Revolut is Europe’s most valuable fintech, having raised more than $1.7bn in funding from big-name investors like Balderton Capital, Molten Ventures, Index and Ribbit.

Last summer the fintech was crowned with a $45bn valuation following a secondary share sale which saw employees and longtime investors flog equity to investors such as Tiger Global, Coatue, D1 Capital and Mubadala.

Founded in 2014 by former Credit Suisse employees Nik Storonsky and Vlad Yatsenko, Revolut started life as a travel finance app, before branching out into product verticals such as crypto trading, telecoms and even pet insurance. Earlier this year, the financial superapp reported profitability for the second year in a row, bolstering its position as Europe’s top fintech.

But while CEO Storonsky may be the face of the company, he didn’t build Revolut alone.

Speaking to company insiders and using company information, Sifted has identified the executives who exert influence over the business, which now employs more than 10k staff.

The list includes those who run key segments in the finance function, legal and marketing as well as some of Revolut’s biggest revenue makers such as subscriptions, crypto and business banking.

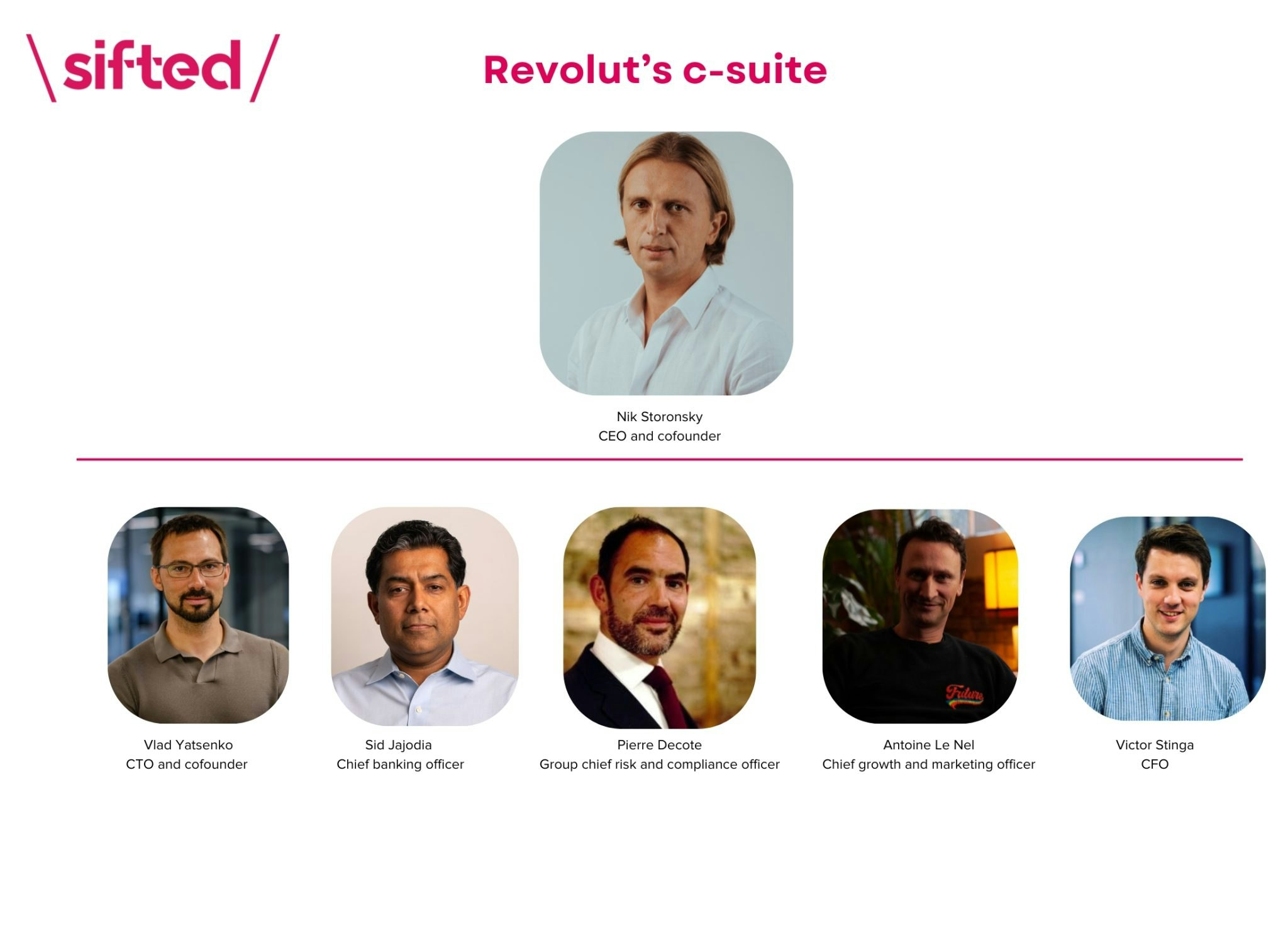

The c-suite

Nik Storonsky — chief executive officer and cofounder

Nik Storonsky is Revolut’s founder and chief executive officer. A former trader at Credit Suisse and Lehman Brothers, Storonsky is known to be a tough but fair boss who’s laser-focused on execution above all else.

