NTT aims to establish and list a new data center real estate investment trust on the Singapore Stock Exchange, to be seeded with six NTT-owned data centers.

In its latest earnings release for the financial year ending March 2025 published this week, NTT said it aims to transfer six NTT Limited-owned data centers to a proposed Singapore real estate investment trust NTT DC REIT. The facilities will be sold for approximately 240.7 billion yen ($1.573bn).

REITs are companies that own, and often operate, income-producing real estate such as apartments, retail outlets, offices, and data centers. They act as a fund for investors, generating revenue via leasing space and collecting rent on their properties. Data center REITs are investment trusts where all or the majority of the trust’s revenues come from leasing data centers.

“By incorporating data center assets into a real estate investment trust (REIT) scheduled for FY2025, we aim to achieve sustainable growth by securing further growth opportunities while maintaining financial soundness,” the company said. “Through the formation and operation of this REIT, we aim to introduce a capital recycling model for data center assets, thereby promoting further growth in our data center business and maximizing corporate value. Our group plans to utilize this REIT as a scheme to accelerate the investment recovery cycle for data centers, generate additional investment funds, and maintain financial soundness.”

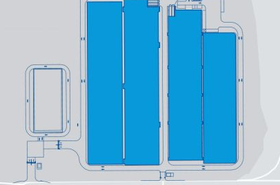

The facilities set to be transferred to the REIT include data centers in Ashburn, Virginia; Sacramento, California (x3); Vienna, Austria; and Singapore. The facilities total more than 41,000 sqm (441,320 sq ft) and around 80MW. Occupancy rates vary from around 90 percent up to 97 percent.

NTT aims to list the REIT on the Singapore Exchange, but will retain a share of the new company. The company added it could sell other NTT-owned data centers to the REIT in future.

Reports that NTT was considering establishing a REIT surfaced last year. Several major data center firms – including Equinix, Digital Realty, Iron Mountain – operate as REITs. Digital Realty also set up a listed data center REIT – known as Digital Core REIT – in Singapore seeded with a number of stabilized facilities from its portfolio.

For the year, NTT posted operating revenues of 13.704.7 billion yen (up 2.5 percent year-on-year), an operating profit of 1,649.6 billion yen (up 14.2 percent), and EBITDA of 3.239 billion yen.

In 2024, NTT said it opened new data centers at seven sites in eight buildings, bringing its

cumulative total to 163 sites in 216 buildings.

More in Colocation & Wholesale

Episode

Decarbonizing the Indian market

Read the orginal article: https://www.datacenterdynamics.com/en/news/ntt-to-launch-and-list-data-center-reit-in-singapore/