Dutch quantum startup QuantWare has raised €20 million ($21.5m) in a Series A funding round.

Co-led by Invest-NL Deep Tech Fund and Innovation Quarter, and with participation from the European Innovation Council Fund, the company said the money would be used to advance its quantum processor scaling technology.

Founded in 2021 after spinning out from TU Delft and its affiliated research institute QuTech, QuantWare has developed technology that routes connections vertically, thus solving the issue of scaling bottlenecks, which is currently limiting the size of quantum processing units (QPUs).

QuantWare says that the technology, dubbed VIO, “provides a scaling platform to any qubit design,” unlocking the “fastest path towards monolithic processors with more than 1 million qubits.”

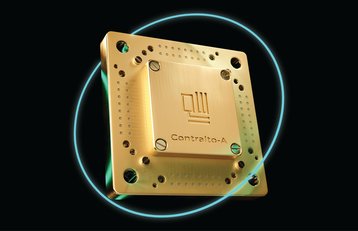

The company currently has seven of its own VIO-supporting hardware offerings listed on its website: Contralto-A, Contralto-D, Soprano-D, Tenor-D, Crescendo-S, Crescendo-E, and Concerto, but also provides foundry and packaging services to allow third-party customers can make use of its VIO technology.

Pre-orders for Contralto-A – the startup’s first QPU for quantum error correction – opened in February. Designed to be easily upgradable to QuantWare’s larger VIO-powered QPUs, the company says Contralto-A is almost twice as large as competing solutions that are commercially available.

“Our mission is to make VIO the scaling standard, and have it power the first million-qubit quantum computers of the hyperscalers of tomorrow,” said Matthijs Rijlaarsdam, CEO and co-founder of QuantWare. “We are building the best team in the world to achieve this mission. Accelerating the path towards that moment is a very important thing to do, as systems of that size will change the world.”

QuantWare says that it powers quantum computers for customers across 20 countries globally and the newly raised funds will be used to further develop VIO and build out its chip fabrication facilities.

Read the orginal article: https://www.datacenterdynamics.com/en/news/quantware-raises-20m-for-quantum-chip-scaling-technology/