Vertice, a London-based startup that helps customers save money on their software and cloud computing bills, tops the second Sifted 100: UK & Ireland Leaderboard — an annual ranking of the 100 fastest-growing companies in the region, in partnership with Marriott Harrison.

In second place is London’s Robin AI, an AI-powered legal copilot that can draft, review, search and raise queries on contracts. Third is another London company, Switchee, which uses technology to prevent renters from living in cold, damp homes.

The leaderboard ranks 100 companies with the strongest revenue growth over the past three financial years, calculated using a two-year revenue compound annual growth rate (CAGR). Collectively, the 100 have generated revenues of £5.38bn over the last three years and currently employ over 19k people.

Founded by brothers Eldar and Roy Tuvey in 2021, Vertice boasts a 689% CAGR between 2022 and 2024. Vertice targets procurement and finance managers with tools that give alerts on “maverick spend” within companies and provide “real time” SaaS pricing benchmarks.

Robin AI, whose cofounder/CEO Richard Robinson has said he was partly inspired to become a lawyer following the bad experience of his uncle, who never received royalties for his number one hit, Pass the Dutchie, notches a 640% two-year CAGR (again, from 2022 to 2024).

Switchee records a 565% CAGR, due to a jump in revenue from £225k to £10m between 2022 and 2024. The team has had to dig deep after the loss of their cofounder, Ian Napier, who took his life in 2019. Writing about the loss at the time, Switchee’s other cofounder, Adam Fudakowski, said: “There is no silver lining, but it has galvanised us in the belief that the important work that Ian was doing must and will be continued.”

