Italian startuppers and entrepreneurs attracted the interest of angel&incubators as well as venture capital by innovating mature sectors and creating niches in the credit and financing market. Here is a roundup for the week ending last March 6th.

Italian startuppers and entrepreneurs attracted the interest of angel&incubators as well as venture capital by innovating mature sectors and creating niches in the credit and financing market. Here is a roundup for the week ending last March 6th.

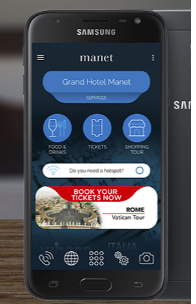

Manet Mobile Solutions srl, an Italian startup that develops web-based and mobile software solutions for the tourism and hotellerie sectors announced that Italy’s LVenture Group together with business angels of the Angel Partner Group network subscribed a Serie A investment round of 1 million of euros (see here a previous post by BeBeez). Antonio Calia, ceo of Manet said that after this injection of capital the company would start an internationalization process. Manet produces an innovative solution that allows hotels to supply voice and data connection to their guests and also a Customer Relationship Management platform.

Equinvest, the owner of the eponymous platform for equity crowdfunding that belongs to Fabio Bancalà and four other persons, merged with BackToWork24, a company that helps SMEs to raise funds from managers and other private investors (see here a previous post by BeBeez). The Bassi family owned BTW24 through Ipb Holding, after having acquired 90% of the business from Gruppo 24 Ore, the listed Italian publishing and media company. The merged entity maintained the BackToWork24 name and launched a capital increase of 2 million of euros on the ground of a pre-money enterprise value of 8 million (10 million post-money) for developing the business. BacktoWork24 now belongs to Alberto Bassi (30%), Fabio Bancalà (founder of Equinvest, 30%), Equinvest’s managers and other previous shareholders. BacktoWork last year posted sales of 1.8 million euros, with a 0.2 million ebitda. For 2018, the company aims to generate sales of 2.5 million and an ebitda 0.35 – 0.400 million, said Bassi. The company is about to start two further activities: a P2P lending platform focused to SMEs and a private equity and venture capital fund with a raising target of 20 million. The members of the BacktoWork24 network will invest in the lending platform and the fund.