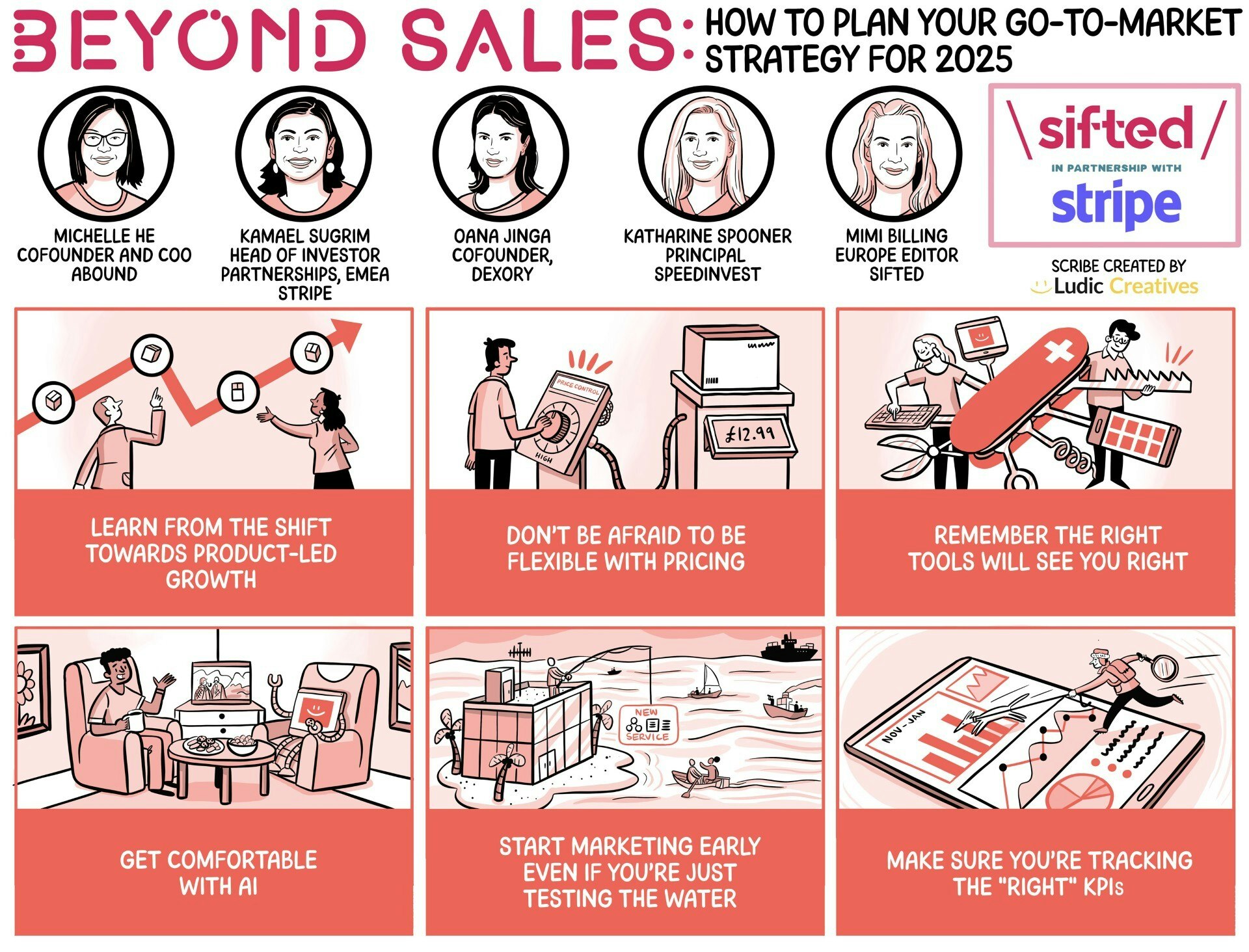

In a market where AI is boosting the competition and making customer journeys richer and more complex, how can startups hone their go-to-market strategies in 2025?

We asked the following experts on how to build in the AI era:

- Katherine Spooner, principal at early stage investor Speedinvest

- Kamael Sugrim, head of investor partnerships Europe at payments firm Stripe

- Michelle He, cofounder and CEO of UK fintech startup Abound

- Oana Jinga, cofounder of UK autonomous robot startup Dexory

1/ Learn from the shift towards product-led growth

How has the go-to-market strategy evolved in recent years?

Sugrim explained that, until recently, software and technology companies typically relied on a sales-led approach, as customers needed substantial education on both the products and their adoption. However, in today’s more tech-savvy market, product-led growth has become the dominant strategy. With this model, the product drives customer acquisition by allowing users to try before they buy — through self-serve options, freemium offerings or usage-based pricing.

