The UK’s competition regulator has launched an inquiry into satellite operator SES’ acquisition of rival operator Intelsat.

Announced last week, the Competition & Markets Authority’s (CMA) merger anti-trust inquiry process is designed to avoid “substantial lessening of competition” in British markets for goods or services through the monopolizing process of mergers.

The CMA will be inviting comments from any interested party until calls close on April 29. A decision on whether to proceed to a more intensive phase 2 investigation will be expected on June 12.

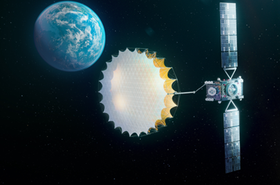

Betzdorf-based SES, founded as an initiative of the Luxembourg government, intends to acquire Intelsat for $3.1 billion in a deal announced last year.

“The combination will create a stronger multi-orbit operator with greater coverage, improved resiliency, expanded solutions, enhanced resources to profitably invest in innovation, and benefit from the collective talent, expertise, and track record of both companies,” SES said in a statement after announcing the merger in April last year.

The satellite fleet of the combined companies will include more than 100 geostationary Earth orbit satellites and 26 medium Earth orbit satellites, and spectrum rights spanning C, Ku, Ka, Military Ka, and X-band, as well as ultra-high frequency.

British regulatory barriers?

Given that UK start-up OneWeb merged with Eutelsat in 2023, and the same year saw Inmarsat and Viasat merge without incident, the anti-trust process being launched under a staunchly “pro-business” administration eager to demonstrate its loyalty to markets appears to be due process more so than a realistic threat to the merger.

A recent string of mergers between legacy satellite operators appears to be driven by the rapid rollout of big tech LEO services, demonstrated by the fast success of Starlink, expected to be compounded by the rollout of Kuiper. In such an environment, smaller operators appear to believe that they need scale in order to effectively compete with billionaire-backed rivals with more resources and deeper pockets to weather subsidized costs in the interest of absorbing market share through predatory pricing.

London and UK markets have sometimes been accused of being over-regulated, though usually by American entities used to lighter government oversight. The theory has often been cited to explain decreasing interest in the London Stock Exchange in favour of US listings, though given recent economic shocks coming out of Washington, this may stop being a truism in 2025, as market participants remember what regulation protects markets from.

Read the orginal article: https://www.datacenterdynamics.com/en/news/uk-competition-regular-launches-inquiry-into-ses-intelsat-merger/