It’s 11am and Alice Bentinck has already been up for eight hours.

“I flew in from San Francisco on Monday, so this is night two of jetlag,” she says, with a chirpiness that belies her lack of sleep.

The cofounder and now CEO of Entrepreneurs First (EF), Europe’s most-fabled accelerator, is used to juggling timezones having travelled the world with the company over the past decade or so.

Since launching in 2011 in London, EF has expanded into eight different countries across the globe. After a rapid period of growth in the late 2010s the company shuttered some operations, and is now active in the UK, France, India and the US.

Bentinck has spent much of the last year in San Francisco, on what she describes as a “secondment” establishing the company’s operations, travelling back to Europe and Asia every month or so. Even with her imminent move back to the UK, there’s no end in sight to the regular timezone hopping.

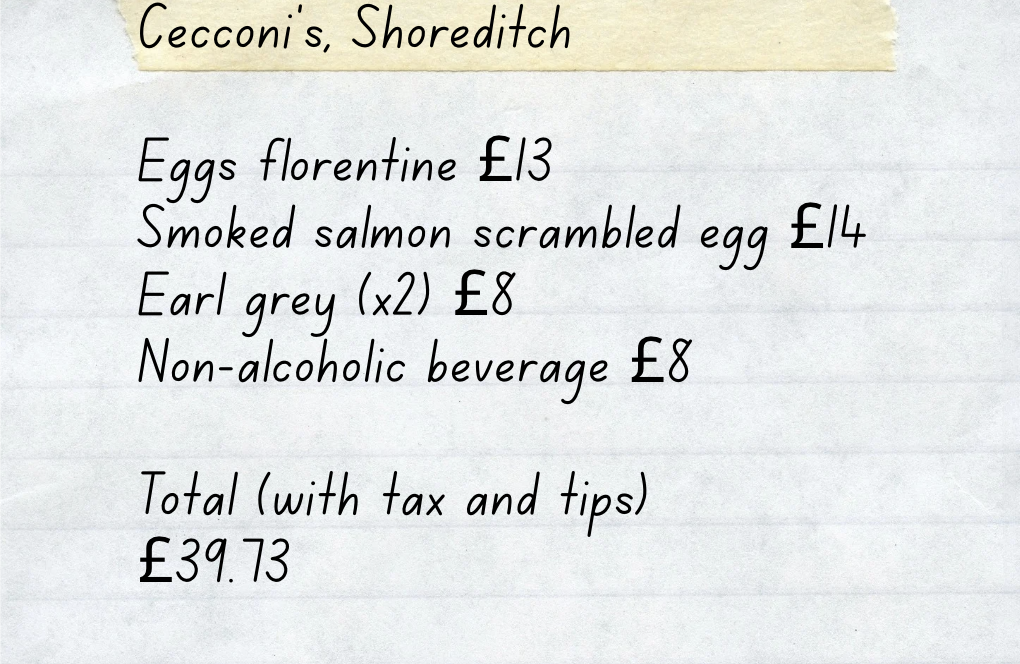

Sitting across from me at Cecconi’s, an Italian restaurant in the heart of the London startup scene’s ancestral home in Shoreditch, Bentinck is unfazed: “As someone who’s travelled a lot for work the last 10 years, it’s not really a big deal.”

Early days

All that jetsetting has borne fruit. In the decade or so since she and cofounder Matt Clifford launched EF, the accelerator has paired nearly 500 startup founding teams through its unique Love Island-crossed-with-Y Combinator programme format.

Founders don’t even need to have an idea to apply to EF, spending the first three months of the programme trying to find a cofounder and developing a startup proposition. Select newly formed founder teams then receive pre-seed funding, head to SF for the second half of the programme and get the chance to woo investors at a demo day.

It was one of two ideas that Bentinck and Clifford were experimenting with when they left cushy corporate jobs at consultancy McKinsey in 2011. The other was a dating app, Bentinck tells me, as we pour over the brunch menu at the Soho House-owned restaurant.

“We didn’t really think EF was going to work, so alongside it we had this idea of a dating app that would connect you to your friend’s friends — which was partly what Tinder did,” Bentinck says with a chuckle.

The pair didn’t get beyond a couple of prototypes for the app, before EF “began to get very busy” and they ditched it to focus on building relationships of a different kind.

That decision has paid off so far. EF says startups that’ve come from its cohorts are now worth a collective $13bn and have been backed by the biggest names in VC including A16z and Sequoia.

