nicola Leonardi, Andrea Ballardini, Marco Grazioli, and Andrea Corradini founded Ninesquared in 2018. The company posted a net profit of 0.1 million without any at the end of its first year of activity. Ninesquared foresees to generate sales of 3.5 million with a 1 million ebitda in 2024 and to hit a 100 million turnover in 2030, when it could list.

Italian sport-tech Golee raised 850k euros from venture capital Maider, whose head is Andrea Marangione (an investor in Chef in Camicia), and from entrepreneurs Carlo Cozza, Daniele Alberti, Stiven Muccioli (the founder of Ventis and cofounder of Golee) and other investors (see here a previous post by BeBeez). Tommaso Guerra, Daniele Roselli, and Felice Biancardi are the further founders of Golee who received the support from incubators and accelerators such as Wylab, Hype, Trentino Sviluppo, and SpeedMiUp. The startup supplies digital services for sport clubs.

The Italian Ministry for the Economic Development (Mise) launched a blockchain-based project for protecting made in Italy products together with IBM Italia (see here a previous post by BeBeez). The project is based on a shared proof-of-concept platform. Stefano Patuanelli, the Italian Ministry of Economic Development said that this project is part of the European Blockchain Partnership that Italy signed on 10 April 2018 together with other 20 member states in view of exporting the Italian model of protection for the production chains.

Bocconi For Innovation (B4i), the new accelerator of Milan’s Bocconi University, launched a first call for choosing 10 startups to support (see here a previous post by BeBeez). The Bocconi for Innovation Startup Call will expire on 6 January 2020 and on 9 March 2020, 10 startups will start an acceleration programme that will end on 10 July 2020. After then, the companies could pitch a community of business angels and of venture capital funds for raising further resources. Further to providing services and hosting to 50 startups, B4i will also help Italian SMEs to develop entrepreneurship and innovation. Istituto Italiano di Tecnologia (IIT), Politecnico di Milano, Università degli Studi di Milano, Henkel X Ventures (the corporate venture capital of Henkel), the Citi Foundation of Citi are the partners of B4i who will support 20 startups per year by investing 30,000 for up to 5% of the business and an acceleration programme of 4 months.

Italian startup EcoSteer received the AXA/Angels for Women award section of Premio Gaetano Marzotto as the best women-led startup (See here a previous post by BeBeez). The startup will receive an incubation support worth 50,000 euros from Angels for Women. Elena Pasquali founded EcoSteer in 2017. The company created a data ownership platform with a blockchain technology. The company already raised 0.61 million euros with 2 pre-seed rounds and a seed one. Patrick Cohen is the ceo Axa Italia, while Lorenza Morandini is the managing director of Angels for Women which will launch a call for women-led startups in 2020. The call is for startups that contribute to women empowerment and will provide an investment support of 0.1-0.5 million further to professional support. Axa Italia and Impact Hub Milano launched Angels for Women, which supported with 0.1million Orange Fiber, a startup that produces fabrics out of citruses.

Italian social commerce platform for the art sector Artune is about to launch an equity crowdfunding campaign on 200crowd on the ground of a pre-money valuation of 2 million euros (See here a previous post by BeBeez). The fundraising target is of 0.15-0.3 million euros with a post-money equity stake of at least 6.98%. Artune’s ceo is Guido Mologni. The company will invest the proceeds in its organic development and IT infrastructure.

Unicredit launched the seventh edition of Unicredit Start Lab 2020, an acceleration and open innovation programme for startups and SMEs no more than 5 years old (See here a previous post by BeBeez). The programme’s first edition took place in 2014. Companies that belongs to the following cathegories can apply by 20 April 2020: Innovative Made in Italy, Digital, Clean Tech, Life Science. Previous winners are DeepTrace Technologies (Life Science); Captive Systems (Clean Tech), Hiro Robotics (Innovative Made in Italy), and AppQuality (Digital). Unicredit also invested in the equity of the startups that joined the programme. In November 2015 the bank invested in WIB Machines, a Sicilian developer of vending machines.

The Finance Commission of the Italian Parliament discussed on 25 November, Monday, the change of the regulation for PIR investment funds, that are fund dedicated to retail investors which should invest part of their assets into financial instruments issued by SMEs (see here a previous post by BeBeez). The current regulation requires to invest 3.5% on Aim-listed companies and the same amount in venture capital funds. The change proposal would eventually require investing a whole 3.5% of the asset under management in small and mid cap businesses not listed on Milan’s Ftse Mib and Fitse Mid indices or other regulated indexes.

Milan-based biotech startup Peptitech launched an equity crowdfunding campaign on BackToWork, a platform in which Neva Finventures invested, for financing Glauconext (See here a previous post by BeBeez). Evarist Granata and Marco Feligioni, who holds a PhD in pharmacology and achieved a 15-years’ experience in the field of neurosciences, founded Peptitech. Grannata is also the cofounder and ceo of Alternative Capital Partners, an investor in alternative ESG assets. Granata is a shareholder and former vice-president of Horizon Telecom and formerly president and shareholder of CTIP Green Utility an investor in local utilities and waste-to-energy companies. Peptitech’s pre-money value is of 6.3 million euros. The company aims to raise 0.1 – 0.7 million for a 1.56% stake with an investment ticket of at least 500 euros. The company will invest the proceeds of the fundraising in its core activity. However, if Pepsitech reaches the upper target, it will invest 49% of the funds in R&D.