In recent months, Storonsky has sought to exert more control over Revolut. In April, he increased his ownership stake by acquiring an “indirect, non-voting interest” as part of a reorganisation of its ownership structure. Storonsky now owns, directly or indirectly, more than 25% of Revolut’s issued share capital.

Vlad Yatsenko — chief technology officer and cofounder

Vlad Yatsenko is Revolut’s cofounder and chief technology officer. Known internally for his engineering knowhow, former employees credit his expertise for the technology behind Revolut.

“He’s really into the details,” a former employee tells Sifted.

Yatsenko is said to be more focused on employee development over hard-and-fast execution. Several former employees describe Yatsenko as a “nice guy” and someone who “really cares” about the people working at Revolut.

And while he’s said to be less ruthless than Storonsky, Yatsenko is still as diligent as his cofounder. One former employee describes an instance where they received feedback on a project they were working on at 5pm on a Saturday.

Sid Jajodia —chief banking officer

Siddartha Jajodia is Revolut’s chief banking officer and joined the company four years ago. According to his LinkedIn, Jajodia leads the development and rollout of the company’s banking capabilities globally. He’s also Revolut’s regional CEO for the US, a country which the fintech has yet to crack; the vast majority of Revolut’s revenue comes from its Europe and UK activities.

Pierre Decote — chief risk and compliance officer

Pierre Decote is Revolut’s chief risk and compliance officer and joined the company five years ago. He previously held positions at student loan fintech Prodigy Finance and fellow neobank Tandem Bank.

As part of his role at the company, Decote is in charge of developing risk and compliance frameworks in line with the size and complexity of an ever-growing business such as Revolut.

Antoine Le Nel — chief growth and marketing officer

Chief growth and marketing officer Antoine Le Nel joined Revolut four years ago, making him one of the newer additions on Sifted’s list. Formerly global head of growth at King, a gaming company most known for mobile games such as Candy Crush, Le Nel is responsible for user acquisition and growth at Revolut.

Le Nel has presided over Revolut at a time of rapid user growth — the fintech currently has over 50m users globally. He’s also been the public face behind some of its more high-profile marketing pushes, such as its Revolutionaries event in November, which featured panels hosted by sports pundit Alex Scott, a pitch session with Storonsky and Dragons Den’s Steven Bartlett, as well as a performance from popstar Charli xcx.

Victor Stinga — chief financial officer

Victor Stinga is Revolut’s chief financial officer and joined Revolut more than seven years ago as part of Storonsky’s CEO office — a role the company calls “founder associates” internally and one that is seen as a springboard to success in the company.

Sifted understands he helped lead Revolut’s 2021 $800m Series E and likely also took a leading role during last year’s secondary funding round.

He’s also said to be one of key figures behind rectifying Revolut’s previous accountancy troubles. Auditor BDO previously flagged Revolut’s 2021 figures with a rare “qualified opinion”, which warned it was unable to verify the bulk of Revolut’s revenues at the time. That had the knock-on effect of delaying the fintech’s 2022 accounts by three months.

In between the filings, the company’s CFO at the time, Mikko Salovaara, quit; Victor Stinga took on the role of interim CFO before stepping into the role full-time.

Revolut’s other power players

Aleksej Polukarov — general manager, credit

Aleksej Polukarov joined Revolut in 2017 as a data scientist before moving into the role of general manager of Revolut’s credit products in 2019. Revolut’s credit products are yet to constitute a substantial portion of its revenue as of yet — but it’s an area the fintech is pushing into with mortgages and credit card launches on the horizon.

Alex Dolgopolov — chief of staff

Alex Dolgopolov is Revolut’s chief of staff and reports directly to Storonsky. A former investment banker at JPMorgan, Dolgopolov joined Revolut six years ago as a founder associate like Stinga, before rising to the role of chief of staff in 2022.

Anshuman Bajoria, general manager, revenue

Anshuman Bajoria joined Revolut close to six years ago from Uber where he worked on strategy and planning. He started off his tenure at Revolut as operations lead before going into the role of general manager, revenue.

Christos Chelmis — general manager, payments

Christos Chelmis joined Revolut eight years ago as operations manager and has held a number of roles before moving into managing card payments in 2021. Chelmis was previously an investment manager at a family office in Athens. Prior to that, he was an analyst at JPMorgan.

