Italian angels and venture investors keep the deal flow steady and solid and attract resources of foreign institutionals.

Milan-listed incubator H-Farm sold 15% of Travel Appeal, a startup operating in the travel sector, to Dutch financial firm Airbridge Equity Partners (see here a previous post by BeBeez). H-Farm will get 0.9 million of euros, with a capital gain worth 12X the capital it invested and will keep 10.96% of TA. In 2014, H-Farm issued a pre-seed financing of 0.25 million for Travel Appeal, when the company joined the acceleration program Unicredit Start Lab. Last year the company raised 0.72 million from three international entrepreneurs of the travel sector. These investor acquired a 12% stake that took the post-money enterprise value of Travel Appeal to 6 million.

P101, an Italian financial firm, announced to have raised 65 million of euros for Programma 102 (P102), its second venture capital firm (see here a previous post by BeBeez). The list of limited partners for P102 includes European Investment Fund,Fondo Italiano d’Investimento, Azimut, and Fondazione Sardegna. The firm will target Italian digital and technology-driven companies that supply B2C and B2B services for the sectors of food, fashion, design, travel, real estate, fintech, and cybersecurity. P102 will invest in businesses phases that go from early to later stage with single tickets worth 1-10 million. The fund may also invest in Italian entrepreneurial projects based abroad or foreign companies interested in the Italian market. In four years, P101 invested more than 40 million of euro in 26 early-stage tech companies such as BorsadelCredito.it, Cortilia, Tannico, and Musement.

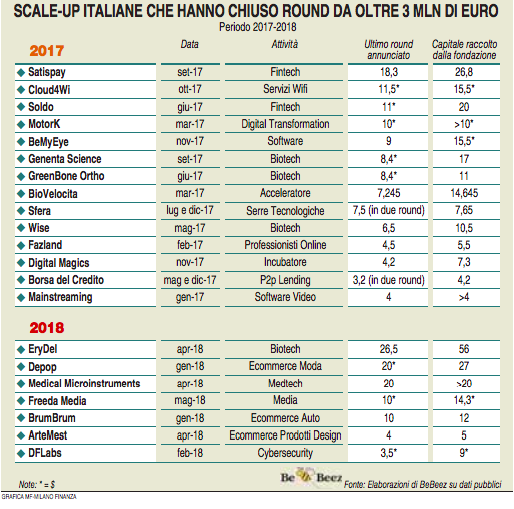

Support to scaleups companies, startups and scaleups internationalization, support to technological transfer, new type of investors are the new trends in the Italian venture capital market which have been stressed in the 2017 Venture Capital Report made by BeBeez for P101 sgr (see here a previous post by BeBeez). Download here the Report, where you may also find all the venture capital deals in 2017 on Italian companies. As for scaleups, the trend is quite strong also this here with about 90 million euros raised by 7 scaleups since the beginning of 2018, with 5 of them raising more than 10 million euros per investment round: EryDel, Depop, Medical Microinstruments, Freeda Media and BrumBrum. This figure emerge from the BeBeez database (see here a previous post by BeBeez).