The company has garnered its own share of investor interest, picking up $450m from the likes of DeepMind’s Demis Hassabis and Mustafa Suleyman, Stripe’s Patrick and John Collison, Monzo’s Tom Blomfield and Wise’s Taavet Hinrikus.

Shift to the US

The waiter arrives and Bentinck goes for the scrambled eggs and salmon. Eggs florentine for me. With food ordered, I’m keen to get Bentinck’s thoughts on SF — a startup city with an intense working culture that divides opinion in Europe.

“It is very intense,” says Bentinck after a pause, when I ask whether she has liked the lifestyle out there. “Everything’s work. In some ways it’s great fun, because I’m new in town and people are very open to meeting. Everything is networking. A kid’s birthday party is networking.”

It’s far from Bentinck’s first visit to SF — she says she’s bounced back and forth from the city around three months a year for the past four — but an extended stay is different, she tells me.

“Once you really embed, you only then realise how deeply interconnected every part of it is, every founder, every investor, every angel investor, every operator,” Bentinck says, with an enthusiasm that rarely dims throughout our hour-long brunch. “The depth of connections is what makes it special.”

EF is now in its second period of expansion, following a period of international growth between 2016-20, when the accelerator launched programmes in Singapore, Berlin, Hong Kong, Paris, Bangalore and Toronto. Some of those didn’t work out.

“We failed to globally expand in the fragmented way we attempted,” Bentinck tells me. “That was pretty painful. We grew very fast, we got decent returns, but ultimately our returns in London were way better.”

Cohorts in Singapore, Berlin, Hong Kong and Toronto are closed today and the company is now looking west. “Our new strategy is building companies in Europe and India, and incorporating them in the US,” she tells me. “We are trying to build a bridge between here and the US.”

Cohorts in London, Paris and Bangalore spend the first 12 weeks of the programme in home cities, before selected founder teams head to SF for the final 12 weeks (there’s also a cohort based in SF from the get go). Those teams can raise up to $250k from EF and an investment partner for a chunk of equity.

The company took its first batch out to SF in early 2024 “as an experiment” before making the switch a permanent feature. All the startups founded out of EF are heavily encouraged to incorporate in the US.

Founders taking part in EF — who Bentinck calls “customers” — were hugely keen to get access to the US market, where they saw greater opportunities to sell and raise VC cash than in Europe, she tells me.

I believe great things will happen to the UK if we build fantastically successful British founders.

“The thing we really noticed was how much faster it was for companies to get customers,” Bentinck says. “American customers move so fast that startups were able to get contracts and design partners within weeks, not months.” Funding is also far more readily available, she adds.

The accelerator itself has no plans to shift its own headquarters Stateside. All of the company’s fund operations are-UK based, as are the majority of its employees and the London cohort produces 40% of EF’s startups each year.

“The UK is a great place to run a business from a corporate structure and business environment perspective, it’s a very easy place,” Bentinck says.

But not a great place to scale a business? I ask. “I don’t think that’s true as there’s a bunch of great examples of businesses that have scaled in the UK,” she responds, before quickly adding: “I take your point that we’re now encouraging our companies to go to the US to scale there.”

More thought should be given to alternative ways to scale companies outside of home markets in Europe, Bentinck says. And there’s another big advantage to European-founded startups HQ’ing in the US but keeping some presence at home — access to affordable high-quality engineering talent.

“The European talent market, European universities are some of the best in the world. We just need to think about different models and how we can make the most of both markets.”

Criticism

There has been pushback from some investors and founders in Europe, who argue encouraging the region’s brightest and best to set up companies across the Atlantic has a detrimental effect on local startup scenes.

“I think there’s a bunch of people who would prefer if the companies didn’t move to the US,” says Bentinck. “I’m European, I’m British, and I want the ecosystem here to do really well.”

But her job as a founder is to try to make EF as valuable as possible, she tells me. “I think EF can be one of the most valuable companies in Europe, and I believe the strategy shift will give us a better path to getting there.”

When I ask what criticism Bentinck has heard about the model, she tells me some have said it “reduces the supply of high quality companies that are available to be funded from Europe” — before quickly adding the company hasn’t had that much flak.

EF’s reputation within the European ecosystem is overwhelmingly positive, but the few critical voices do seem to have played on Bentinck’s mind.

