Cryptomining firm Argo Blockchain is set to delist from the UK’s London Stock Exchange amid a majority takeover.

The UK company this week announced that, as part of a recapitalization and restructuring plan, it intends to delist from the London Stock Exchange. Argo aims to retain its listing on the Nasdaq in the US. The company expects to delist from the exchange on December 9.

In May, Argo warned that there were “uncertainties that may cast significant doubt” around the company as a going concern due to its debt liabilities, with the company “actively exploring solutions to address its capital structure and liquidity position.”

In June, Argo entered into a restructuring plan with Growler Mining, LLC n/k/a Growler Mining Tuscaloosa, LLC, with Growler taking a stake totaling more than 87 percent of the company. Growler is also providing a loan facility of up to $7.5 million to finance the restructuring.

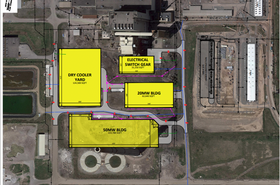

According to Argo, Growler is a privately held company wholly owned by Stan Pate, an entrepreneur with more than 45 years of experience in commercial real estate, oil and gas, and emerging technologies. Growler currently operates cryptocurrency mining facilities in Alabama, and is also “actively exploring” opportunities in the AI infrastructure space.

Founded in 2017, Argo was among the first Bitcoin miners to list publicly, debuting on the LSE in 2018 and the Nasdaq in 2021.

Argo owns a 15MW, 40,000 sq ft (3,716 sqm) cryptomine data center in Baie Comeau, Quebec, Canada, that launched in 2021. The site is reportedly expandable to 23MW.

Earlier this year, Argo signed a deal with Merkle Standard to host 9,315 miners at Merkle’s Memphis, Tennessee, location, as well as up to 4,000 machines at its Washington State location.

Last year, Argo exited Galaxy’s Helios facility in Texas, which is being leased to CoreWeave for GPU hosting. Argo had sold the site to Galaxy in 2022, signing a two-year hosting agreement, partly to lessen the threat of bankruptcy. Argo sold another facility in Mirabel, Quebec, for $6.1 million last year, partly to pay down debt.

In the restructuring filings, Argo noted the number of Bitcoins it mines per day has dropped from 5.9 in 2022 to 2.1 this year, as a result of the Bitcoin halving, aging mining hardware losing efficiency over time, and the sale of approximately 8,000 mining machines.

“The group’s current mining machines are now more than four years old and are coming to the end of their useful economic life,” the company said. “The company expects its current fleet to be economically and operationally unviable at some point between Q1 2026 and Q2 2026, and will thereafter require significant capital expenditure to replace its operational mining machines. The group cannot fund such capital expenditure without the restructuring plan.”

More in Investment / M&A / Financing

Read the orginal article: https://www.datacenterdynamics.com/en/news/cryptominer-argo-to-delist-from-london-stock-exchange/