Germany, the beating heart of Europe’s economy, has cemented its status as a powerhouse for innovation and entrepreneurship. Far from resting on its industrial laurels, the country has embraced a future-forward mindset, creating a fertile ground for startups to thrive. The 2024 Deutscher Startup Monitor reveals a vibrant ecosystem where technology-driven solutions lead the charge. Key sectors like SaaS, healthcare, and DeepTech are not only attracting substantial investment but also redefining global benchmarks for innovation.

This progress is underpinned by a unique synergy of world-class research institutions, regional diversity, and proactive government support, such as state funding initiatives that provide critical lifelines for budding startups. While cities like Berlin and Munich are renowned hubs for innovation, emerging centres in regions like North Rhine-Westphalia and Bavaria are increasingly shaping the narrative, demonstrating that Germany’s entrepreneurial spirit knows no boundaries.

As the landscape continues to evolve, a wave of disruptive startups is rising, reflecting the country’s commitment to technological leadership. On that note, we’ve curated a list of 10 promising startups from 2023 onwards that exemplify Germany’s dynamic and ever-expanding startup ecosystem.

Bees & Bears: Founded in 2023 and based in Berlin, Bees & Bears raised €500 million to simplify financing for renewable energy installations. The platform enables flexible payment plans for customers, allowing easy access to financing for solar systems, batteries, and heat pumps. They facilitate fast credit decisions, enabling installers to get paid quickly and provide a streamlined process that bypasses traditional bank loans. This makes renewable energy solutions more accessible to consumers while supporting businesses with fast, reliable payment solutions.

Black Forest Labs: Founded in 2024, this Freiburg-based company develops advanced generative deep-learning models for images and videos, making these technologies widely accessible. Its tools streamline and enhance creative workflows, enabling users to experiment with AI-assisted designs. The company’s AI can generate realistic images and video content from simple text prompts, modernising media creation. With €28 million in funding, Black Forest Labs aims to democratise AI tools for media creation, fostering broader use across industries such as media and entertainment.

Deepoi: Headquartered in Berlin, deepoi is developing Europe’s leading IT operating system to simplify daily IT challenges for employees at SMEs. The company helps businesses manage IT operations such as employee onboarding, cybersecurity, compliance, and device management, reducing complexity and ensuring smoother workflows. Established in 2023, this pioneering startup has raised €9 million to enhance IT management and software solutions for small businesses across the continent.

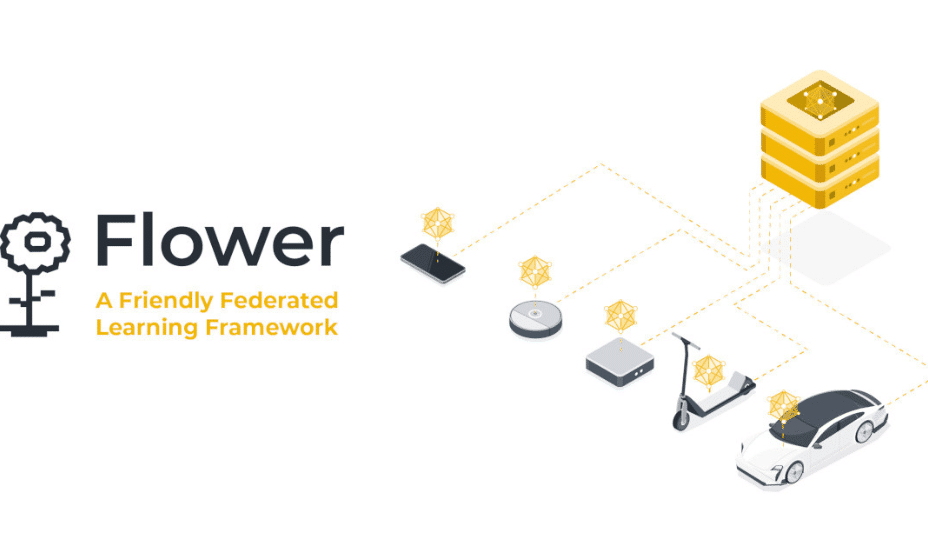

Flower Labs: Based in Hamburg, this machine learning startup develops a platform that enables decentralised training of AI models through a method called federated learning. This method enables teams to collaborate on refining large language models without sharing sensitive data. Participants can compete on a leaderboard, driving innovation in areas like language processing and coding. With privacy, efficiency, and collaboration at its core, Flower Labs is paving the way for secure AI growth. Founded in 2023, the startup has raised an €23 million in funding.

