Cryptocurrencies and market gaps for day by day life attract interest from Italian venture capitalists and angels.

Cryptocurrencies and market gaps for day by day life attract interest from Italian venture capitalists and angels.

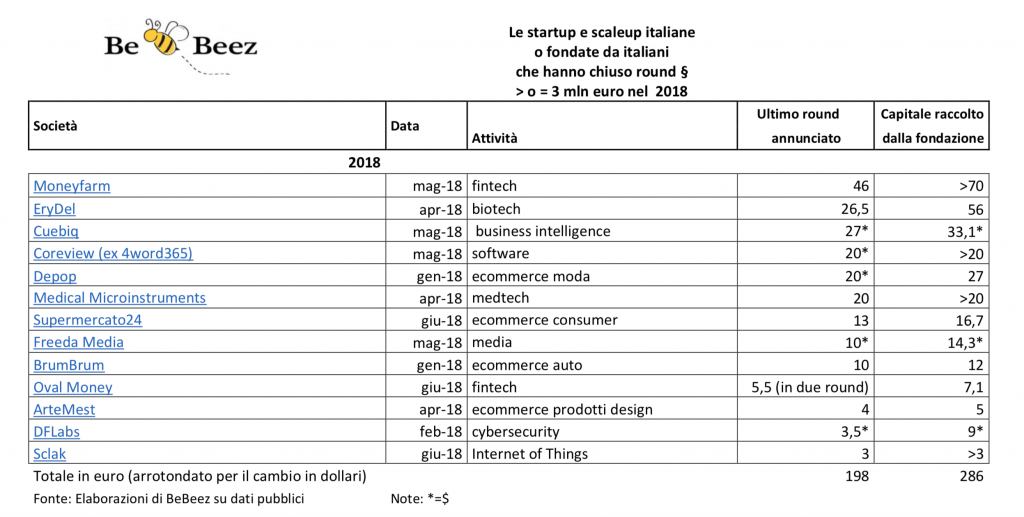

Supermercato24, the web platform for grocery shopping, raised 13 million of euros through a capital increase that financial firms Fondo Italiano d’Investimento (FII) and Endeavor Catalyst subscribed (see here a previous post byBeBeez). Further investors are 360 Capital Partners and Innogest. The company, of which Enrico Pandian is the chairman and Federico Sargenti the Managing Director, will invest such resources in expanding the business in Italy and abroad.

Principia sgr invested 5 million euros in CrestOptics, a provider of electro-optic technology for material science and heatlhcare that Vincenzo Ricco, Andrea Latini and Franco Fazioli founded in 2012 (see here a previous post byBeBeez). The company will invest these proceeds in R&D.

Conio, a B2B startup provider of blockchain services, raised 3 million of US dollars through a capital increase (see here a previous post by BeBeez). Conio enterprise value is above 40 million. Christian Miccoli, the former ceo of Italy’sCheBanca! (part of Gruppo Mediobanca), founded the San Francisco-based company together with Vincenzo Di Nicola, a Stanford alumnus that developed Gopago and sold it to Amazon. Further to the co-founders, the list of Conio’s shareholder includes Poste Italiane, Banca Finanziaria Internazionale, Fabrick, Boost Heroes, Italian Angels for Growth, and David Capital.