Nine unicorns, 40 fintechs

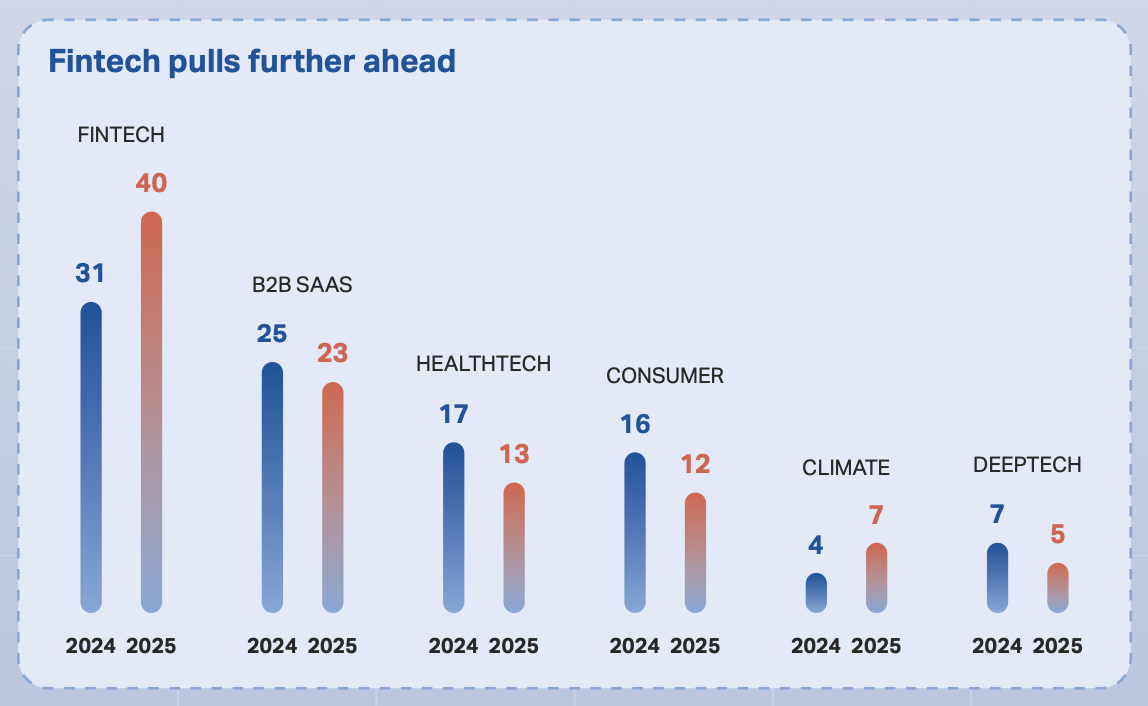

Fintech is, once again, the dominant industry on the ranking, represented here by 40 startups (up from 31 last year). Business-focused software startups are the second biggest category, with 24 places, one fewer than last year. Healthtech and consumer categories also saw drops (from 17 to 13, and 16 to 12, respectively).

The vast majority of the cohort (71) are based in London. Dublin is home to seven companies (+4 on 2024). Cambridge follows with three. It’s a near shutout up north: there’s just one startup from Manchester compared to two in 2024, one from Birmingham and two from Edinburgh.

This year’s ranking features 75 new startups. Of the 25 returning names, only two climb the list — Switchee (+40 places) and Cambridge biotech bit.bio (+71).

Nine unicorns feature, including Dublin security automation startup Tines (which hit a $1bn valuation in February), London period-tracking app Flo Health and Dublin small business lender Wayflyer. Others on a swift valuation ascent on the list include London AI company PolyAI and Allica Bank, the fintech that finished top of the same leaderboard last year.

LocalGlobe is the private investor that’s backed the most startups on the ranking, investing in seven companies — including fintechs Monzo, Wagestream and Cleo. Both Octopus Ventures and Balderton Capital each back six. The full investor ranking is available here.

16 companies have been part of a Tech Nation programme (compared to 32 last year) and 10 have received grant funding from government agency Innovate UK. Eight of the companies have raised capital on crowdfunding platform Crowdcube.

The most active angel investors for the top 100 are Monzo founder Tom Blomfield, Katana Capital founding partner Charlie Songhurst and Wise cofounder Taavet Hinrikus, each backing four companies.

The 10 fastest-growing startups in the UK and Ireland

- Vertice: helps companies save money on SaaS and cloud spend

- Robin AI: automates the process of drafting and negotiating contracts

- Switchee: puts intelligent thermostats into social housing to optimise energy and tackle fuel poverty

- Lindus Health: helps the clinical research industry run faster and more reliable clinical trials

- Monument Bank: a digital bank that offers core banking services tailored for affluent clients

- Magic AI: offers a fitness mirror powered by AI with intelligent personalised tracking

- Flagright: offers an AI-native AML compliance platform for fintechs and banks

- Healthtech-1: automates repetitive processes for healthcare systems

- Hived: a parcel delivery network offering sustainable delivery options in the UK

- Zelt: a HR tech platform offers services from onboarding and payroll, expenses to reviews and asset tracking

View the full leaderboard here.

How the 100 were chosen

To be eligible, companies had to meet the following criteria:

- Private and independent

- Headquartered in the UK or Ireland

- Majority of revenue must be generated by proprietary technology

- No older than 15 years old (founded in or after 2010)

- At least three years of revenue data, either between 2021-2023, 2022-2024 or 2023-25 depending on filing dates, across comparable accounting periods of at least 26 weeks

- Revenue (annualised if necessary) of at least €50k (or £42k) in the base year (2020, 2021 or 2022) and at least €500k (or £420k) in the latest financial year (2023, 2024 or 2025)

Sifted’s research team used their own proprietary data, along with information from Companies House and Dealroom to identify and contact relevant high-growth startups. Applications were accepted from January 1 to February 28, 2025.

Companies were required to submit relevant, signed documentation to support financial information disclosed to Sifted not publicly available at Companies House. Some companies chose to keep some of this information private.

Sifted Leaderboards do not claim to be exhaustive as private company data can be difficult to obtain. Leaderboards are based on historical financial data and do not guarantee future company performance.

Read the orginal article: https://sifted.eu/articles/spend-platform-vertice-tops-sifteds-second-uk-and-ireland-leaderboard/