green flexibility: Founded in 2023, Green Flexibility is a leading manufacturer of extensive battery storage systems designed to facilitate the integration of renewable energy sources into the power grid. Based in Kempten, the company specialises in developing large-scale energy storage solutions that help balance supply and demand fluctuations, ensuring grid stability and efficiency. Its battery systems are utilised in applications such as solar and wind farms, industrial energy storage, and grid backup solutions. With €400 million in funding, the startup aims to expand its production capabilities, invest in cutting-edge research, and contribute to the global transition towards sustainable energy infrastructure.

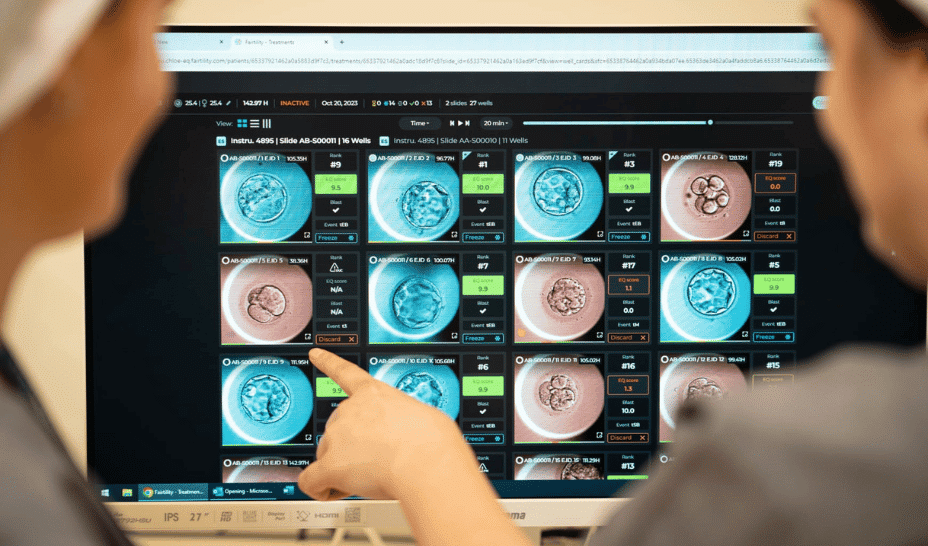

Ovom Care: Headquartered in Berlin, this AI-driven healthcare startup specialises in fertility solutions and predictive analytics. Founded in 2023, Ovom Care harnesses advanced artificial intelligence to deliver personalised fertility insights, optimise treatment plans, and improve patient outcomes. With €6 million in funding, the startup is focused on expanding its platform, integrating new AI capabilities, and transforming reproductive healthcare through data-driven precision.

Purpose Green: This climate tech startup, Purpose Green is committed to sustainable building solutions. The company provides tailored strategies to improve energy efficiency, reduce carbon footprints, and enhance the economic value of properties through sustainable transformation and regulatory compliance. Founded in 2023, the Berlin-based startup has secured €18.5 million in funding to drive green building initiatives, contributing to a more sustainable future in residential construction.

Proxima Fusion: Founded in 2023 and based in Munich, this pioneering clean-tech startup focuses on developing innovative fusion power plants using quasi-isodynamic stellarators. It aims to deliver clean and sustainable energy by leveraging advancements in simulation, high-performance computing, and magnetic confinement technologies. With €51.5 million in funding, the startup uses high-temperature superconducting magnets and advanced simulation-driven engineering to enhance fusion energy efficiency and safety.

