Ten-year old Octopus Energy has grown into one of the UK’s largest domestic energy suppliers, surpassing incumbents decades older than it.

Its quick-paced expansion has been fuelled by $2.5bn in funding from backers including Al Gore’s Generation Investment Management and Canadian pension fund CPP. In May last year, Octopus Energy’s valuation hit $9bn, more than British Gas owner Centrica.

Despite its growth, Octopus’s latest financials, filed this week, saw a dip in profitability, down 59% to £83m for the year ending April 30, 2024.

As well as supplying energy to retail customers in seven different countries, Octopus also has a tech arm, Kraken, which helps manage customer billing and run energy assets like solar panels and heat pumps.

Kraken is increasingly stepping out from under its parent company’s shadow: its latest accounts (which are filed separately to the parent company) show a near six-fold increase in profits for its tech arm.

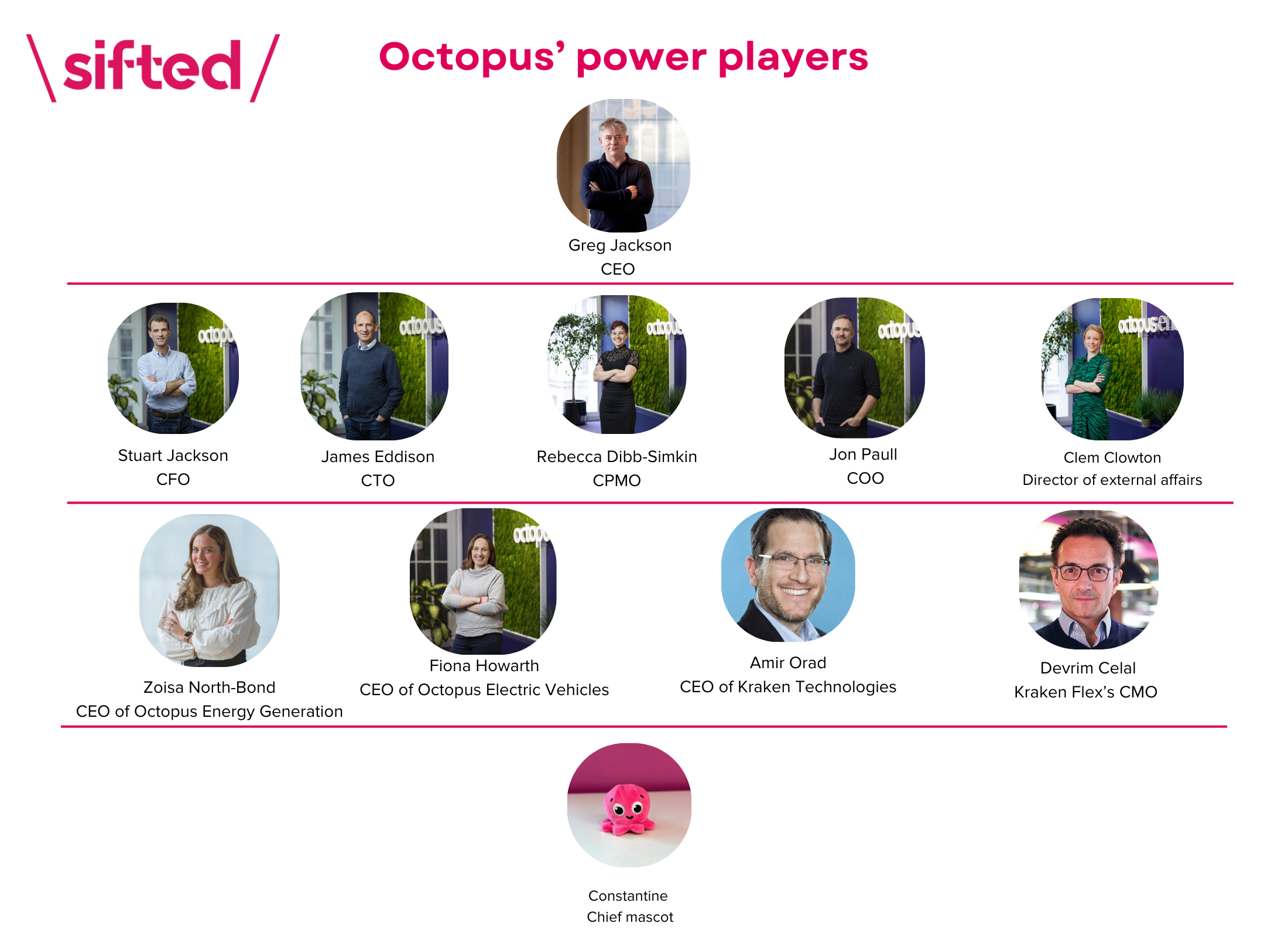

Here’s the team behind the energy giant and its tech wing.

The Octopus Energy C-suite

Octopus Energy was founded in 2015 by Greg Jackson, Stuart Jackson (no, they’re not related) and James Eddison.

Greg Jackson is Octopus’s CEO. He’s a serial entrepreneur who built and sold a number of startups before founding the company, including marketing tech startup C360 UK. He was also non-executive director at Zopa, a peer to peer lending fintech, between 2010 and 2018.

Stuart Jackson is Octopus’s CFO. He was previously director of Barclaycard UK, a role which involved managing a £5bn P&L.

James Eddison is the company’s CTO. He joined from Tangent Communications, which helps organisations build their tech. There, Eddison helped develop tech platforms for the UK Labour Party and French car maker Citroen. Eddison is credited with thinking up Kraken, Octopus Energy’s tech platform when it launched in 2016.

Also in the C-suite is Octopus Energy’s chief product and marketing officer Rebecca Dibb-Simkin, who joined in 2017 from British Gas. There she was head of product for Hive, a smart thermostat.

Team Kraken

Kraken was initially built for use in-house, but is now licensed to other energy companies, including EDF, E.ON and Tokyo Gas.