From an investor’s perspective, Spooner noted that VCs are drawn to this clear path to revenue. However, she added that the shift towards product-led growth may have been accelerated by AI. These tools help refine targeting, personalise customer experiences and automate lead generation, resulting in faster revenue generation and shorter sales cycles.

Jinga added that community-led go-to-market strategies have been successful for Dexory.

“For us, community-led go-to-market is very important. We rely heavily on influencers in our space. We build strong relationships and count on others to talk about us — especially within enterprise sales and LinkedIn’s influencer culture.” — Oana Jinga, Dexory

2/ Don’t be afraid to be flexible with pricing

“When setting your pricing and figuring out strategy, remember to be flexible in testing your options early on,” Sugrim said. “Many startups think: ‘Oh, I’ve put my pricing on my website, so now it’s set in stone and I can’t undo it.’ Not true. Take some time to figure out the best rhythm to engage with your user.”

Flexibility can also extend to offering different currencies and payment methods. For example, as Copenhagen-based investment platform Female Invest’s customer base moved beyond Denmark, the company used Stripe Billing to offer flexible subscription options.

Jinga also warned that personalised pricing could backfire, so recommended caution. In the robotics industry, everyone knows each other, making preferential pricing risky. Instead, they adjust pricing based on set criteria such as warehouse size, inventory levels and goods movement. “If you do it, it needs to be very clear, set in stone, and fully transparent,” she said.

For Abound, lending and pricing decisions are determined by their proprietary AI model.

“The customer’s individual risk profile is crucial, and we use extensive data to thoroughly understand it — including their willingness and ability to pay. This is a key factor in pricing, which we assess through our AI engine.” — Michelle He, Abound

3/ Remember the right tools will see you right

“Get a good CRM system,” Oana said. She advised early-stage startups to avoid expensive solutions but stressed the importance of tracking early user interactions to learn, stay engaged and move leads through the funnel. A CRM should integrate well with data sources, help identify the right contacts, and trigger follow-ups. Additionally, a strong product tracking tool can provide insights into user behaviour and link back to the CRM, prompting timely outreach.

Abound’s CEO, He, emphasised that for digital journeys, tracking conversions is crucial. Understanding where customers drop off — such as 20% leaving a specific page — helps optimise the experience. Tools like PostHog provide insights, allowing product teams to refine high-drop-off pages for better engagement.

“Get a strong product tracking tool to understand how users engage with the product, where they spend the most time and, if possible, link it to the CRM to trigger prompts for customer outreach.” — Jinga

4/ Get comfortable with AI

On AI, Sugrim said that the tech is helping businesses gain a deeper understanding of their customers, which in turn allows for more flexibility in their services, enabling businesses to adjust pricing for specific customer groups. It also allows them to introduce new pricing models and adapt to regulatory requirements when entering international markets.

AI and machine learning can also help manage fraud. For instance, Swedish startup CoinPanel used Stripe Radar to detect and prevent fraudulent transactions while maintaining a seamless customer experience.

At Speedinvest, Spooner has seen many of their 300 companies adopt AI for these reasons.

“AI enables companies to segment customers based on factors like purchasing behaviour and demographics, allowing for tailored pricing strategies that maximise customer satisfaction.” — Katherine Spooner, Speedinvest

5/ Start marketing early even if you’re just testing the waters

Abound began market testing early on, said He, even before the official launch. By that point, around 20k users had already signed up to express interest.

He said the right time for market testing is “as soon as possible”. Whether based on a minimum viable product or market research, this process helps shape key aspects of the business, including product development, technology and strategy.

Because marketing informs product decisions, forecasting and data collection, Jinga said early marketing is an essential first step.

“But to me, the most important thing is to clearly communicate what you’re offering. If that requires additional marketing support at the product marketing level, it’s best to bring it in early.” — Jinga

6/ Make sure you’re tracking the “right” KPIs

What KPIs to track depends on the stage of the business, concluded He. Early on, proving scalability and gauging interest are key. Over time — volume, growth potential and unit economics become the top three metrics that matter.

Jinga added: “My advice overall would be to map out your customer journey. Where are you now with these numbers and what conversion rates are you seeing? Then, continuously work on improving that — reducing the sales cycle, increasing the annual contract value and lowering the cost of acquisition. But first, establish a benchmark. Identify one or two KPIs for each stage, gather data and then start discussing internally how to improve on them.”

“An interesting one for me is always churn – specifically breaking it down. Do you have churn because someone signed up for your product and then abandoned it? Or do you have churn after a certain amount of usage? If you can break it down, you can actually influence your top-line revenue.” — Sugrim, Stripe

Like this and want more? Watch the full Sifted Talks here:

For startups looking to refine their product-led approach, Stripe’s guide, How to Evolve Your GTM Strategy with Product-Led Sales, offers insights on combining self-serve adoption with high-touch sales to accelerate growth. Read more here.

Read the orginal article: https://sifted.eu/articles/go-to-market-strategy-sifted-talks/