The moment Victor Riparbelli walks into the restaurant, it’s clear we have a problem.

Crammed between neighbouring punters at the back of Mortimer House Kitchen, an Italian eatery in London’s West End, I’d been wondering how well our sleek but small round table would accommodate the Danish businessman, who — at a lofty 6’3” — is tall even by Scandinavian standards.

I spot the CEO of Synthesia, one of Britain’s most valuable generative AI startups, and wave for him to join me at my tiny table. Sporting a fitted black t-shirt and silver chain, he strides across the restaurant, flashing a boyish grin of pearl white teeth.

We shake hands but, before we’re done introducing ourselves, he’s flagging down a waiter and asking with some urgency that we be allowed to sit elsewhere. He rolls his eyes with mock embarrassment: “I fucked up my back.”

In full-swing at a party two years earlier, Riparbelli explains how a misjudged attempt at amateur acrobatics left him with lasting back pain. “I picked my girlfriend up to try and, like, spin her around,” he says, raising his hands above his head before imitating the crunch of a branch snapping. “I don’t go to the doctor much. I’m one of those ‘It’ll be all right’ kinda people.”

Far from all right, the weekslong episodes of agony that followed would leave Riparbelli feeling desperate. He recalls his pleas to one doctor: “I want you to open up my back and rip out my […] I don’t fucking care. Just do whatever you need to do. I’m not afraid of surgery. Just fix it.”

In the end, Riparbelli’s spinal problems turned out to be more bacterial than backbreaking. His physician prescribed a course of antibiotics, a surprisingly common cure for chronic back pain, which has come close to solving the problem.

“I spent every waking hour with this for years, always being conscious of my back because it was so painful, and then some antibiotics…” he says, shaking his head. His hard-won new mantra? “Just go to the doctor.”

‘Hyperscale mode’

Party antics aside, Riparbelli has plenty to celebrate.

Since launching eight years ago, Synthesia has withstood the shifts and the shocks — strategic pivots, mercurial funding cycles and a global pandemic — that led other much-hyped tech companies to collapse. With a price tag of more than $2bn, it’s among the crown jewels of London’s AI startups.

Over the course of our hour together, Riparbelli is upbeat and chatty, nimbly switching from his time spent studying at Stanford (he was impressed by the people there but found the course itself “super boring”) to complaints over the EU’s “stupid” AI regulations and his lifelong passion for electronic music.

“I always wanted to be a musician. I thought that was going to be my path.” He still produces tracks in his spare time but, when pressed, politely declines to share his DJ name. “That’s not one for publicity.”

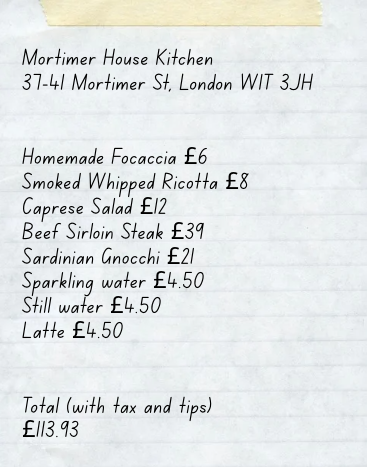

Turning to the menu, described as “inspired by summers on the Amalfi Coast”, Riparbelli encourages me to order the gnocchi, while he opts for the sirloin steak (“I’m trying to stay healthy.”)

Originally an AI dubbing tool, Synthesia started out by enabling users to reanimate actors’ lips with foreign languages. An anti-malaria ad campaign featuring David Beckham speaking French, Arabic, Hindi and more showcased the company’s early potential.

But Synthesia’s first few years “were kind of horrible,” Riparbelli admits. “The technology didn’t really work and everybody thought we were completely crazy.”

Upon realising the limitations of video-dubbing, the Synthesia team eventually pivoted to AI avatars for customer service. The product has proven lucrative, recently snagging Synthesia more than $1m of revenue in a single day.

“It’s super early but I believe we have found the first truly valuable use-case which can run at hyperscale mode.”

Face2Face

Riparbelli’s entrepreneurial streak emerged at an early age.

As online shopping boomed in the late 2000s, the tech-savvy teen made money by helping local businesses set up their online stores. “They thought getting on the internet would cost them thousands. But I could spend a few hours setting up their Shopify account, then charge them for it,” he tells me. “It was good money for a 17-year-old.”

This early success informed Riparbelli’s love of product. “I’ve never been a great coder but I’m very good at slapping stuff together […] I can make things work by duct-taping them together. That’s always been my strength.”

He enrolled on a joint honours degree in computer science and business at the IT University of Copenhagen, through which he got to spend a semester at Stanford University in California. Among the most prolific incubators of tech talent, former students have gone on to launch era-defining companies like Google, Linkedin, Netflix and WhatsApp.