In its latest financial results, filed this week, Kraken grew its profits to £35m in the year up to April 30, 2023 — a 483% increase on the year prior. Recurring revenue increased 70% in the year to April 2024 to £89.6m.

Kraken Technologies’s CEO is Amir Orad. He joined in July last year from Sisense, a cloud AI company, where he was also CEO.

Other Kraken management includes Devrim Celal, who leads on marketing and heads up Kraken Flex, which helps firms control their energy assets.

Octopus Energy’s other business arms

There are other tentacles to the Octopus Energy operation.

The company manages a portfolio of renewable energy assets, such as wind turbines and solar parks. That’s spearheaded by Zoisa North-Bond, CEO of Octopus Energy Generation. Her team manages more than renewable energy projects across 13 countries, including wind turbines and solar parks.

North-Bond, who previously worked at Dutch energy firm Eneco, also heads up the business retail arm of Octopus Energy, selling energy to businesses rather than households.

There’s also Octopus Electric Vehicles, which leases EVs to customers. Fiona Howarth heads up that division — she was previously head of transformation at fellow British energy company Ovo.

👉 Read: Octopus Energy spreads its tentacles in acquisitions spree

The lobbyist

Clem Cowton is Octopus Energy’s director of external affairs. She heads up the company’s advocacy on policy and government affairs. Cowton led Octopus’s campaign for an energy price cap and has worked closely with UK governments.

Cowton has been at Octopus for seven years. Before she joined the company she worked in political consultancy.

Constantine the Octopus

He’s in every team pic so we’re giving him a mention: the company’s logo and mascot, a pink Octopus named Constantine.

Octopus Energy’s head of front-end development is credited with naming the creature, so called after a host of inspiring Constantines, from the Emperor of Rome to John Constatine, played by Keanu Reeves in a detective classic of the same name.

The Constantines were originally handmade in Wales but, as demand has grown, production has been outsourced to China.

Read the orginal article: https://sifted.eu/articles/octopus-energy-power-players-team/