“There is a lot of nationalism in VC and startups, and I don’t think that is always helpful. We shouldn’t be trying to build British startups for Britain. We should be trying to get great British founders to build companies for the world.”

Getting political

Our eggs arrive and I move the conversation onto what’s holding the UK tech sector back. Bentinck pauses for a while before laying out what the UK does well (it’s very easy to found a company, for one) with characteristic optimism.

That’s not quite the question I asked, but Bentinck gets back on topic. “To get political, I think Brexit was a really bad idea,” she says, adding that the UK’s vote to leave the EU has damaged the country’s access to top talent.

“We definitely saw post-Brexit a change in the way that talent was thinking about coming to the UK.” The knock-on effects of Brexit are beginning to play out now, Bentinck says. “Is there a sufficient supply of new great international talent coming through? If I was the government, I would be very paranoid about that.”

Bentinck dodges the question when I ask about how she thinks the current UK government is doing. “I’m out of the loop on this”, she says, having been based in the US for the past year.

Politics is back of mind among many in the startup community, Bentinck tells me. I find this surprising, given the weight of Big Tech founder and VC support thrown behind president Donald Trump. “The startup world and VC world are very split,” she says.

“Friends in the UK will say to me ‘What are people talking about?’ But it’s not something that comes up a huge amount.”

Changing European tech

Much has changed since EF launched over a decade ago. Startup funding in Europe has nearly quadrupled, most of the major US VCs have opened offices on the continent and there is a growing pipeline of second generation founders launching new projects and angel investing.

There’s also lots more people wanting to be founders, says Bentinck. “The idea that being a founder is an aspirational, ambitious career path feels like it’s really landed.”

EF has played a significant role in this — and Bentinck says bringing people into the startup sector that would otherwise have found jobs in more traditional industries is the thing she’s most proud of professionally.

The conversation shifts back to tech nationalism, and I get the feeling that it’s a sore spot for Bentinck. “The challenge of being a founder [in the UK] is that you are trying to do something that is really difficult and has a very low chance of success, while also feeling responsible for building an ecosystem.”

European tech shouldn’t be trying to compete with the US, but acknowledging how far ahead it is (50 years, according to Bentinck) and tapping into that success, she says.

Her logic is that if homegrown founders up sticks to the place they can achieve the most scale, they’ll come back to the UK to expand internationally or to build their next team as a second time founder.

“I believe great things will happen to the UK if we build fantastically successful British founders,” Bentinck says. “And that’s British founders, not British companies.”

Could that have a negative impact on European tech, I ask? “Ultimately, you have to remember being a founder is so hard, the likelihood of success is so slim, and we have to do everything we can to support British and European founders.” That means releasing them from the obligation of building an ecosystem — alongside building a business, she adds.

“Like, we’ve done a huge amount to build the ecosystem,” Bentinck says, sounding slightly defensive and pointing to Code First Girls, a social enterprise that offers free coding and data skills training to women and non-binary people, which spun out of EF in 2014.

‘Pretty obsessive’

Things have changed for Bentinck too in recent times. She became CEO at EF towards the end of 2023 after Clifford stepped down to focus on his work with the UK government.

While Clifford previously focused on fundraising, Bentinck was predominantly preoccupied with product and “growing” EF. “It was a shift at the beginning, and Matt and I still work incredibly closely together and have an amazing cofounder relationship,” she says.

The time zone difference to London has meant that as Clifford’s going to bed, Bentinck is “frantically sending him a million messages”, she says, grinning.

The EF founder seems to be genuinely enjoying her new role at the company, and it’s hard not to get caught up in the positive narrative when listening to her wax lyrical about why she does what she does.

“I’m pretty obsessive about what we do, I love it honestly,” Bentinck says with characteristic enthusiasm. “Our business is a people business, we have people and they help other people to achieve crazy things. And I think that’s the bit that I can’t and won’t ever get bored of, which is that founders are the most quixotic and interesting and challenging people to work with.”

As we approach the end of our hour together, I wonder what the future looks like for Bentinck. Will she still be at the helm of EF in decades to come — will this be her life’s work? The answer is, perhaps unsurprisingly, yes.

“If I wasn’t doing this, I’d be investing in people anyway, and it’s much more fun to do it with a team with all the infrastructure that EF has in the brand,” she says. “I can’t think of anything else I would rather do.”

Read the orginal article: https://sifted.eu/articles/alice-bentinck-brunch/