Letting builder bots loose on sites feels like a no-brainer. Construction ticks the three Ds of automation — dull, dirty and dangerous — with ease. It’s the largest industry in the world, in terms of dollars spent, with a high rate of injuries and fatalities.

Construction is also facing a huge labour strain. The global population is growing, many countries have large housing deficits and there’s a shortage of skilled manpower. And no one can argue construction doesn’t need a shot to its productivity, which is not just low but declining in some countries, according to McKinsey consultants.

But when you really think about it, it’s harder to imagine robots being able to replicate builders. Robots thrive in environments where things are smooth and predictable. Out on a building site, things are varied and changeable. No two developments are the same. Any bot brave enough to take its chance must withstand rain, dust and dirt while dealing with varying topography and other surprises.

And yet despite all that, a handful of European startups — some much-hyped — are having a go at making construction robots.

For a full deep dive on construction robots, see our recent report on builder bots, in partnership with Leonard

Something to build on

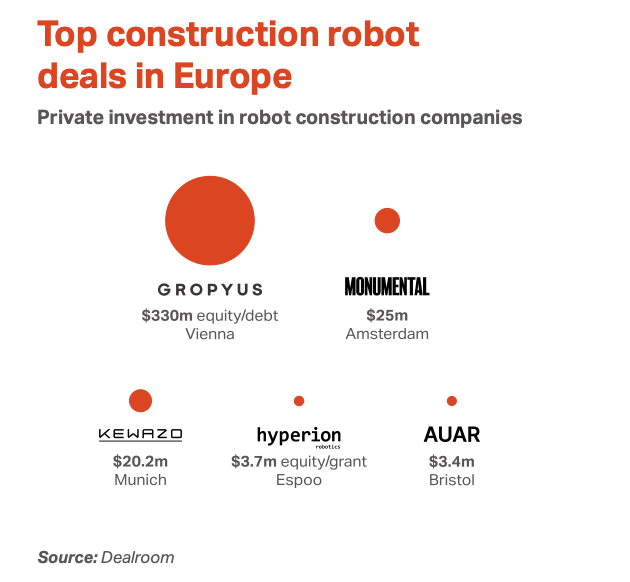

The standout construction robot startup in Europe, for now, is Vienna-based Gropyus, which pulled in €140m from investors last year — a huge sum for this branch of robotics.

Gropyus’ new robot-stuffed factory — which prefabricates housing units — is targeting output of 250k square metres a year, equivalent to around 4,000 one-bed apartments. A pilot in 2022 saw the company build 54 homes within 11 weeks of finishing the concrete foundation. Perhaps inevitably, one investor has crowned the company “the Tesla of construction”.

Salar Al Khafaji is the man behind Europe’s second biggest builder bot company for VC dollars raised. Monumental picked up $25m in February 2024 to develop bricklaying bots. The Dutch company’s only three years old but already its bots are helping to build houses in a suburb of Rotterdam.

You expect investors to hype the companies they’ve backed — but rarely do VCs talk so enthusiastically about a founder as they do with al Khafaji.

“We met Salar after he sold his first company [data-visualisation firm Silk] to Palantir [the Peter Thiel-founded data company]. We had no idea what he was going to come up with next — we just knew we were going to back him no matter what,” says Firat Ileri, partner at VC firm Hummingbird Ventures.