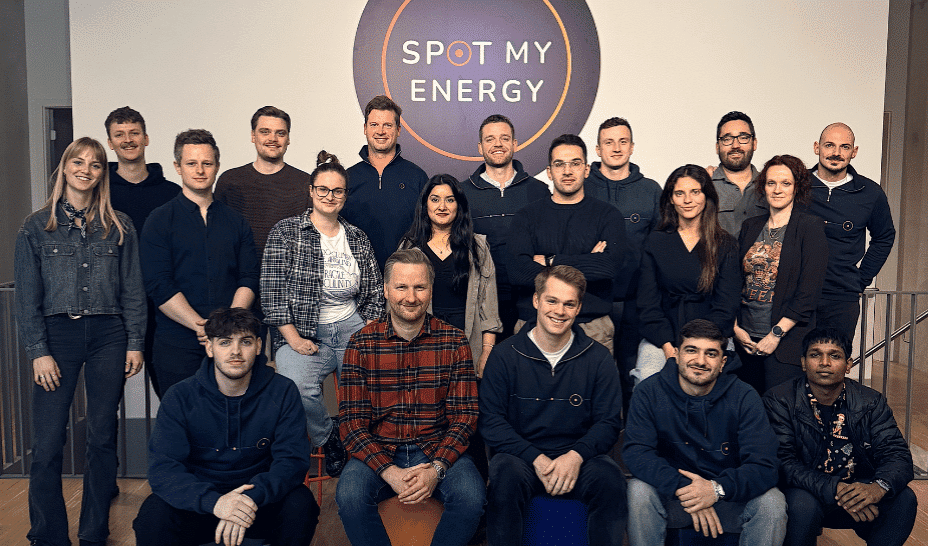

SpotmyEnergy: This clean-tech startup is transforming home energy management with innovative smart solutions designed to improve savings and drive sustainability. By seamlessly integrating solar panels, storage systems, and electric vehicles into one cohesive platform, the startup empowers consumers to take full control of their energy consumption, reduce costs, and foster a greener, more sustainable lifestyle. Founded in 2023 and based in Köln, the startup has already secured €14 million in funding, positioning it as a key player in the transition to smarter energy solutions.

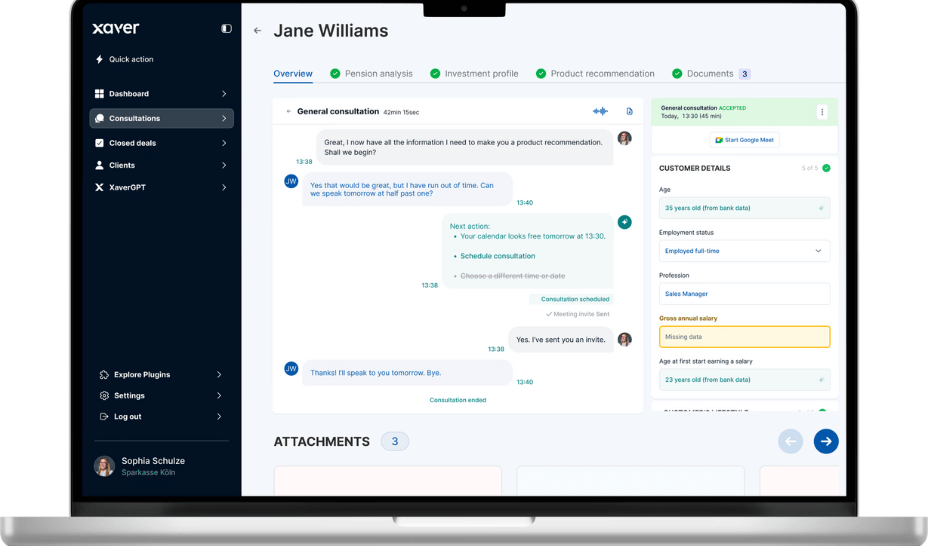

Xaver: Founded in 2023, Xaver is a Cologne-based fintech company offering AI-driven platforms to enhance operational and sales efficiency for financial institutions. Its technology enables personalised customer journeys, financial analysis, and 24/7 AI-powered sales support, all while maintaining compliance and security. With €6 million in funding, this innovative startup is transforming private pension and life insurance sales through a B2B approach.

By the way: If you’re a corporate or investor looking for exciting startups in a specific market for a potential investment or acquisition, check out our Startup Sourcing Service!

Read the orginal article: https://www.eu-startups.com/2025/01/inside-germanys-dynamic-startup-ecosystem-10-promising-startups-to-watch-in-2025/