David Tirado, VP Global Business Development

A former executive at Vodafone, David Tirado joined Revolut five years ago. According to his LinkedIn, he reports directly to the CEO and leads 15 commercial and business development teams.

Diomidis Papas — head of engineering (mobile platforms)

Diomidis Papas is Revolut’s head of engineering (mobile platforms) and joined the company more than seven years ago. Previously, he’s held engineering roles at food delivery company Deliveroo and taxi app Hailo.

Donato Lucia, head of technology

Donato Lucia is Revolut’s head of technology and joined the company seven years ago as a senior software engineer. Lucia has previously held roles at travel company Lastminute.com and American multinational tech company IBM.

Emil Urmanshin – director, crypto and new bets

Emil Urmanshin joined Revolut in 2019 as part of the CEO office. His role now sees him oversee Revolut’s crypto division, which in the past was a key piece in Revolut’s route to profitability.

In Revolut’s most recent set of financial results, the company wrote: “Wealth revenues grew 298% YoY, driven by increased crypto trading activity as observed throughout the industry and the launch of the Revolut X crypto exchange.”

Urmanshin’s also a key player in shifting Revout’s crypto services to serve institutional clients. Last month, Sifted reported the fintech was recruiting for a number of roles – including a general manager to build out a crypto derivatives product.

Hadi Nasrallah — general manager, telco and retail director

Hadi Nasrallah joined Revolut five years ago as senior strategic partnerships manager before heading into the role of general manger of Revolut’s telco and retail offerings. He’s also one of the masterminds behind the fintech’s loyalty programme RevPoints, which it launched in July last year, and its eSim product.

Revolut is in the early stages of building a set of points-based credit cards for its subscription tiers in a bid to rival dominant players such as American Express, according to a Sifted report in April.

Ivan Vazhnov, head of engineering

Ivan Vazhnov joined Revolut over eight years ago as a mobile engineer before landing the role of head of software engineering in 2022. He’s previously held the role of team lead (mobile) at enterprise software company CMW Lab.

James Gibson — general manager, Revolut Business

James Gibson joined Revolut seven years ago from the consultancy firm Oliver Wyman as a business development manager. Gibson become general manager of Revolut’s business banking arm. Revolut Business provides banking services including business debit cards, multi-currency accounts and invoicing aimed at freelancers and companies with fewer than 10 employees.

It currently accounts for 15% of Revolut’s total revenue, per its latest annual report. Revolut is making a bid to bank larger companies as of late, securing Irish airline Aer Lingus and fitness company Barry’s Bootcamp as clients.

Matt Acton Davis, VP Sales

Matthew Acton Davis joined Revolut five years ago as head of business growth before rising to the role of global head of sales in 2022.

Pavel Iukhnevich, head of engineering (wealth and trading)

Pavel Iukhnevich has worked at Revolut for more than eight years. Iukhnevich joined as a software engineer before moving into his current role as head of engineering (wealth and trading) in 2022.

Robin Stones — general manager, global entity operations

Robin Stones joined Revolut five years ago after working at hedge fund Marshall Wace and British bank Barclays. Stones joined Revolut in 2019 as head of internal assurance but now holds the position of general manager, global entity operations and is based in Singapore.

Tom Hambrett — group general counsel

Tom Hambrett is Revolut’s chief legal officer. A former solicitor at Herbert Smith Freehills, Hambrett joined Revolut eight years ago as senior counsel before stepping into the role of chief legal officer in 2021.

Described as Storonsky’s “left hand man”, Hambrett likely had to flex his legal muscles during the fintech’s pursuit of banking licences in the UK and Europe.

Tara Massoudi — general manager, premium products

Tara Massoudi joined Revolut as an executive associate more than five years ago before landing the role of director and general manager of Revolut’s premium products, particularly subscriptions.

Revolut’s tiered paid plans are a key moneymaker for the company, bringing in £423m in 2024 — a 74% increase year-on-year.

The international power players

Revolut operates in more than 30 countries and has built up an army of executives to lead its international efforts. For ease, Sifted has listed all of them below:

Europe

Joe Heneghan — CEO Revolut Europe

Francesca Carlesi — CEO UK

Beatrice Dumurgier — CEO Western Europe

APAC

Matt Baxby — CEO Australia and New Zeland

Paroma Chatterjee — CEO India

Raymond Ng — CEO South East Asia

Yoko Makiguchi — CEO Japan

LatAm

Glauber Mota — CEO Brazil

Juan Miguel Guerra — CEO Mexico

Agustin Danza — CEO Argentina

MENA

Ambareen Musa — CEO UAE

Read the orginal article: https://sifted.eu/articles/revolut-power-players-2025/