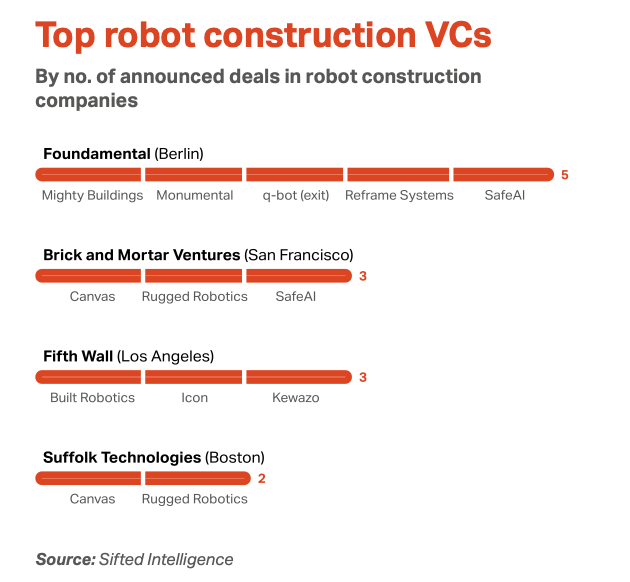

“He’s probably the best European founder in our portfolio,” says Patric Hellermann, founding partner of Berlin-based VC firm Foundamental.

After selling his company, al Khafaji says he needed to do “something meaningful. And if you can do something big in construction, you’re doing something big for global GDP,” he says. The Dutchman had no background in construction — much less robotics — but a plan that investors loved and an appreciation for beautiful buildings. “How were we able to build such great things in the past when we had no advanced tools? It’s mind-boggling. We have more technology than ever and somehow we can’t seem to build the way we used to.”

The TikTok star

Europe’s third biggest builder bot raiser is Kewazo in Germany. The company’s creation — called Liftbot — is effectively an automated hoist system that goes up and down scaffolding systems — a lot like the lift used by moving companies to transport furniture to a high-level apartment floor. The battery-powered bot has been used at sites including the US Capitol.

Kewazo has an unusual way of promoting itself: a lively presence on TikTok. In one of the company’s videos, we see its lift going up and down on a site, while a dog vigorously nods his head in approval.

Builder bots have not seen a lot of private capital globally. By Crunchbase’s count, just 17 robot construction companies in the world have raised funding from investors since 2022. More than three-quarters of financing rounds have been completed by seed-stage or Series A startups. San Francisco-based Built Robotics, Japan’s Linkwiz and Gropyus are among the exceptions, each raising growth and late-stage capital in recent years.

“The fact that tech penetration for construction is one of the lowest of any industry is a clear opportunity,” argues Ileri. “It’s an unsexy area that’s not going to attract tens of companies — so if you’re a founder you can take your time and build real tech.”

Robots roll into valley of death

But if the industry’s slowly warming to new technology, there are no guarantees that the founders selling it will succeed. In fact, there are still many reasons why they might fail.

Profit margins in construction are generally razor thin, so when it’s cheaper to hire a human, contractors will do just that. Specialist subcontractors — the ones who are making good money because there’s a scarcity of their talents — may not be incentivised to deploy robots either.

“It’s a really hard market to sell into, anyone who says otherwise is surely lying,” says Kewazo founder Artem Kuchukov. “A lot of different dynamics; a lot of stakeholders. If you enter this market, you can only hope to get 5-8% of it, at best. You can’t imagine you’ll get 80%, it’s not going to happen.”

And because companies are attempting something that’s so new, so untested, it’s inevitable some will crash and burn. For example, UK-based HyperTunnel, which pioneered a way of building tunnels entirely with robots, went into administration this year after failing to attract new investment. Company financial data for the year to April 30 2023 reveals it was £9.6m in debt.

Founders have to earn the trust of the construction industry but they also need to be wary of bad advice, says Alice Leung, vice president of platform and product strategy at Brick & Mortar Ventures, a San Francisco-based VC firm.

“The biggest challenge is not necessarily anyone in the construction industry, it’s the investors,” Leung explains. “They’re often pushing companies into business models that don’t make sense for this world.”

Tech people shouldn’t bring too many assumptions with them, agrees Sten Tamkivi, cofounder and partner at Plural, which has invested in Monumental. “The startups that have stumbled are the ones that thought they could change the industry. But the more you can mimic what the industry expects — charging contractors on the price per brick instead of a SaaS model, for example — the better.”

His advice for founders boiled down: don’t overdo the techie-ness.

For a full deep dive on construction robots, see our recent report on builder bots, in partnership with Leonard

Read the orginal article: https://sifted.eu/articles/europe-construction-robots/