Berlin-based startup Noxtua — formerly known as Xayn — has raised a €80.7m Series B round to develop what it says is Europe’s first “sovereign” legal AI tool.

Amid ongoing geopolitical instability, tech leaders are calling for Europe to reduce its dependency on foreign technology providers. Noxtua’s legal AI is powered by its own large language models (LLMs) trained exclusively on European legal data.

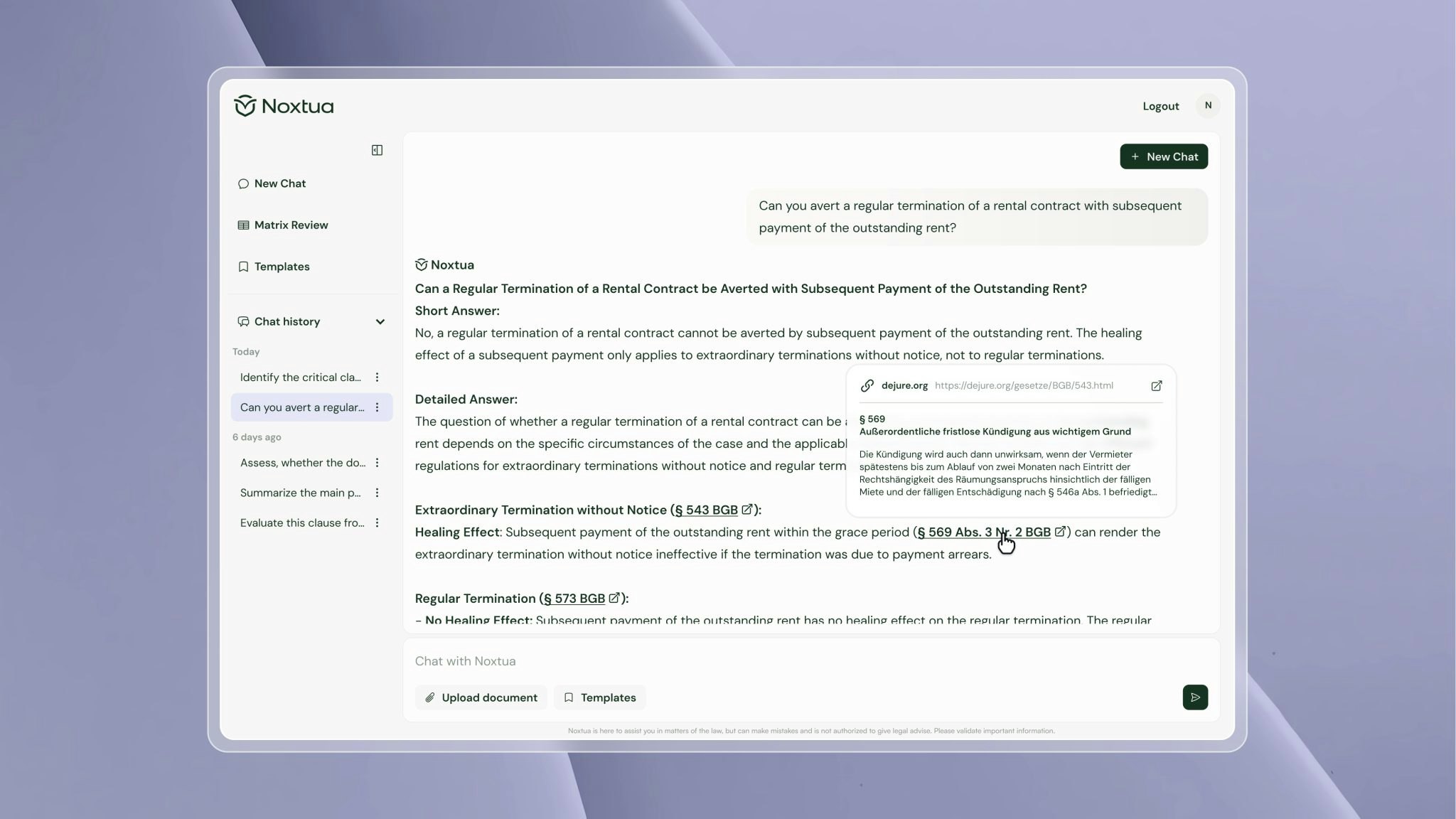

The tool helps lawyers research legal matters and analyse and draft documents, and is already in use by law firms such as Nordermann, the legal departments of companies such as Allianz and German savings bank Deka.

The Series B round was led by German legal publisher C.H.Beck, with participation from business law firm CMS, high-performance computing specialist Northern Data and global law firm Dentons.

The round brings the total capital raised by Noxtua to over €100m.

The startup was founded in 2017 based on research conducted by Dr Leif-Nissen Lundbæk and Professor Michael Huth at Oxford University and Imperial College London. Felix Hahmann is the company’s third cofounder who, prior to founding Noxtua, was an IT project manager at German automaker Daimler. He’s since left the company to found a solar startup, Aurum Solartech.

“The legal AI is not just a product, but a way to uphold European values such as privacy, transparency, and the rule of law through cutting-edge AI technology,” Lundbæk tells Sifted.

“The geopolitical situation has become highly volatile, with historical certainties being questioned. During these times, independence, sovereignty, and autonomy become ever more important, and whoever has a leading position in the global AI race has autonomy and power.”

Building a European AI

Noxtua trains its AI on datasets provided by legal experts such as CMS which co-initiated Noxtua’s AI tool. These datasets include documents such as court decisions from Germany and other EU countries, contract templates and interactions with contracts and lawyers.

As part of the Series B round, Noxtua will gain access to the online database of C.H.Beck which contains over 55m documents.

Lundbæk says Noxtua’s main competitor is US legal AI Harvey, but there are key differences between the companies — one being that Harvey’s models are based on OpenAI.

“Noxtua is from A to Z a European project with a strong focus on security and privacy,” he says, adding that the company hosts the AI and infrastructure on “true” EU cloud providers — “not American ones that are locally based in Europe.”

Noxtua also does not store documents long term, and all the data that comes into its possession is encrypted to protect sensitive client information, says Lundbæk.

The Berlin-based startup will use the fresh capital to roll out new products such as its new legal AI workspace based on a new model called Beck-Noxtua, and moving into new European markets.

Noxtua is in the process of transitioning its company structure to a Societas Europaea (SE), which allows companies to carry out business activities more easily across EU member states.

Read the orginal article: https://sifted.eu/articles/noxtua-sovereign-ai-series-b/