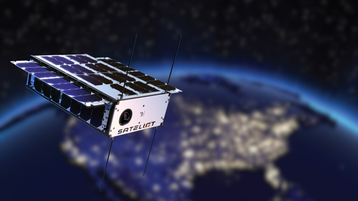

Barcelona-based Sateliot has closed a Series B funding round with €70 million ($77.3m) to fuel the deployment of a 100-satellite 5G-IoT constellation.

The funds will deliver connectivity to remote applications across defense, cybersecurity, telecommunications, logistics, mining, energy, environmental monitoring, agriculture, and critical infrastructure.

The company has secured €270 million ($298.3m) in contracts across 400 clients in 50 countries with an aim to see €1 billion ($1.1bn) of revenue by 2030.

Of the total, €10 million ($11.05m) came from Hyperion Fund in Madrid, a venture capital and private equity specialist seeking to reinforce Spanish high-tech industries. Another €13.8 million ($15.25m) comes from the Spanish Society for Technological Transformation (SETT), in addition to a €30 million ($33.15m) debt injection from the European Investment Bank (EIB), the first granted to Sateliot.

The company’s CEO Jaume Sanpera told DCD that confidence in the investments came from the evidence of real execution of satellite launches, signed contracts, a day-one revenue model, and announced strategic partnerships.

Sateliot flashback

The company is part of San Diego’s EvoNexus high-tech incubator program, with a Series A that raised $20.2 million in 2022, with $6.42 million coming from Banco Santander.

In 2024, Sanpera described the United States as Sateliot’s No. 1 market, with Brazil, Australia, Nigeria, South Africa, and Canada being listed as “important secondary markets”

Sanpera told us that the US and Brazil remain enormous opportunities, but Europe has quickly become more central to its roadmap thanks to increasing investment from EY programs, regulatory support, and a growing push for digital and defense sovereignty. He stated that European companies now represent around 15 percent of the company’s global future revenue.

Sateliot will enter its commercial launch phase in 2025 and, by 2026, will have 16 satellites in orbit. It then intends to enter more partnerships with global telecom operators and governments, and innovate through AI-optimized operations and advanced payloads.

European fortification

The investments are part of a wider trend across NATO states and the EU in which defense budgets and critical industries like aerospace are seeing rapid reprioritization following fears over the waning of the Atlantic Alliance. The EU has announced institutional funding of up to €800 billion, and national governments have committed to adding to bringing defense budgets up to 2 percent of GDP.

Sateliot’s role in this is its contribution to European sovereign telecommunications infrastructures.

“The European Investment Bank’s €30 million investment was the first ever in a European satellite communications company—proof that we’re not a bet, but a long-term pillar of European resilient infrastructure,” Sanpera said. “We’re giving Europe the infrastructure to connect where fiber and 4G/5G can’t reach—without relying on non-European systems like Starlink or Kuiper… With shifting alliances globally, sovereignty over secure communications is now non-negotiable.

Hyperion Fund was launched by asset manager Singular Asset Management and has raised €150 million ($165.7m) so far, and is exploring more than 200 NATO-aligned companies in artificial intelligence, robotics, geolocation, photonics, electromagnetics, and aeronautics. Its advisory committee includes former NATO Secretary General Anders Rasmussen, former US Under Secretary of State Paula Dobriansky, and former French Defence Minister Michèle Alliot-Marie.

Read the orginal article: https://www.datacenterdynamics.com/en/news/sateliot-secures-70-million-funding-round-from-national-and-european-backers/