“It’s a crazy experience where you’re surrounded by people with lots of drive and ambition,” he says, before painting a less-than-flattering portrait of his home country. “Denmark is a great place but it’s got very little drive or ambition. Everyone’s kind of coasting along.”

I could have moved my company to the US so many times. We want to keep it [in Europe] but they’re not making it easy.

Aiming to build his own company, Riparbelli decided not to pursue a Big Tech job, instead moving to London, where he initially worked as a consultant in virtual reality (VR).

There he met one of his Synthesia cofounders Matthias Niessner, who had recently published a paper called ‘Face2Face’, which demonstrated how AI could be used to manipulate video footage. Riparbelli was enthralled.

“I just fell in love with it. I felt like it was gonna change everything we know about video.” Niessner has retained an advisory role at Synthesia and recently launched a venture of his own, 3D-modelling startup Spaitial, in which Riparbelli is an angel investor.

Building on Niessner’s research, the pair teamed up with two other cofounders — computer scientist Lourdes Agapito and business pro Steffen Tjerrild — to launch Synthesia in 2017.

“There were a lot of super-hard decisions but I think we got most of them right,” says Riparbelli, tucking into his steak with a side of caprese salad.

Amid the twists and turns of the wider ecosystem in recent years, Synthesia has always sought to prioritise utility over novelty, he says. “People start dreaming. ‘What if we put this in VR?’ or ‘Can we connect this to a crypto card that links to your ID?’

“A lot of our competitors have been chased into doing things that are very interesting […] but the technology just isn’t mature enough yet.”

Red tape

Compared to the US, Europe is often seen as sceptical, if not actively hostile, when dealing with fast-growing companies. To Riparbelli’s mind, the relative infancy of Europe’s tech ecosystem means lawmakers should leave well enough alone.

“We shit on our tech companies every time there’s the slightest thing wrong. This constant negativity, that’s what’s holding Europe back more than anything.”

But he acknowledges some upsides to European pessimism. “We don’t have the same veil of bullshit surrounding us […] In Silicon Valley, you can keep the illusion alive way longer. You can convince investors to keep pumping money in on the promise it’ll work someday.”

Asked about the EU’s ongoing attempts to regulate AI, Riparbelli is incredulous. “I’m not a Brexiteer, but if we look back in 10 or 15 years, it might turn out to have saved the UK economy because they would not be following all these stupid regulations.”

In June, Riparbelli was among dozens of European tech leaders to sign an open letter calling on the EU to pause the rollout of its AI Act. Brussels refused, with questions over exactly how the law is going to be enforced still murky.

He says: “I love Europe and I want Europe to succeed. I could have moved my company to the US so many times. We’ve kept it here, and we want to keep it here but man, they’re not making it easy.”

Recalling a meeting in Brussels with a member of the European Parliament (he doesn’t name names), Riparbelli describes how the lawmaker, an older gentleman, arrived for a meeting to discuss AI regulation carrying a briefcase, a stack of papers (“physical papers!”) and no laptop.

“You know when your grandparents call you for tech support with their phone or whatever? Honestly, that’s a joy compared to the conversation I had with this guy,” he says, dumbfounded. “I’m completely fine with people wanting to regulate — but I cannot respect your opinion if you don’t know what you’re talking about.”

As far as an exit strategy goes, Riparbelli says an IPO isn’t on the cards anytime soon but isn’t shy about the problems facing the UK, calling it “very, very unattractive” to float on the London Stock Exchange.

In recent years the LSE has faced a dearth of successful IPOs, with Deliveroo’s 2021 float described by some as the worst in the group’s history, while fintech Wise recently chose to switch its primary listing from the UK to the US, citing the larger pool of investors and trading liquidity.

Admitting it’s not his “area of expertise”, Riparbelli cites the liquidity problem and the lack of pension fund money invested in the ecosystem. “It’s a lot of structural things.”

The UK and Europe may need to step up their game if they want a chance at keeping these fast-growing companies on home turf. “What we really, really, really, really need is one runaway success […] There’s a crop of companies now competing to be the global number one, not just the European number one.”

And does Riparbelli plan to take Synthesia all the way? “What will happen will happen. If I’m the right person to be at the helm of it then I’m happy to do it. if I’m not the right person then, at some point, I’m happy to pass the reins.”

Meal completed, we stand to leave the restaurant in good time (Riparbelli is seeing a specialist to assist with his back pain this afternoon). But before we go, I have to ask one more time: What’s your DJ name?

“It’s just ‘Riparbelli’” he says, shaking his head again as I turn to leave and assuring me: “You can’t find much online!”

Read the orginal article: https://sifted.eu/articles/synthesia-ceo-victor-riparbelli-interview-brunch/