This article first appeared in Sifted’s Up Round newsletter, sign up here.

During a recent conversation with a startup lawyer, I heard something that pricked my ears. Shing Lo, a partner at London-based Latham & Watkins, told me she noticed the share of secondaries in new funding rounds increasing, and cited one round that was made up of roughly 80% secondary shares and 20% new equity.

“We’ve been quite surprised by […] the fact that primary is a lot less than secondary at the moment” for particular rounds, Lo told me of European deals.

The rise in popularity of secondaries is by no means a new trend — as VCs continue to wait for viable exits of their portfolio companies, they’ve grown desperate in the last couple of years to offload some of those shares and get some liquidity for their investors.

Lo told me she thinks we’re seeing a larger portion of secondaries now in part because “companies that have managed to survive the last two years are doing pretty well and they probably don’t need new money coming in to grow, so they’ve been more efficient with their capital. The exit window has also been pushed out quite far.”

Lo said that she observed that maybe half of recent deals included secondaries, mostly in late-stage deals (Series E through pre-IPO).

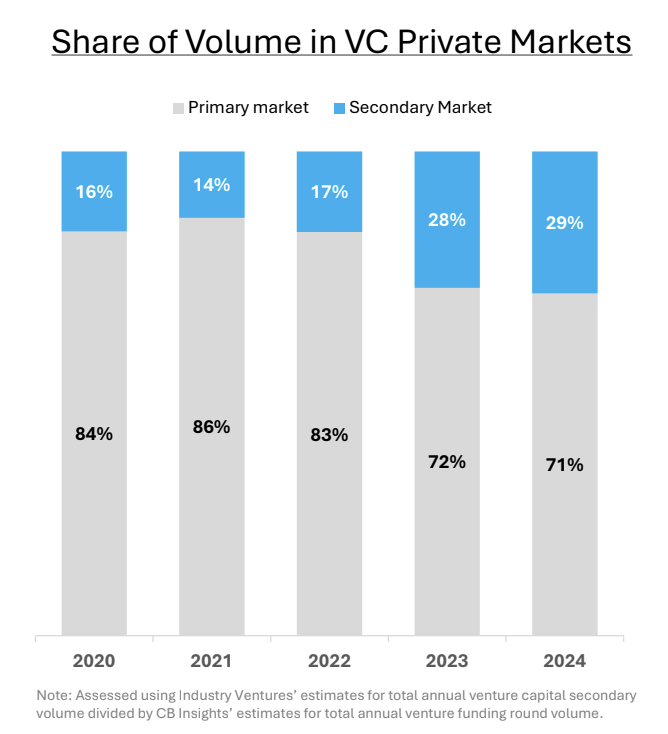

The data on secondaries is a bit slim, but Javier Avalos, the CEO of Caplight, which aggregates private secondary market data, told me that in the last few years secondary volume has been growing compared to total venture capital volume each year, adding that “we are seeing an increase in the number of VC megarounds, those of $100m or more, that include a secondary component.”

According to some recent Caplight analysis, the portion of secondaries in total global venture funding has grown from 14% in 2021 to 29% last year.

Martin Schaper, a partner at Germany-based law firm YPOG, told me that in the last year or two there’s generally been an increase in secondaries.

Still, he doesn’t see the type of deals made up of mostly secondary shares that Lo has. “I think it’s hard to say. […] Something around 10% [of the total round] makes sense.” Schaper said that if the secondary shares make up about 5% or 10% of a new round, they are typically integrated into the funding round, but if a “major” part of a deal is made up of secondaries it’s often as a separate deal that may be timed closely to an equity round.

As I reported earlier this year, nearly 80% of tech companies were considering a secondary sale this year, according to a study by equity management platform Ledgy. But I’m curious to hear from you, VCs: are you noticing secondaries making up an increasing percentage of total new rounds compared to equity? Are you aiming to buy more secondaries now versus last year? Are there good deals for secondaries right now? What stages are you noticing more secondaries? I’m all ears.

Read the orginal article: https://sifted.eu/articles/secondaries-venture-capital/