Investors fell head over heels for AI companies last year — making up 14% of UK deals done last year, up from 9% in 2023.

And in a bid to woo those AI startups’ founders and get their name on the term sheet, investors have been agreeing to some much more founder-friendly conditions, according to a new report on UK VC term sheets from HSBC Innovation Banking.

It is based on 588 term sheets issued in 2024, sourced from 27 law firms.

The AI term sheets

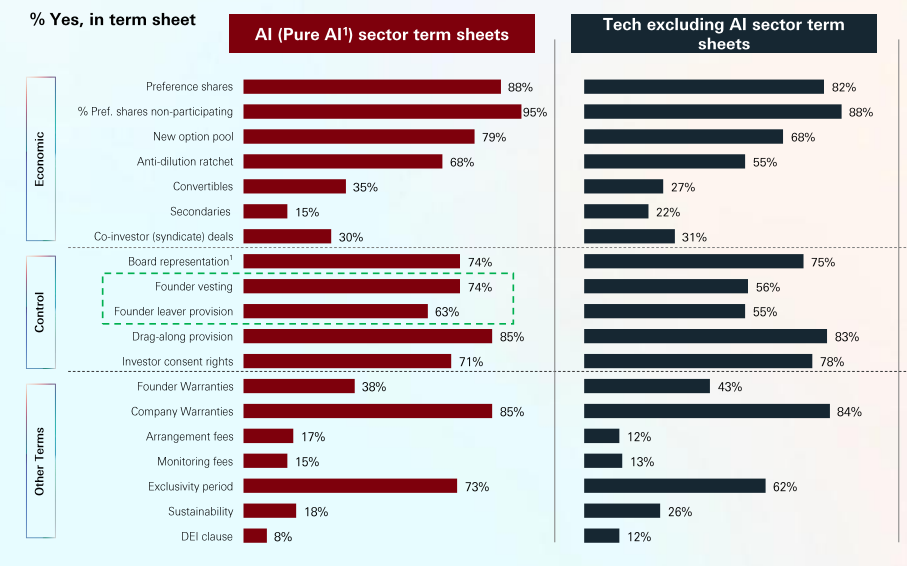

Non-participating preference shares are seen in 95% of AI term sheets — meaning investors may not necessarily have the right to retain their pro-rata share of ownership by participating in subsequent funding rounds.

In non-AI sector deals, non-participating preference shares are less common, appearing on 88% of term sheets.

Founder warranties, which make founders personally liable for their company’s performance, are less common, appearing on 38% of AI term sheets, compared to 43% of non AI-term sheets.

Founder vesting is, however, more common on AI term sheets (74%), compared with 56% of non-AI term sheets — as is a founder leaving provision (63% compared to 55%).

It’s no surprise investors are asking for founder vesting; it’s seen as a way of ensuring a founder remains committed to the company for the long-term. Founder leaving provisions, meanwhile, deal with what would happen if a founder left the company, and what would happen to their options and/or equity.

This is likely a result of the fact many AI deals are happening at the earlier stages, notes the report; at seed, founder vesting appears on 65% of all term sheets, compared to 43% at Series C. Founder leaving provisions appear on 59% of all seed stage term sheets, and just 25% at Series C+.

What else do the term sheets tell us?

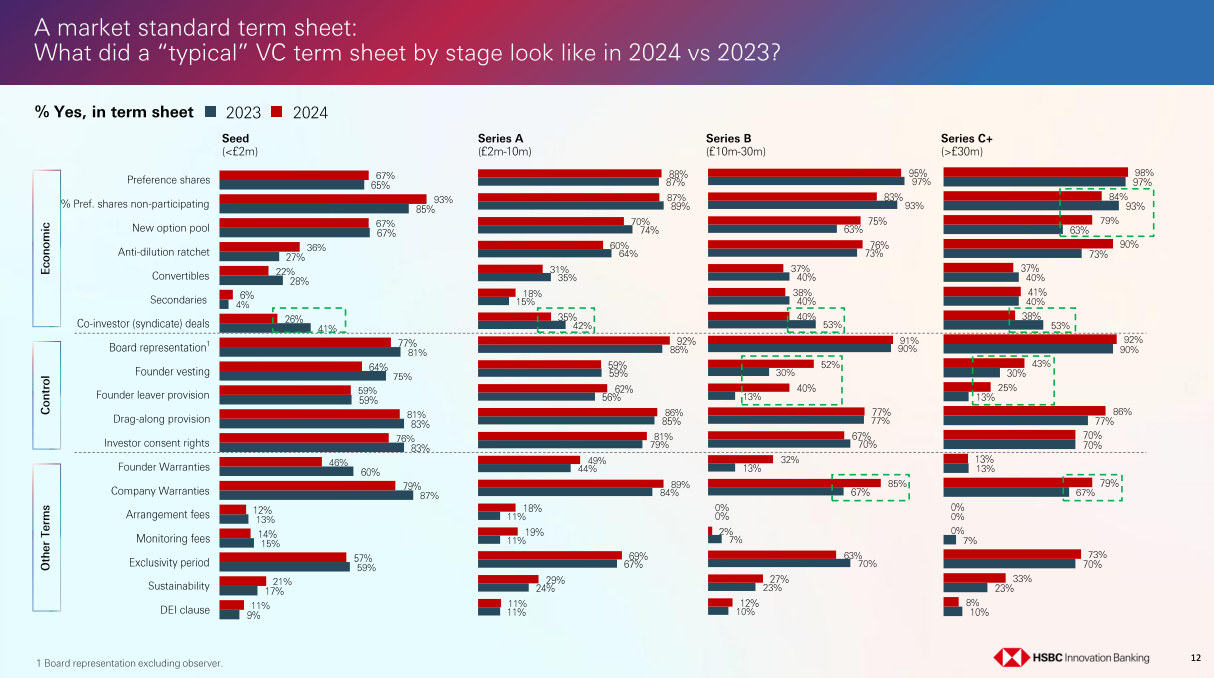

Deal syndication — when several investors come together — decreased to 33%, from 42% in 2024, as deals got more competitive and VCs felt the pressure to put their dry powder to use.

This change is marked across all stages, with syndicated deals down from 41% at seed in 2023 to 26% in 2024, and to 38% at Series C+, down from 53%.

At AI startups, and Series C+ scaleups, new option pools were common features of term sheets — appearing on 79% of AI and Series C+ term sheets, up from 63% of term sheets for companies at the same growth stage last year. It’s a sign that investors are keen to incentivise founders and employees to stick around with strong share options schemes.

Which sectors were hot?

AI dominated, but fintech also saw a small boost in 2024, accounting for 12% of deals, up from 10% the year before.

Cleantech and energy deals (8%), and healthtech deals (10%), dropped as a percentage of total deals done; each down by 2%.

Who leads the deal?

At the earliest stages, UK-based investors typically lead deals; 69% of those at seed, and 58% at Series A. There was also a small bump in interest from US investors at seed stage in 2024 — leading 9% of deals, up from 3% the year before.

At the later stages, however, UK companies were more likely to turn to international investors last year — with 80% of Series C and beyond deals being led by backers based outside of Britain. (That’s up from 51% in 2023.) 43% of Series C+ rounds last year were led by European investors; 27% by US investors.

Read the orginal article: https://sifted.eu/articles/vc-startup-term-sheets-uk-2024/