There’s never been a more exciting time to be covering the data center cooling market, as the continuing AI revolution shifts the paradigm for many operators.

While DCD has spoken to myriad companies, particularly those operating in the enterprise colo space for whom traditional air cooling remains sufficient for their needs, there is no doubt 2025 was the year liquid cooling went fully mainstream, with leading-edge GPUs and other AI chips requiring a new level of chilling that only liquid can provide.

Meanwhile, the topic of waste heat, and what to do with it, has seen firms more willing than ever to embrace novel solutions.

Consolidate to accumulate

The end of 2024 saw significant M&A activity in the cooling space, and the trend continued throughout 2025, with power and cooling firms adding additional liquid expertise to their teams.

Liquid cooling deals announced include Eaton’s bumper $9.5 billion acquisition of Boyd Thermal, Trane’s December purchase of Stellar Energy Digital, and Daikin buying Chilldyne.

Consolidation makes sense in a market that has, in its nascent years, been characterized by a lot of small vendors offering similar products, and in 2025, we started to see the fruits of deals that were struck a year earlier.

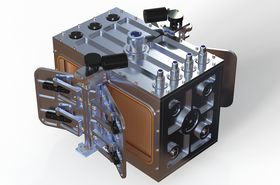

Schneider Electric and Motivair unveiled their first joint cooling portfolio, with a cooling distribution unit (CDU) capable of managing 2.5MW of processing power, while Flex and JetCool, another of 2024’s big M&A deals, came up with a modular liquid cooling solution that can be stitched together to create up to 1.8MW of cooling capacity.

Indeed, 2MW-ready CDUs now seem to be becoming the norm, with CoolIT hailing its 2MW offering, announced in April, and data center operator Switch trumpeting a proprietary hybrid air and liquid cooling system it says is capable of supporting 2MW. DCD has seen the units in situ at Switch’s data center in Las Vegas, and can confirm they look pretty impressive.

Open standards and new technologies

Open standards are emerging in liquid cooling, and many vendors are following the blueprint laid out by Google with its Project Deschutes, the in-house CDU design developed by the cloud and search giant. Revealed earlier this year, Google has made the specs of Project Deschutes available to the Open Compute Project (OCP) community.

At the OCP Europe Summit, held in Dublin in May, Google revealed the extent of its own liquid cooling deployments, demonstrating how the technology has taken hold among the hyperscalers. Around half of Google’s global data center footprint has liquid cooling enabled and/or deployed, meaning the firm has around 1GW of liquid cooling capacity deployed across 2,000 pods equipped with its Tensor Processing Unit AI chips. It achieved uptime of 99.999 percent.

Away from direct-to-chip liquid cooling technologies, immersion cooling remains an option being pursued by some in the industry, and vendor Submer, one of the biggest names in the space, is looking to build its own data centers equipped with immersion technology, with the launch of an AI cloud business that is looking to take on the neoclouds. So far, few cooling firms have diversified into offering data center services themselves, and it will be interesting to see if this becomes a trend in 2026.

Submer got off to a good start in July, when it announced it had signed a Memorandum of Understanding with the government of Madhya Pradesh to jointly develop up to 1GW of liquid-cooled AI data centers in the Indian state.

Vendors such as Dug and Vertiv have also debuted new immersion pods in 2025, while LG, SK Enmove, and GRC have agreed to work together to develop a new immersion cooling system.

New technologies are also driving innovation in cooling. One firm that emerged from its chrysalis in 2025 is Corintis, a Swiss vendor with a novel cooling approach. Instead of traditional cold plate technologies, Corintis is developing a system to push coolant through tiny channels etched into chips, with the AI designs bio-inspired, somewhat akin to the veins on a butterfly’s wing.

In September, Corintis announced a research partnership with Microsoft, stating that its system removed heat up to three times better than cold plates. The company has certainly convinced investors of its merits, having raised $24 million in a Series A round announced in September, and following that up with a $25m raise led by Applied Digital. It also claims to have signed deals with several tech giants.

Elsewhere, Israel’s Nostromo Energy became the latest vendor to bring a data center “ice battery” to the market. Ice batteries work by cooling ice stored in cells at times where demand for power is low. The batteries use the cold temperature of the ice to chill the cooling liquid needed in HVAC systems, eliminating the need for mechanical chillers, which are big consumers of electricity. Nostromo believes it can make up to 40 percent of data center power consumption flexible, which could be a big boon for operators looking to trim costs.

Waste not, want not

As the cooling demands of data centers go up, the amount of waste heat generated also threatens to balloon.

While developers of new data centers have often talked vaguely of heat reuse, pressure is now being applied by communities and local authorities to find tangible ways to better utilize the heat generated by cooling systems.

One vendor, AirJoule, believes it has a solution that can take waste heat and extract water from it using a patented sorbent. Its device is based on metal-organic frameworks – subject of the 2025 Nobel Prize in Chemistry – and delivers pure water that is ready to be recycled in cooling systems.

In December, AirJoule, which is backed by power technology firm GE Vernova, announced the first data center to deploy its technology would be a 600MW facility being planned outside Hubbard, Texas.

An old favorite among data center developers is to pledge to deliver their excess heat to district heating networks. These promises often ring a little hollow, as such networks are more developed in some markets than others. While the Nordic nations lead the way when it comes to district heating, other European countries, such as the UK, are striving to catch up.

Projects announced in 2025 include several schemes in Germany, including a pilot in the city of Norderstedt using heat from an unidentified data center, and a deal between Digital Realty and Frankfurt-based Samson AG, which will see the former providing heat to warm the latter’s factory and offices.

In France, waste heat from two supercomputers operated by French weather forecasting organization Météo France in the city of Toulouse will be used to warm up 27 large buildings in the area, thanks to a deal struck in July. Let’s hope the outlook remains positive for similar schemes to get underway in 2026.

Read the orginal article: https://www.datacenterdynamics.com/en/analysis/chilling-out-in-2025-a-year-in-data-center-cooling/