Details about Microsoft’s reported pulling back on global data center projects have emerged.

As reported by Bloomberg, which cites “people familiar with the situation,” the cloud giant has halted or delayed talks for data center projects in Indonesia, the UK, and Australia, as well as Illinois, North Dakota, and Wisconsin in the US.

Reports that Microsoft has been slowing its data center deployment strategy have been rife in recent weeks. TD Cowen analysts first reported that the company had withdrawn from around 200MW of data center leasing agreements in February of this year.

A few weeks later, the brokerage expanded this to 2GW of data center projects across the US and Europe, though details about the exact projects were not shared.

The latest Bloomberg report suggests that this has now expanded to the APAC region as well.

In response to all reports, Microsoft has consistently stated: “Thanks to the significant investments we have made up to this point, we are well positioned to meet our current and increasing customer demand. Last year alone, we added more capacity than any prior year in history. While we may strategically pace or adjust our infrastructure in some areas, we will continue to grow strongly in all regions. This allows us to invest and allocate resources to growth areas for our future. Our plans to spend over $80bn on infrastructure this FY remains on track as we continue to grow at a record pace to meet customer demand.”

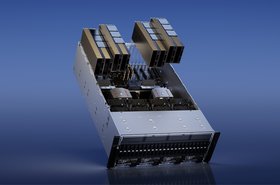

In the UK, Microsoft reportedly withdrew from negotiations to lease space between London and Cambridge at a data center Bloomberg said was “marketed for its ability to host advanced Nvidia chips.” The company was also reportedly negotiating with Ada Infrastructure to lease space at its 210MW data center in the London Docklands, but failed to commit to the project. Similar negotiations were canceled for a data center near Chicago in the US.

On the construction side, Microsoft is said to have paused work on a campus in Jakarta and an expansion of its Mount Pleasant data center complex in Wisconsin. According to Bloomberg, the first six months of construction at the Mount Pleasant site saw $262m in investment, $40m of which was used for concrete alone. DCD reported in January that some work on the site had come to a halt.

The company told Bloomberg that it remains “committed” to the Wisconsin site, which will come online next year, and that the Jakarta data center for its Indonesia Central cloud region remains on track to go live in Q2 of 2025.

Bloomberg did not share details about the reported roll back in Australia.

In March of this year, reports emerged that Microsoft had withdrawn some of its commitments to CoreWeave. Though CoreWeave denied this to DCD at the time, stating: “We pride ourselves in our client partnerships and there have been no contract cancellations or walking away from commitments. Any claim to the contrary is false and misleading,” the company’s CEO Michael Intrator later said that Microsoft had backed away from a proposal to increase its leasing capacity with CoreWeave.

According to Intrator, CoreWeave found an alternative buyer for the capacity and said that a pullback on data center spending is isolated to Microsoft. “It’s pretty localized, and their relationship with OpenAI has just changed,” Intrator said. “So it stands to reason that there would be some noise.”

Opinions surrounding the pullback on data center agreements have varied. The TD Cowen analysts who first drew attention to the issue wrote: “We continue to believe the lease cancellations and deferrals of capacity points to data center oversupply relative to its current demand forecast.”

The concern of oversupply was also voiced last month by Alibaba’s Joe Tsai, who particularly pointed to US hyperscalers with massive capex planned for AI data centers.

Tsai said: “I start to see the beginning of some kind of bubble.” He noted that there are projects beginning that haven’t yet secured uptake agreements. “I start to get worried when people are building data centers on spec. There are a number of people coming up, funds coming out, to raise billions or millions of capital.”

This perspective has not been universal, however, with Mizuho Securities analyst Jordan Klein arguing in February: “To me this all looks and sounds like business as usual. A company this large and with $80 billion of annual spend has the right to move in and out of data center leases, many of which were never officially signed.”

More in Construction & Site Selection

Read the orginal article: https://www.datacenterdynamics.com/en/news/microsoft-steps-back-from-data-center-developments-globally-report/