Italian VC, Angels, and startups keep their pipeline active and hefty.

Italian VC, Angels, and startups keep their pipeline active and hefty.

Financial investor Oltre Venture contributed to found EatRight, an Italian startup that will develop a new retail concept for healthy food (see here a previous post by BeBeez). Oltre Venture owns 76.92% of EatRight, while the ceo Enrico Domenico Capoferri holds the remaining 23:08%. Oltre Venture’s founders and partners Luciano Balbo and Lorenzo Allevi implemented a social return attitude to investments and in 2016 raised 30 million of euros.

Liquidweb, an Italian company active in the field of artificial intelligence, raised 2.5 million of euros from financial firm RSV (see here a previous post by BeBeez). Pasquale Fedele, is the ceo and founder of Liquidweb, while Roberto Zanco, managing partner an co-founder of RSV together with Elisa Schembari, will be the company’s chairman. RSV holds in its portfolio stakes in Fazland, an online platform for business development; Leaf Spac, a company that supports owners of microsatellites; BeMyEye, a market research business; Dianax, a developer of portable devices for clinic diagnostic; andWIB (Warehouse in a box), a developer of vending machines for products with different packaging.

LexDo.it, an Italian startup providing automated legal services, raised a second round of financing worth 0.85 million of euros from Boost Heroes, the Italian venture capital firm that Italian entrepreneur Fabio Cannavale founded, and further investors (see here a previous post by BeBeez). Giovanni Toffoletto founded the company.

Club degli Investitori, the Piedmont-based network of business Angels, invested 0.2 million of euros in Solo Crudo, a startup producer and distributor of healthy food (see here a previous post by BeBeez). Solo Crudo will invest such proceeds in the brand consolidation and opening of stores and restaurants in the main Italian cities.

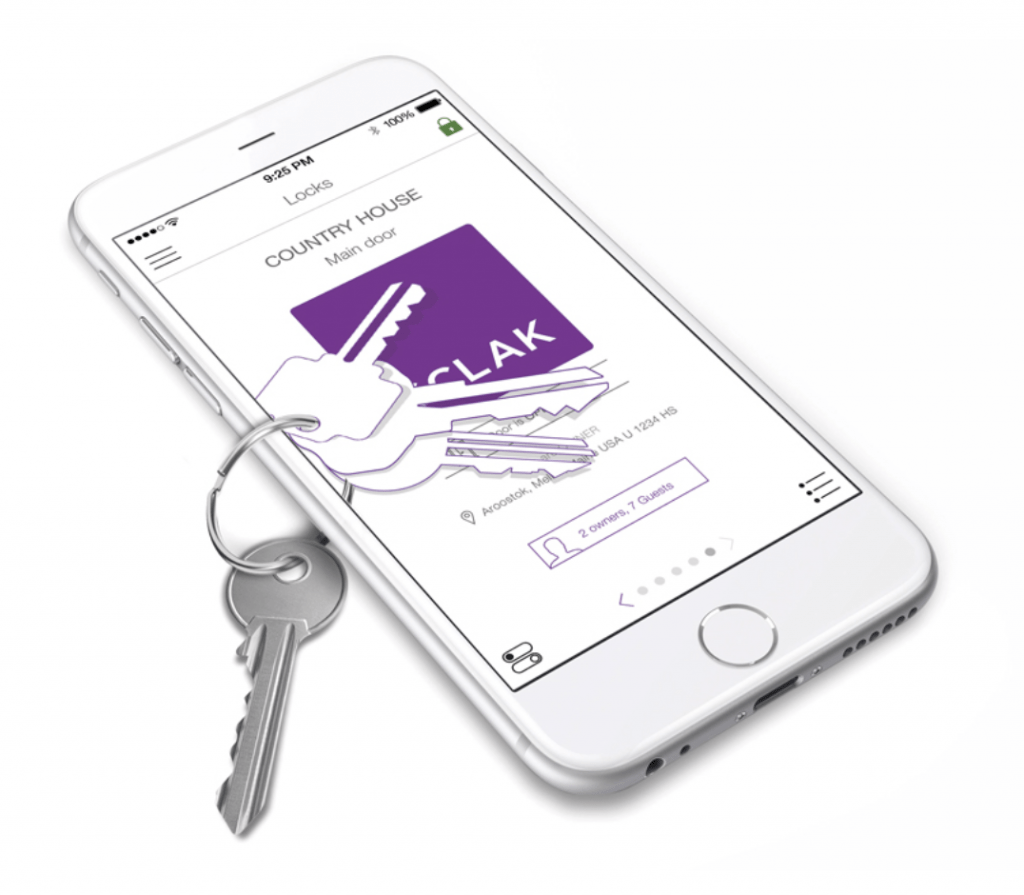

Naples-based financial investor Vertis Venture 2 Scaleup invested 3 million of euros in Sclak, an internet of things company that Andrea Mastalli, Andrea Ferro, and Daniele Poggi founded in 2014 and of which Walter Coraccio is the ceo (see here a previous post by BeBeez). Sclak’s proprietary technology allows to link doors to an online platform and to control the flow of access. Since its foundation, the company signed partnerships with short-term rents providers such as SweetGuest and HomeatHotel, facility management companies like Ceg Facility, and passive security firm Assa Abloy. Sclack generates 30% of its sales mainly in Spain, but it’s starting to develop its business in France, the UK, Hong Kong, and Australia.

Oval Money, the fintech startup fintech for investing small amounts of money based in London and Turin, raised 4 million of euros from Neva Finventure, a venture capital of Intesa SanPaolo (see here a previous post by BeBeez). Earlier in April Oval Money raised 1.5 million, of which 0.9 million through the equity crowdfunding platform CrowCube. The list of investors includes Mauro Del Rio, the founder of digital contents provider Buongiorno and Fabio Cannavale, the owner of Venture Capital firm BeHeroes and ceo of Lastminute.com. Intesa Sanpaolo aims to launch an industrial partnership between its instant banking arm Banca 5 and Oval Money and provide basic banking services to lower mass clients.Benedetta Arese Lucini, the former country manager of Uber in Italy, founded Oval Money together with Claudio Bedinoand Edoardo Benedetto, which previously created with Simone Marzola Starteed.com, a B2B crowdfunding firm.