Property investor Segro and Pure DC have formed a joint venture to build a 56MW data center in West London.

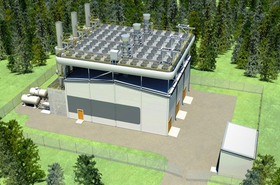

The JV, known as Segro Pure Premier Park Data Centre Limited, will develop a 30,000 sqm (322,915 sq ft) data center at Premier Park, an industrial site owned by Segro located on Premier Park Road in the Park Royal area of West London.

Segro will provide the land and carry out remedial work to prepare the site, which is currently home to a vacant warehouse, for development.

Pure DC has secured access to 70MVA of power from the grid, which will enable it to provide 56MW of IT capacity at the site.

The companies expect to lease the data center to a hyperscale tenant once completed. It will feature a closed-loop water system to minimize the impact on the local water supply. Planning permission has yet to be secured.

The project is Segro’s first step into full data center development, though the company has a long history and building and leasing powered shells to clients. It announced its intention to expand its data center business last month.

David Sleath, CEO of Segro, said: “Building on our 20 years of experience in the powered shell data center market, we have been exploring how best to utilize our skills and 2.3GW land-enabled power bank to maximize the opportunity in this fast-growing sector.

“This innovative joint venture with Pure DC allows us to develop our first fully fitted data center, alongside a highly experienced partner with an excellent track record of delivering world-class facilities to global hyperscalers.

“We expect this project to deliver an attractive risk-adjusted return and it will also help further strengthen SEGRO’s expertise in this area, enabling us to optimize and accelerate the significant value creation opportunity within our portfolio.”

Pure was established in 2015 and is backed by funds managed by Oaktree Capital Management. The London-based company currently has more than 500MW of IT capacity in operation or development in markets across Europe, North America, Asia, the Middle East, and Africa. It is currently expanding its campus in Brent Cross, London, to take its capacity to 90MW.

Dame Dawn Childs, CEO of Pure DC, said: “This joint venture demonstrates Pure DC’s ability to scale in a rapidly expanding market, creating fresh opportunities for growth and investment. With over 500MW of data capacity in development or operation, Pure DC brings deep expertise in building data centers and working alongside hyperscalers.”

News of the development has been welcomed by the UK government, which has been actively encouraging new data centers since taking office last year.

Technology secretary Peter Kyle said: “This announcement is another powerful endorsement of Britain as a home for tech investment, which will not only bolster the local economy and create job opportunities but also pave the way for a digital and AI-powered future.

“Private investment like this innovative partnership between Segro and Pure DC will help us ensure the UK has the digital infrastructure it needs to thrive, helping us harness the power of technology to grow the economy and raise living standards.”

Park Royal is close to Slough, the UK’s busiest data center market. Companies developing in the area include Vantage, which announced plans for a 20MW facility in Park Royal in 2023.

More in Construction & Site Selection

Read the orginal article: https://www.datacenterdynamics.com/en/news/segro-and-pure-dc-team-up-to-build-56mw-data-center-in-park-royal-west-london/