Renowned for its high quality of life and robust economy, Denmark is also a hub of innovation ranking among Europe’s leading startup centres, with dynamic clusters in IT, life sciences, and cleantech. Denmark’s focus on innovation and sustainability, coupled with a flexible work culture and reliable infrastructure, makes it an attractive destination for businesses aiming to grow and succeed globally.

In recent years, Denmark’s startup scene has experienced remarkable growth, carving out a significant role in the European tech landscape. Despite challenging market conditions, the country stood out in 2023 as one of the few European ecosystems to achieve growth in venture capital investment. Key sectors such as health tech, fintech, and enterprise software have emerged as pillars of strength, driving the ecosystem forward. Even more impressive, Denmark now boasts the highest number of rising unicorns per capita in Europe, with 7.7 per million people—surpassing both the UK and Finland in unicorn density. This achievement highlights the dynamic and rapidly evolving nature of Denmark’s startup ecosystem.

With this in mind, we have curated a list of 10 standout Danish startups to watch this year. Each was launched after 2022, showcasing the country’s thriving entrepreneurial spirit. Let’s dive right into it:

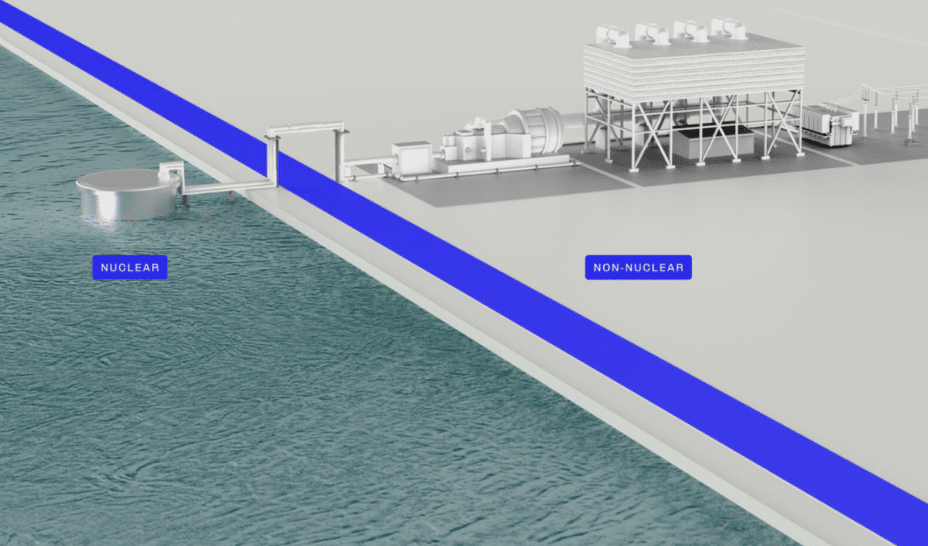

Blue Energy: Founded in 2023, Blue Energy is revolutionising clean energy with its innovative approach. The startup develops modular nuclear power plants constructed in shipyards, enabling faster and more cost-effective production. Their mission is to deliver clean, reliable energy while maintaining affordability and prioritising safety. Blue Energy provides energy solutions to customers through long-term agreements and has secured €43.26 million in funding, positioning itself as a leader in the CleanTech sector. Based in Kastrup, the company is contributing to a sustainable future through cutting-edge energy technologies.

Hakio: This pioneering startup offers AI-powered demand forecasting tools specifically designed for the fashion and retail industry. Its platform helps brands predict trends and seasonal patterns, optimise inventory, and enhance product availability.

By leveraging real-time data, Hakio minimises overstocking and stockouts, boosting working capital efficiency and supply chain resilience. Ultimately, Hakio aims to empower sales and operations teams to make better, data-driven decisions. Founded in 2022 in Aarhus, the startup has raised €4 million in funding.

Kvantify: Based in Copenhagen, Kvantify develops quantum computing management software designed to tackle complex computational challenges across industries such as life sciences and finance. In drug discovery, the company leverages high-speed, physics-based methods to enhance compound testing, significantly accelerating pharmaceutical research.

Founded in 2022, Kvantify offers cloud-based solutions, including a platform for binding affinity and kinetics calculations, to optimise the drug discovery process. With €12.5 million in funding, Kvantify is gaining momentum as a leader in quantum computing innovation.

Light: Launched in 2023, Light offers an AI-powered platform designed to help multinational companies manage their accounting and reporting processes. The startup automates tasks such as accounts payable and receivable, invoice reconciliation, and expense tracking. By integrating with tools like Slack and Teams, Light streamlines financial workflows, reduces errors, and accelerates approvals.

The platform also simplifies procurement and vendor management, enabling businesses to handle finances seamlessly on a global scale. Headquartered in Copenhagen, Light has secured €12.5 million in funding, cementing its potential in the financial services sector.

Lun: Copenhagen-based Lun is advancing the decarbonisation of homes with its innovative operating system for heat pump installers. Using 3D scanning technology, the platform enables quick and accurate measurement of rooms and heating systems, facilitating precise energy calculations and reports.

Lun’s technology can assess a building’s heat loss in minutes and generate DIN-compliant energy reports, streamlining the process for installers. Founded in 2022, Lun has raised €10.3 million to accelerate the transition to sustainable residential heating systems.

Parahelp: This innovative startup specialises in AI-powered support for software companies, providing an intelligent agent capable of managing tasks such as ticket handling and refund requests. Founded in 2024 and headquartered in Copenhagen, Parahelp has raised €480k, showcasing its potential in the B2B AI software sector. With its cutting-edge technology, Parahelp aims to transform customer service and streamline support operations.

Proem: Founded in 2013, Proemial is an innovative platform that leverages AI to simplify complex scientific research. It helps users explore, understand, and apply scientific findings quickly and efficiently by providing personalised summaries of the latest research papers. Users can ask questions, receive concise answers, and delve deeper into specific studies.

Additionally, Proemial enables the creation of curated collections, or “Spaces,” to stay updated on relevant topics, fostering collaboration and learning within scientific communities. Based in Aarhus, the platform has raised €2 million to make research more accessible and engaging on a global scale.

Spektr: Founded in 2023, this Copenhagen-based startup simplifies compliance management for businesses. Its no-code platform streamlines tasks such as client onboarding with integrated KYC (Know Your Customer) and KYB (Know Your Business) checks. Spektr provides real-time monitoring and alerts, along with an organised case management system, helping businesses stay compliant with ease.

By centralising compliance processes, the platform enables companies to adapt to changing regulations efficiently, saving time and effort while ensuring legal adherence. With €5 million in funding, Spektr is demonstrating its ability to automate and address compliance gaps effectively.

Tembi: Founded in 2022 and based in Copenhagen, Tembi specialises in data analytics solutions designed to empower businesses to anticipate market trends and make informed strategic decisions. The platform analyses large datasets to forecast the impact of shifting market conditions on sales and offers real-time competitor monitoring.

By delivering proactive insights, Tembi enables companies to stay ahead of the curve instead of relying on outdated reports. With €2.95 million in funding, Tembi is carving a niche in business process automation and data management.

By the way: If you’re a corporate or investor looking for exciting startups in a specific market for a potential investment or acquisition, check out our Startup Sourcing Service!

Read the orginal article: https://www.eu-startups.com/2025/01/unicorns-european-heaven-10-promising-danish-startups-to-watch-in-2025-and-beyond/