Owner-occupiers aged 60-plus now hold a record estimated £2.89 trillion of net housing wealth in homes worth a total of £2.95 trillion, according to the latest assessment of housing wealth from property firm Savills.

Owner-occupiers aged 60-plus now hold a record estimated £2.89 trillion of net housing wealth in homes worth a total of £2.95 trillion, according to the latest assessment of housing wealth from property firm Savills.

The UK’s largest tenure by value is those who own their homes outright, says Savills. These owners have increased their share of property value in the last decade due to above-average growth in the number of older homeowners joining the ranks of the mortgage-free.

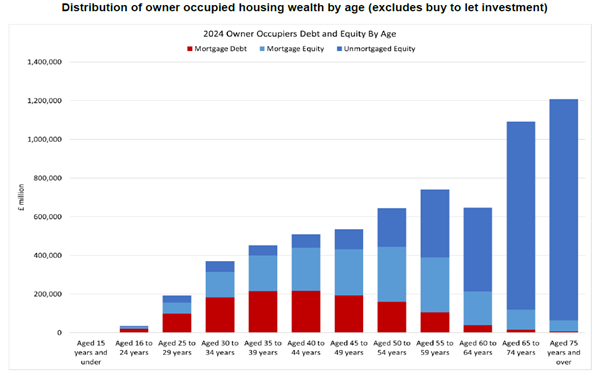

In total, owner occupiers over 60 control more than half (56%) of all owner-occupier housing wealth across the UK, while those over 75 control almost a quarter (23%). In comparison, under 35s hold just 6%.

However, the over-60s are not completely debt-free. They have a total of £60 billion mortgage borrowing still outstanding, but this is just 2% of the total value of their homes, Savills research reveals.

In stark contrast, the under-35s hold property with a total value of £600 billion, but have a total of £300 billion mortgage borrowing still outstanding.

Source: Savills Research

“Over the past 10 years, debt has become a less important component of the growth in the value of the nation’s housing stock, with increasingly more equity concentrated among older homeowners and investors.

“The baby boomers have continued to build wealth, having paid off their mortgage debt, and Generation X has been working hard to achieve the same goal. Meanwhile, Generations Y and Z have had much less opportunity to work their way up the housing ladder profitably.

“But despite many older homeowners holding on to properties that are now too big for their needs, there is little incentive for them to move during their lifetime. While boomers make up 44% of homeowners, they only made up 18.5% of homebuyers last year. Meaning that just one in 57 of them moved house.

“The provision of more retirement housing, along with other incentives to make downsizing more appealing are also fundamentally important. Such measures would help unlock much-needed family housing and equity that can be used to help younger generations get on and trade up the housing ladder.”

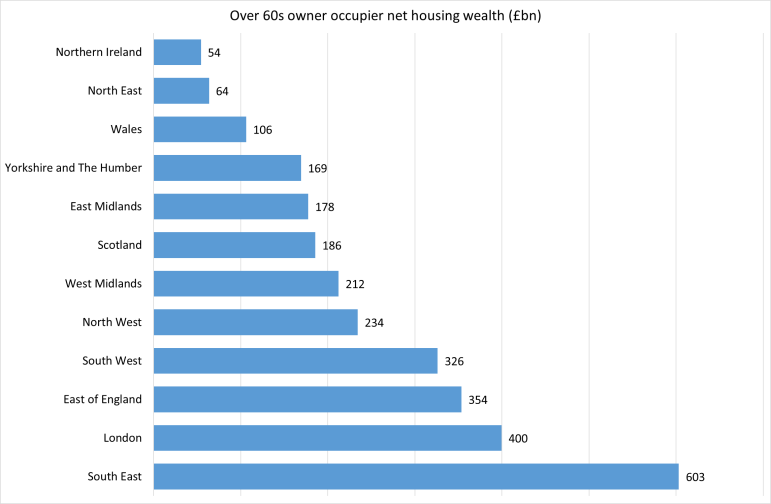

Older owner-occupiers’ wealth is greatest in the South East

On a regional basis, baby boomers make up the highest proportion of homeowners in the South West and Wales (49%), both popular with downsizers and retirees for a host of lifestyle reasons.

Comparatively, over 60s make up the lowest proportion of homeowners in London (38%).

However, owner-occupier wealth is highest by value in the South East. Here, over 60s hold £603 billion of housing wealth (21% of net housing wealth held by this age group). This is £203 billion more than in London and £171 more than across Wales and the South West combined.

Source: Savills Research

Read the orginal article: https://propertyindustryeye.com/housing-wealth-held-by-over-60s-edges-close-to-3trn/