Carbon removal consortium Frontier – which includes Google and Meta – has signed a carbon removal agreement with Hafslund Celsio, Norway’s largest energy-from-waste (EFW) plant, located just outside Oslo.

According to the companies, the agreement will enable the construction of the “first-ever” retrofit of an EFW facility to deliver carbon removal.

As part of the offtake agreement, Frontier will pay Hadslund $31.6 million to facilitate the removal of 100,000 tons of CO2 between 2029 and 2030.

Exact timescales on the retrofit were not shared. DCD has reached out to Hafslund for further information.

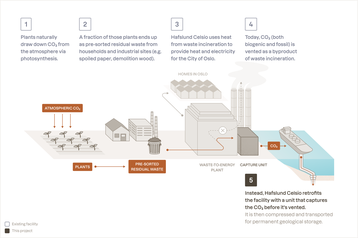

The Hafslund Celsio facility processes 350,000 tons of residual waste per year. The incineration process produces two forms of CO2 emissions, namely, biogenic CO2 from the burning of organic material and fossil CO2 from the burning of inorganic waste such as single-use plastics.

“Waste-to-energy retrofitted with carbon capture is a no-brainer solution for managing pre-sorted, residual waste: it generates carbon-free energy and removes CO2 from the atmosphere,” said Hannah Bebbington, head of deployment at Frontier. “Hafslund Celsio is set to become the first to do it, charting a path for the 500 waste-to-energy facilities across Europe to remove tens of millions of tons of CO2 from the atmosphere.”

The offtake agreement will facilitate the retrofit of the EFW plant with a carbon capture unit that according to the companies will capture both types of CO2.

Hafslund Celsio estimates that the project could capture up to 175,000 tons of biogenic CO2 emissions and 175,000 tons of fossil CO2 emissions per year from the facility,

After it is captured, the CO2 will be transported to the Northern Lights carbon storage facility for permanent storage in a reservoir 2,600 meters (8,530 ft) under the seabed in the North Sea. The first phase of the project is the transport and storage component of Longship, the Norwegian Government’s full-scale carbon capture and storage project. Longship is expected to begin operations in the summer of 2025.

Jannicke Gerner, director for CCS and carbon markets, Hafslund Celsio, spoke of the importance of the offtake agreement in facilitating the retrofit, stating: “Frontier buyers are not only enabling this project to get off the ground, but also validating a model that could be replicated throughout Europe, with the potential to remove tens of millions of tons of CO₂ from the atmosphere.”

As a result, the partners hope the retrofit could act as a powerful test case for the rollout of carbon capture units at EFW plants across Europe. According to Frontier, adding a unit to capture CO2 from EFW facilities has the potential to deliver 400 million tons of carbon removal per year by 2050, in addition to driving other decarbonization benefits.

In addition, it claims that due to the majority of the infrastructure already existing, retrofits can be delivered at an affordable cost and at scale. For example, in Europe, there are around 500 EFW facilities currently in operation that could be retrofitted.

Frontier founders Stripe, Google, Shopify, McKinsey Sustainability, and members Autodesk, H&M Group, JPMorganChase, Workday, and Salesforce purchased as part of this round of offtakes.

Frontier has executed several carbon removal offtake agreements in recent months. Last month, the consortium signed a $33 million in offtake agreements with enhanced rock weathering firm Eion.

As per the agreement, Frontier buyers will secure the removal of 78,707 tons of CO2 between 2027 and 2030.

More in Sustainability

Read the orginal article: https://www.datacenterdynamics.com/en/news/frontier-strikes-316m-energy-from-waste-carbon-removal-deal-with-hafslund-celsio-in-norway/